- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Do Prologis Shares Reflect Real Value After 17.8% Rally Driven by E-Commerce Strength?

Reviewed by Bailey Pemberton

- Wondering if Prologis could be a smart buy or if its recent price reflects real value? You are not alone, as plenty of investors want to know if today's stock price is justified or simply riding the wave of market momentum.

- Prologis shares are up 17.8% since the start of the year and have gained 12.3% over the past 12 months. The past week, however, saw a slight dip of 2.2%.

- News around Prologis has centered on the ongoing strength of e-commerce and supply chain investments. Both of these factors play directly into the company's core business of logistics-focused real estate. Increased demand for warehouse space and positive analyst sentiment have helped shape recent price moves.

- Yet, when you add up the six core valuation checks, Prologis scores just 0 out of 6. It is worth asking if the numbers back up the optimism. Let's dig into the standard valuation approaches, and stick around for an even deeper, smarter way of thinking about value later on.

Prologis scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Prologis Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting future adjusted funds from operations and discounting those projected cash flows back to the present. This method provides insight into whether the stock price reflects the company's true earning potential over time.

For Prologis, the current free cash flow stands at $5.8 Billion, highlighting its robust operating position. Analyst forecasts extend through 2028 and project annual free cash flow to reach $5.67 Billion by that year. Looking further ahead, using extrapolated estimates, Prologis's free cash flows could potentially grow to $8.1 Billion in 2035, although these long-term figures come with increased uncertainty.

