- United States

- /

- Office REITs

- /

- NYSE:PDM

Did Piedmont Realty Trust’s (PDM) Debt Repurchase Mark a Turning Point in Its Capital Structure Strategy?

Reviewed by Sasha Jovanovic

- On November 19, 2025, Piedmont Operating Partnership, LP, a subsidiary of Piedmont Realty Trust, priced a cash tender offer to purchase any and all of its outstanding 9.250% senior notes due 2028, offering US$1,114.09 per US$1,000 principal amount for up to US$532.46 million of notes.

- This debt repurchase is part of a broader effort to optimize Piedmont’s capital structure and may affect the company’s future financial flexibility.

- We'll assess how Piedmont’s proactive debt management initiative could influence its investment narrative and longer-term financial strategy.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Piedmont Realty Trust Investment Narrative Recap

To be a shareholder in Piedmont Realty Trust, you need to believe that its portfolio focus on high-growth Sun Belt and select suburban office markets can offset structural risks from evolving office demand. The recent cash tender offer for its 9.250% senior notes aims to improve capital structure, but it does not materially change the immediate concern around leasing momentum and revenue recovery as the biggest short-term catalyst and risk remain tied to tenant demand and economic conditions.

Of the company’s recent announcements, the November 13, 2025, offering of US$400 million in new 5.625% senior notes is most relevant to the tender offer. These transactions, taken together, highlight Piedmont’s ongoing efforts to actively manage its debt profile at a time of elevated capital constraints and persistent interest expense pressures, all of which play a direct role in shaping its near-term financial flexibility and long-term investment case.

Yet in contrast to the positive signals from capital optimization, investors should be aware of ongoing risks posed by concentrated leasing exposure in specific markets where shifts in remote work...

Read the full narrative on Piedmont Realty Trust (it's free!)

Piedmont Realty Trust's narrative projects $584.3 million in revenue and $62.5 million in earnings by 2028. This requires a 1.1% yearly revenue growth rate and a $130.9 million increase in earnings from the current level of -$68.4 million.

Uncover how Piedmont Realty Trust's forecasts yield a $9.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

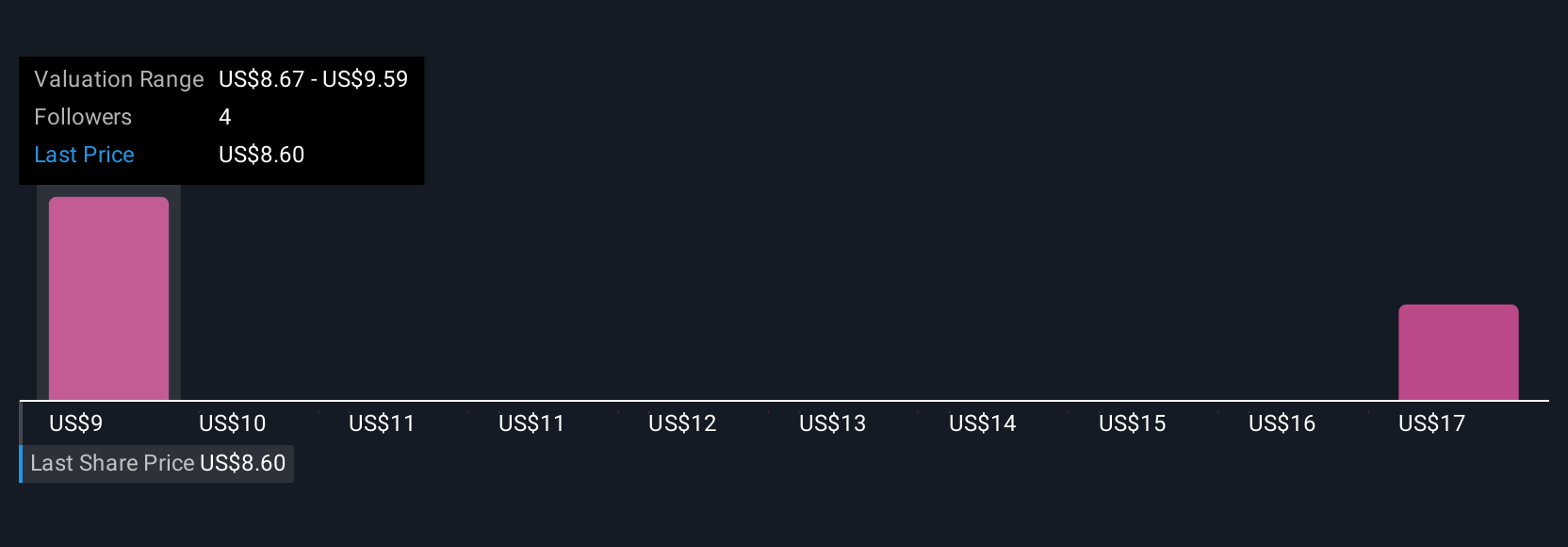

Simply Wall St Community members set Piedmont Realty Trust’s fair value between US$9.33 and US$19.63 from two analyses. Market participants are focused on debt costs and portfolio exposure which could hold back earnings as capital requirements remain high. Explore the range of perspectives for further insight.

Explore 2 other fair value estimates on Piedmont Realty Trust - why the stock might be worth just $9.33!

Build Your Own Piedmont Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piedmont Realty Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Piedmont Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piedmont Realty Trust's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PDM

Piedmont Realty Trust

Piedmont Realty Trust (NYSE: PDM), is a fully integrated, self-managed real estate investment company focused on delivering an exceptional office environment.

Undervalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026