- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Ryman Hospitality Properties (RHP): Reassessing Valuation After the Recent Share Price Pullback

Reviewed by Simply Wall St

Ryman Hospitality Properties (RHP) has been sliding lately, with the stock down about 11% this year and nearly 19% over the past year, even as revenue and earnings continue to grow.

See our latest analysis for Ryman Hospitality Properties.

At around $91.74 per share, Ryman’s recent 7 day and 90 day share price declines suggest momentum has cooled, even though its 3 year and 5 year total shareholder returns remain solidly positive.

If Ryman’s pullback has you reassessing the sector, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With earnings still growing, a sizable discount to analyst targets, and a long-term track record of value creation, investors now face a key question: is this pullback a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 18.2% Undervalued

Compared to Ryman Hospitality Properties’ last close at $91.74, the most followed narrative sees fair value materially higher, framing today’s weakness as a potential mispricing.

Supply/demand imbalances in key markets, where new convention hotel supply is limited but demand catalysts (e.g., infrastructure, new stadiums, expanded airport capacity in Nashville) are accelerating, create favorable pricing dynamics and high barriers to entry, underpinning long-term NOI and FFO growth.

Curious how this supply squeeze, margin roadmap, and ambitious earnings trajectory add up to that higher valuation? The narrative’s playbook for future cash flows might surprise you. Want to see which growth assumptions and profit multiples really power that fair value view? Dive in and stress test the story for yourself.

Result: Fair Value of $112.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structurally higher interest costs and intense competition in key markets could squeeze margins and derail the optimistic growth and valuation assumptions.

Find out about the key risks to this Ryman Hospitality Properties narrative.

Another Lens on Valuation

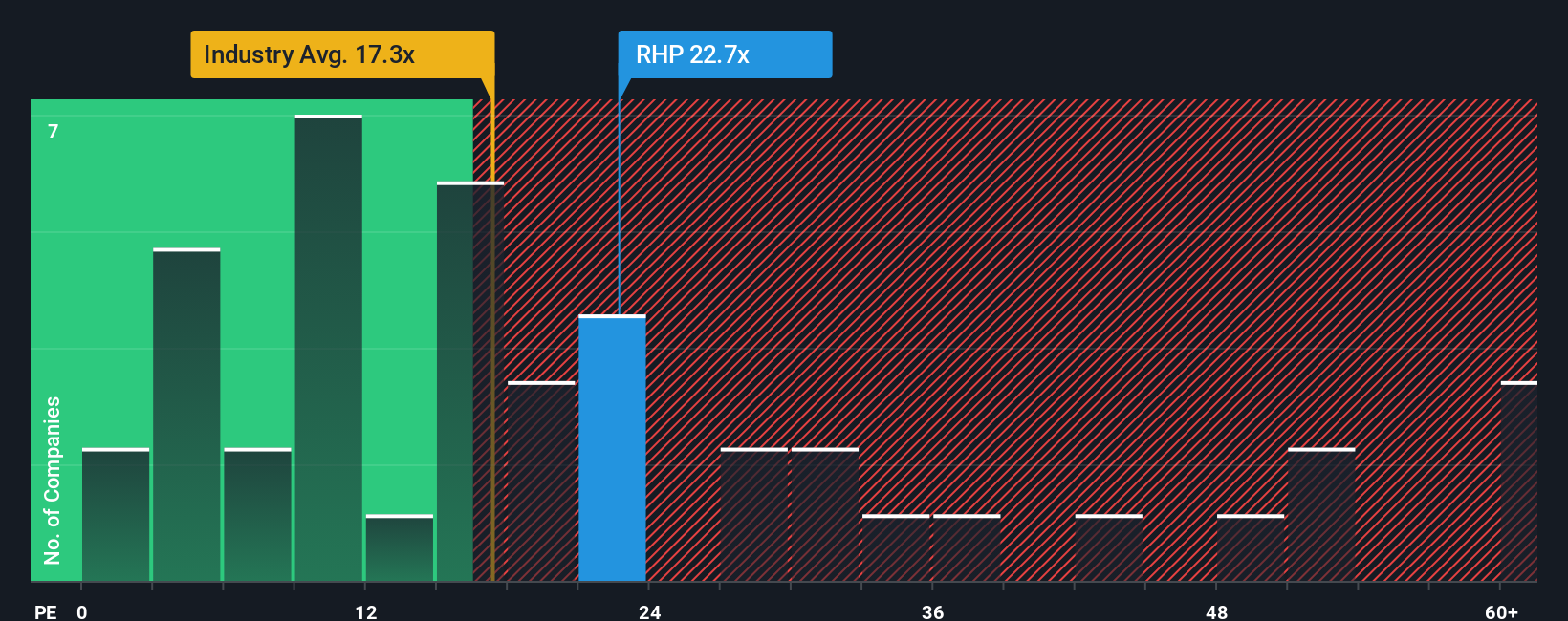

That optimistic narrative sits uneasily beside Ryman’s current pricing on earnings. The stock trades at about 24 times earnings, meaningfully richer than the global Hotel and Resort REITs average of 15.3 times and its peer average of 21.9 times, yet below a fair ratio of 34.5 times that our work suggests the market could drift toward. Is this a cushion for upside, or extra valuation risk if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If this perspective does not quite align with your own, or you prefer to dig into the numbers yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, give yourself an edge by lining up your next opportunities with targeted stock ideas from the Simply Wall St Screener today.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Lock in reliable income streams by zeroing in on these 15 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026