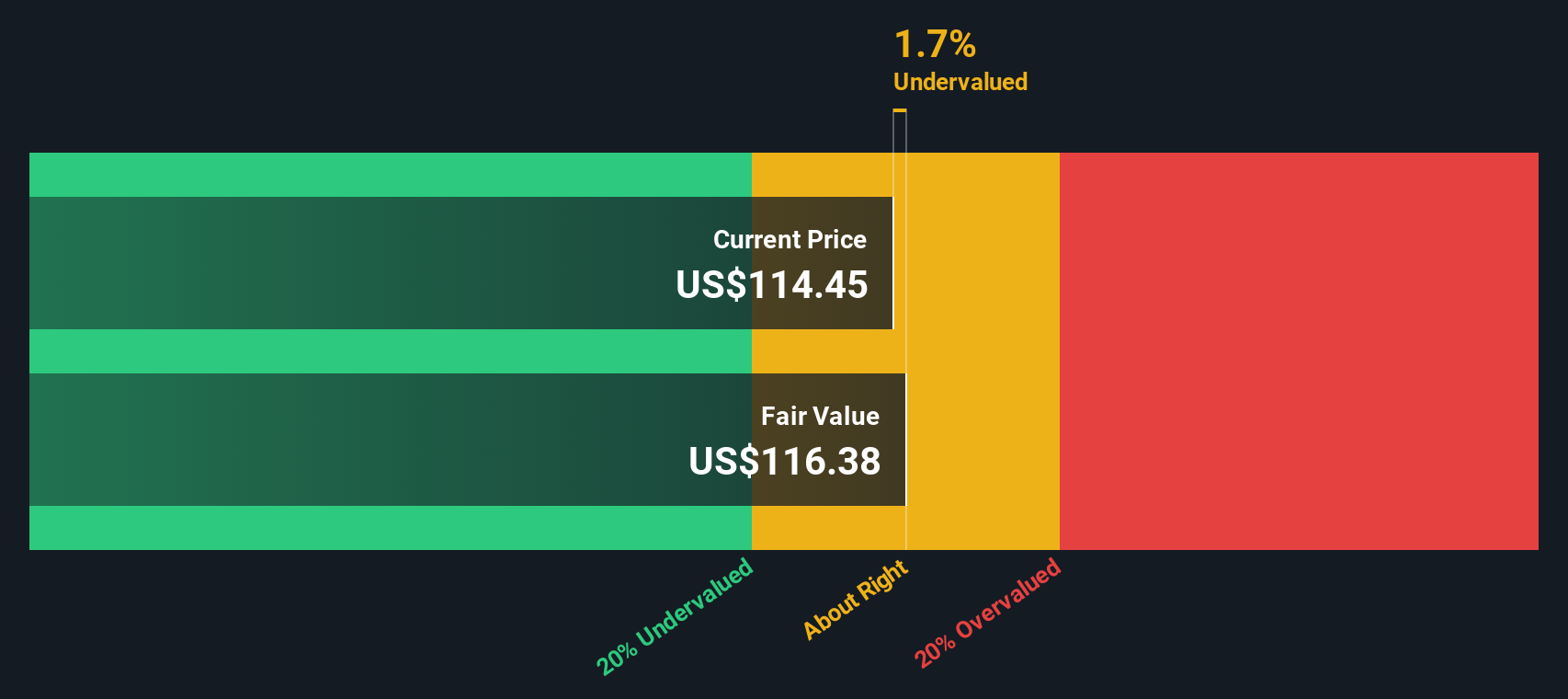

When all projected cash flows are discounted to their present value, the DCF model suggests an intrinsic value of $110.04 per share. This is about 11.6% below the recent share price, indicating the stock currently trades above its calculated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Prologis may be overvalued by 11.6%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Prologis Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely accepted way to value profitable companies like Prologis. Since it shows how much investors are willing to pay for each dollar of earnings, it is especially insightful for businesses with consistent profits and clear growth prospects.

A company’s "normal" or "fair" PE ratio is not a fixed number, as it depends on expectations for future earnings growth and the perceived level of risk. Higher growth companies or those with stable and predictable earnings often command higher PE ratios, while lower growth or riskier firms trade at lower multiples.

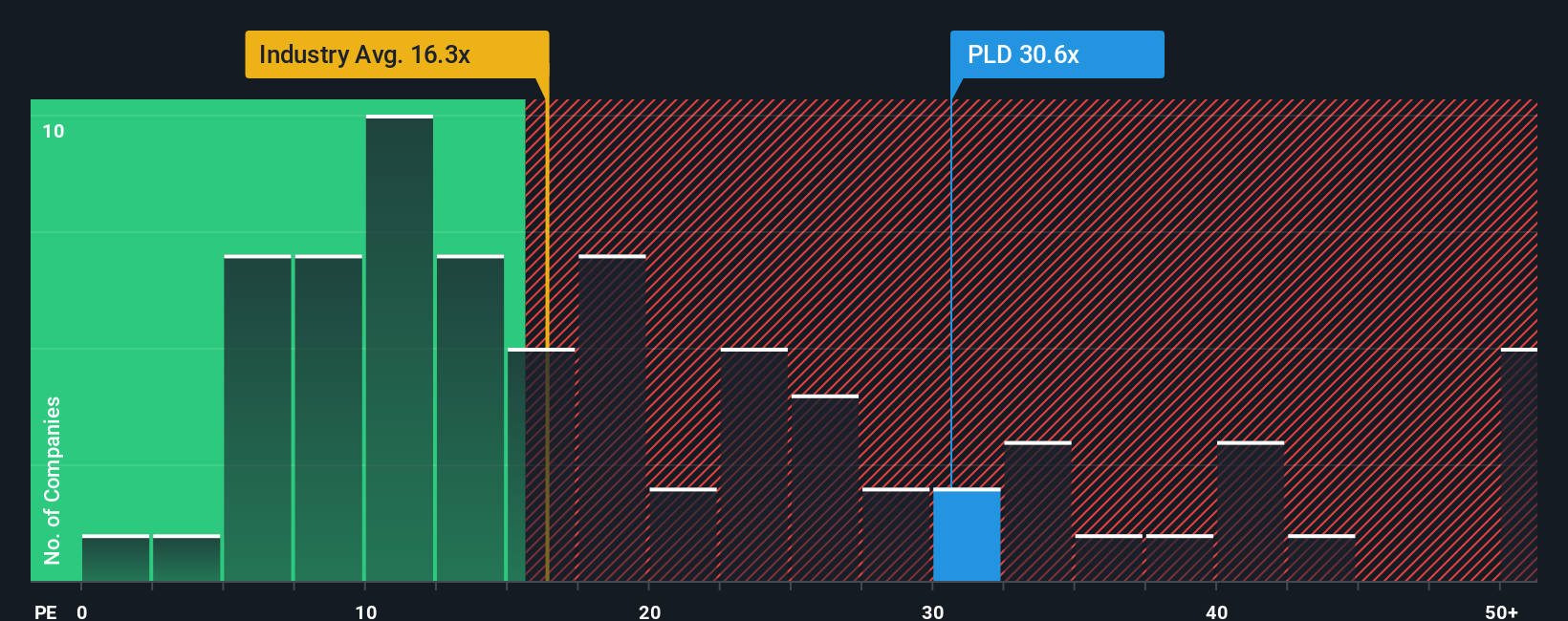

At present, Prologis trades at a PE ratio of 35.6x. This is higher than both the Industrial REITs industry average of 16.4x and the average of its peers at 32.0x. However, Simply Wall St’s proprietary “Fair Ratio” for Prologis is calculated at 33.9x. The Fair Ratio estimates the PE multiple a stock deserves by factoring in earnings growth projections, profit margins, industry norms, company size, and specific business risks.

