- United States

- /

- Residential REITs

- /

- NYSE:UDR

Does Analyst Caution on UDR (UDR) Reveal Shifting Confidence in Real Estate Resilience?

Reviewed by Sasha Jovanovic

- In late November 2025, several major research firms updated their outlooks on UDR, with most lowering their expectations and maintaining mixed recommendations regarding the company's future performance.

- This coordinated shift in analyst sentiment reflects heightened caution toward UDR's near-term prospects amid ongoing market and economic challenges facing the real estate sector.

- We'll explore how the broad trend of analyst caution amid sector headwinds could impact UDR's investment narrative and outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

UDR Investment Narrative Recap

To own shares of UDR, investors generally need to believe in the long-term fundamentals of the multifamily rental market, particularly the persistent demand drivers like housing shortages and declining affordability of homeownership. The recent shift in analyst sentiment, with most firms lowering their price targets but maintaining mixed ratings, reflects wariness regarding UDR’s short-term outlook, though it does not materially change the focus on rental growth or the most immediate risk of oversupply in key Sunbelt and urban markets.

Among UDR’s recent announcements, the company raised its full-year earnings guidance in October, citing stronger net income and revenue growth compared to the previous year. This is particularly relevant as it underlines resilience in core operations despite the sector’s challenges and the cautious stance of analysts, keeping the spotlight on UDR’s ability to maintain occupancy and manage rent growth as a key catalyst.

By contrast, investors should be aware that elevated new supply in certain markets continues to...

Read the full narrative on UDR (it's free!)

UDR's narrative projects $1.9 billion in revenue and $227.8 million in earnings by 2028. This requires 3.7% yearly revenue growth and a $100.7 million earnings increase from the current $127.1 million.

Uncover how UDR's forecasts yield a $40.98 fair value, a 13% upside to its current price.

Exploring Other Perspectives

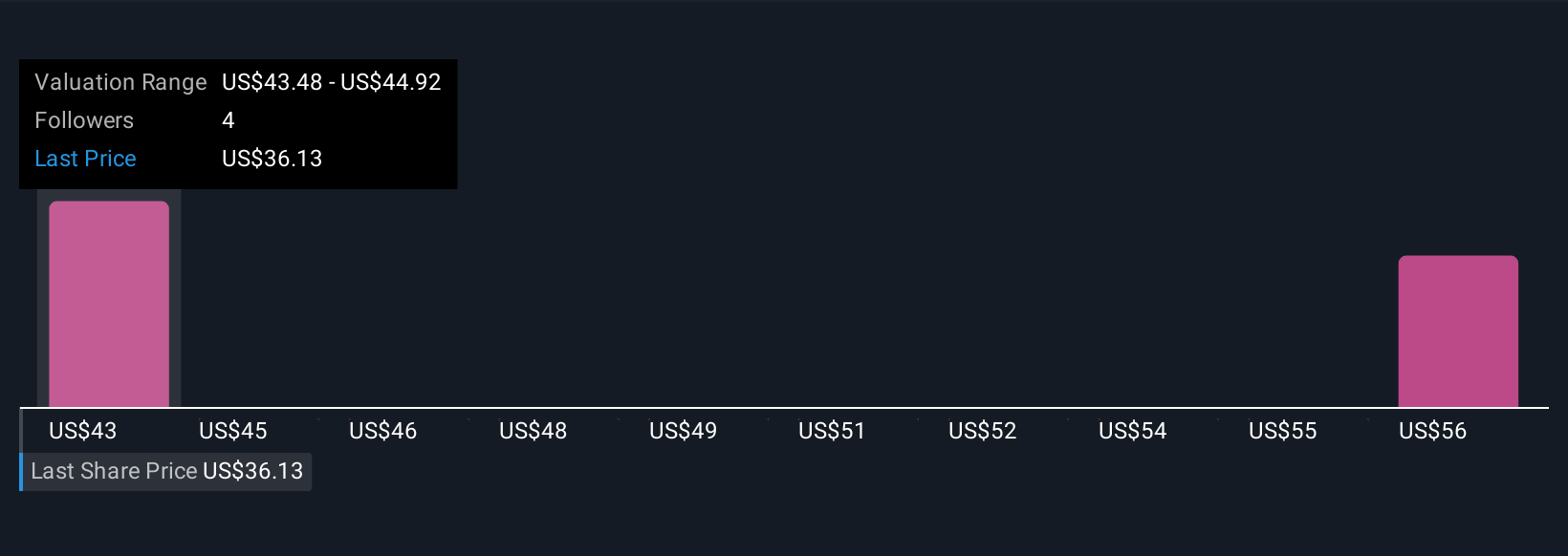

Simply Wall St Community members have posted two fair value estimates for UDR ranging from US$40.98 to US$56.86 per share, showing wide variance in outlooks. The short-term analyst caution around new supply pressures could weigh on sentiment and future valuations, so explore how your perspective fits among these differing views.

Explore 2 other fair value estimates on UDR - why the stock might be worth just $40.98!

Build Your Own UDR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UDR research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UDR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UDR's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026