- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Ryman Hospitality Properties: Valuation Insights as Grand Ole Opry’s 100th Anniversary Draws Investor Focus

Reviewed by Simply Wall St

Ryman Hospitality Properties (RHP) is getting noticed as the Grand Ole Opry embarks on its 100th anniversary celebrations. This milestone event brings attention to Ryman’s entertainment assets while investor activity continues to build around the company.

See our latest analysis for Ryman Hospitality Properties.

With the Grand Ole Opry’s 100th anniversary raising the profile of Ryman’s entertainment assets and hedge fund interest increasing, momentum is showing early signs of recovery. After a challenging stretch, including a 1-year total shareholder return of -14.6%, the stock has rebounded with an 11% one-month share price gain, which may indicate renewed investor confidence for the long term.

If this renewed momentum inspires you, it might be the right time to expand your search and discover fast growing stocks with high insider ownership

With Ryman Hospitality’s shares rebounding and major anniversary events highlighting its core assets, investors are left wondering if this is an overlooked value play or if the recent surge already reflects the company’s growth prospects.

Most Popular Narrative: 14.7% Undervalued

Despite Ryman Hospitality Properties closing at $95.43, the most widely followed narrative puts fair value much higher. This creates an intriguing valuation gap for investors to consider.

Recent acquisitions and ongoing capital investments (for example, JW Marriott Desert Ridge and meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large-scale experiential travel and gatherings, supporting revenue growth and long-term cash flow.

Want to understand the math fueling this fair value? The narrative teases key assumptions most investors miss, including future earnings, revenue growth, and profit margins. Wondering what bullish numbers could justify such a big premium? Dive in to uncover the drivers and see if you agree with the consensus.

Result: Fair Value of $111.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any slowdown in group travel or rising competition in key markets could quickly reverse the emerging positive momentum for Ryman’s shares.

Find out about the key risks to this Ryman Hospitality Properties narrative.

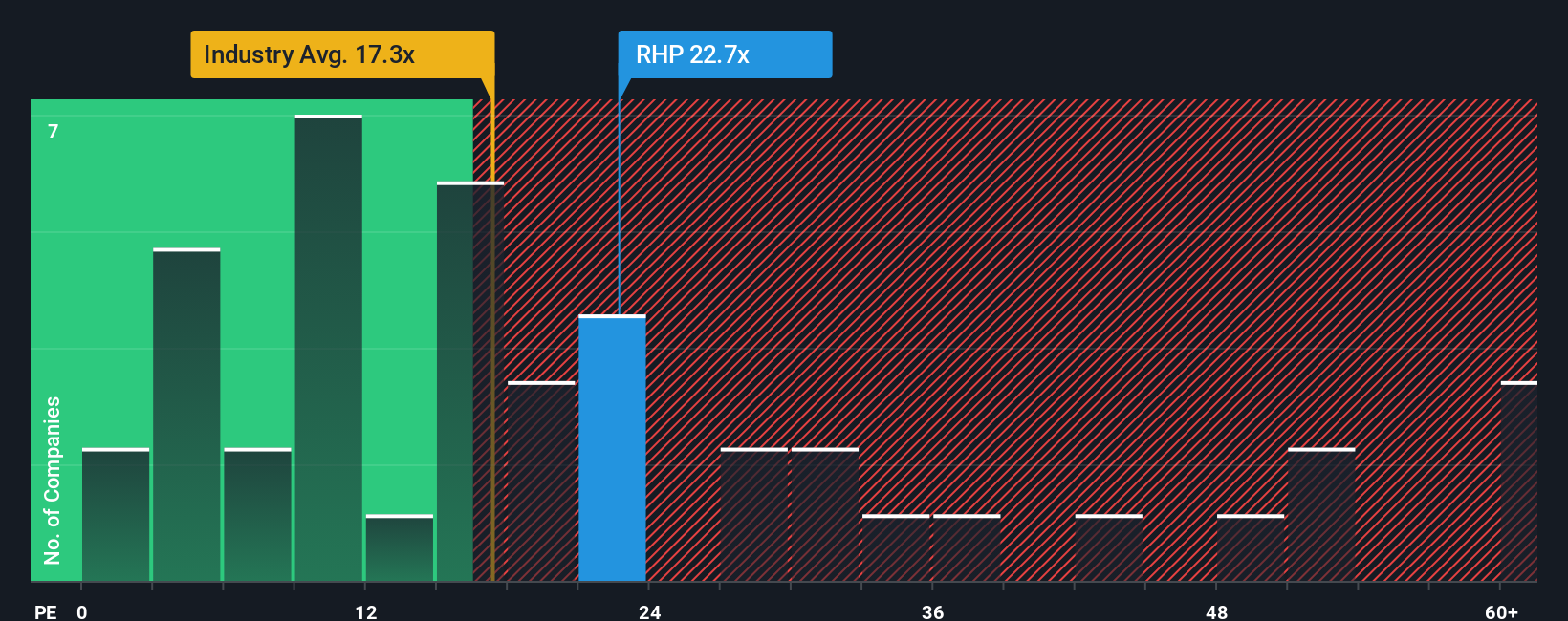

Another View: The Multiples Perspective

Looking at Ryman Hospitality Properties through the lens of price-to-earnings, the story shifts. The company trades at 24.9 times earnings, above both its industry average (15.6x) and peer average (22.6x). This premium suggests the market sees upside, but it also raises the bar for future performance. Interestingly, the fair ratio for Ryman could be as high as 35.3x, hinting at more room if optimism continues. Does this premium signal confidence or added risk for today’s buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If you see the story unfolding differently or want to dig into the numbers on your own terms, you can craft your own view in just a few minutes, too. Do it your way

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and uncover tomorrow’s leaders before the crowd catches on. Don’t let smart investing opportunities pass you by. These unique screeners make it easy to find your edge.

- Tap into future trends by checking out these 25 AI penny stocks transforming industries with artificial intelligence and next-level innovations.

- Snag promising bargains by viewing these 920 undervalued stocks based on cash flows that are trading below their intrinsic value for high-upside potential.

- Uncover steady income streams as you browse these 15 dividend stocks with yields > 3% offering reliable yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026