Comparing against the Fair Ratio is more meaningful than peer or industry comparisons, as it normalizes for what makes Prologis unique. It answers whether the premium investors are paying is actually justified based on the company’s own prospects, rather than just relative benchmarks.

With Prologis's actual PE ratio only slightly above its Fair Ratio, this suggests the stock is priced about right on an earnings basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Prologis Narrative

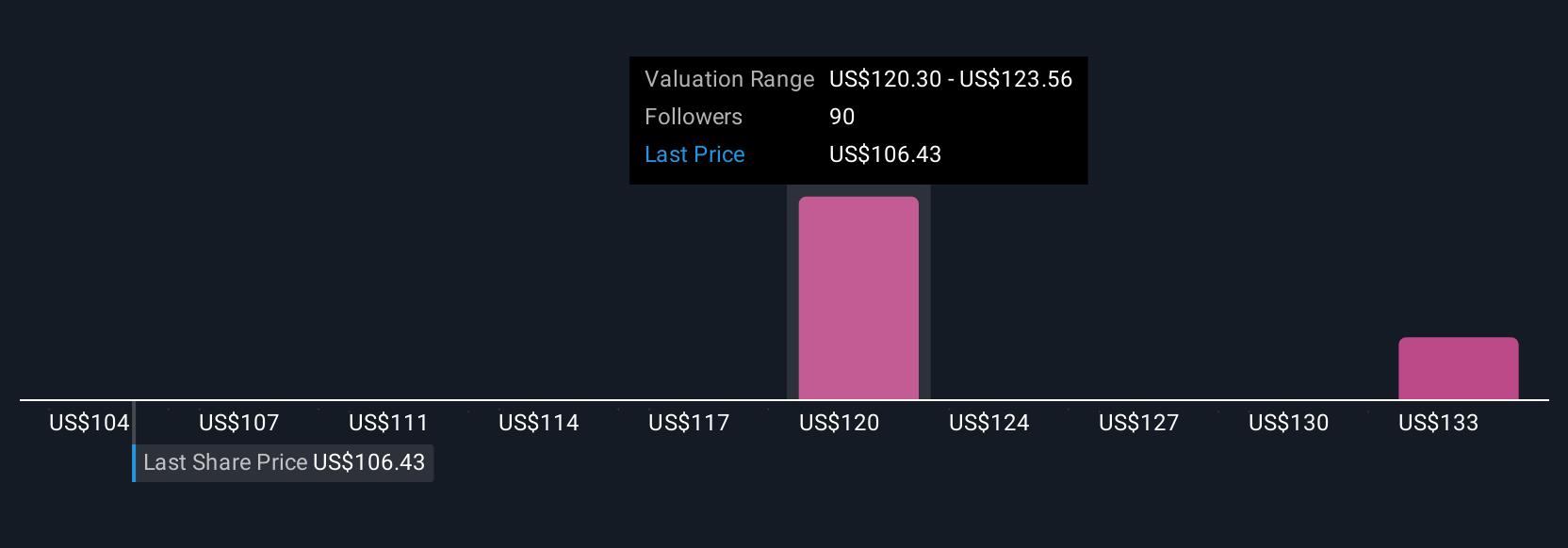

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, your perspective about where it is heading and why, combined with your own estimates for fair value, future revenue, earnings, and profit margins. Rather than just relying on ratios or consensus forecasts, Narratives help you map out the assumptions and big drivers behind the numbers in a transparent, structured way.

On Simply Wall St’s platform, millions of investors can build and share their Narratives on the Community page. Narratives connect a company's story, for example, Prologis benefiting from record leasing and e-commerce growth, or facing risks from slowing tenant demand, directly to a financial forecast and fair value calculation, making it easier to see if your own outlook justifies buying, holding, or selling at today’s price.

Best of all, Narratives are dynamic. They update automatically as new news or earnings are released, keeping your thinking current without extra work. For Prologis, some investors’ Narratives are very optimistic, projecting a fair value as high as $140 due to robust demand, while others are more cautious, estimating as low as $95 based on risks to rental growth. Narratives put you in the driver’s seat, helping you filter through the noise and decide whether the current price matches your view of the company's future.

Do you think there's more to the story for Prologis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives