- United States

- /

- Retail REITs

- /

- NYSE:SPG

How Rising Dividends and New Developments at Simon Property Group (SPG) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Simon Property Group, Inc. recently reported third-quarter results, unveiling higher year-over-year revenue of US$1.6 billion and net income of US$607.01 million, together with a new increased common dividend of US$2.20 per share for the fourth quarter of 2025.

- Alongside its quarterly results, Simon announced plans for Sagefield, a 100-acre luxury mixed-use development in partnership with AJ Capital Partners and restaurateur Sam Fox, emphasizing experiential retail and hospitality expansion.

- As Simon raises its dividend and expands its development pipeline, we'll assess what this means for its long-term growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Simon Property Group Investment Narrative Recap

To be a Simon Property Group shareholder, you need to believe in the enduring value of premier retail and mixed-use properties that attract both tenants and shoppers even as consumer habits evolve. The recent announcement of strong quarterly results and a dividend increase adds confidence around Simon’s current income profile, but does not substantially alter the key immediate catalyst, tenant demand for high-quality retail space, or the principal risk, which is the pressure from ongoing retail bankruptcies and tenant churn.

The launch of Simon’s Sagefield project, a luxury mixed-use development in partnership with AJ Capital Partners and Sam Fox, stands out as the most relevant announcement, tying directly to the company’s push into experience-focused destinations. While Sagefield exemplifies Simon’s strategy to diversify revenue streams beyond traditional retail, whether such ventures can offset structural risks in the retail sector remains a core question for investors.

Yet, in contrast to increased dividends and new developments, investors should be aware that persistent tenant turnover and retailer bankruptcies could still...

Read the full narrative on Simon Property Group (it's free!)

Simon Property Group is projected to deliver $6.2 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes a yearly revenue decline of 0.7% and an earnings increase of $0.3 billion from the current $2.1 billion.

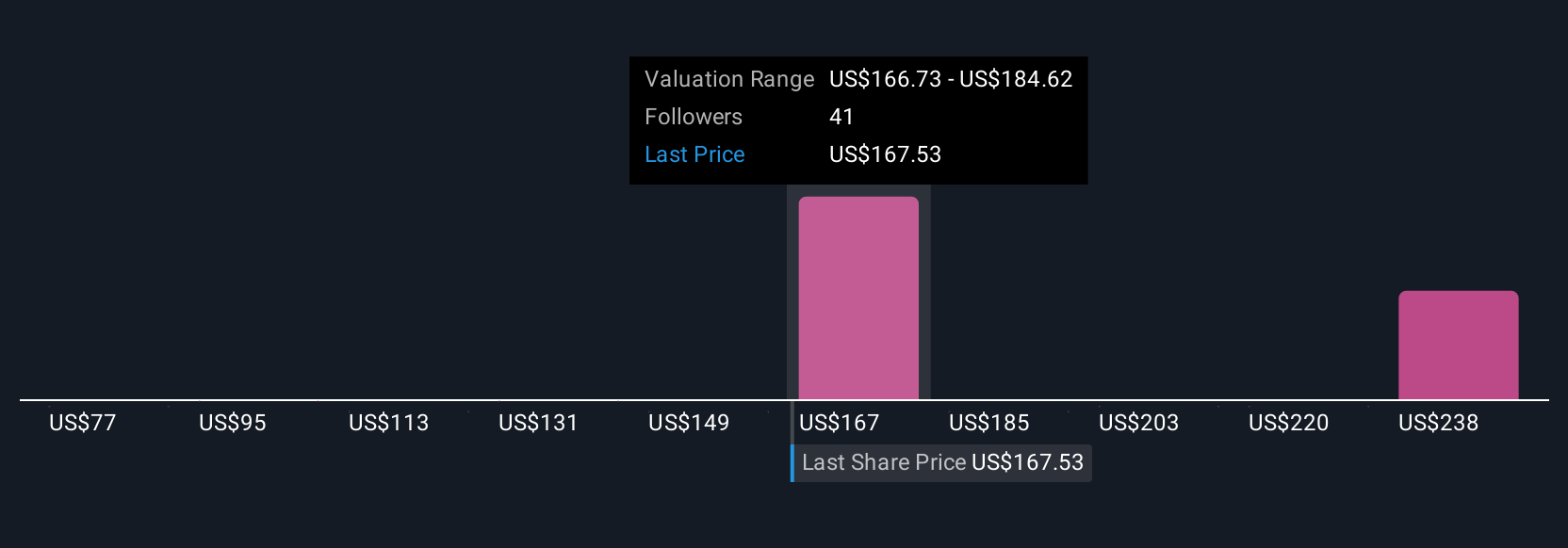

Uncover how Simon Property Group's forecasts yield a $188.40 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Eight individual fair value estimates from the Simply Wall St Community span US$77.30 to US$259.04 per share. While investor views are wide-ranging, recent retail bankruptcies and tenant churn remind us why scrutinizing underlying risks is crucial when evaluating Simon’s long-term prospects.

Explore 8 other fair value estimates on Simon Property Group - why the stock might be worth less than half the current price!

Build Your Own Simon Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simon Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simon Property Group's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives