- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): Assessing Value After Recent Dividend Payment Schedule Change

Reviewed by Simply Wall St

See our latest analysis for Realty Income.

Realty Income has seen its share price pause after a strong start to the year, with an increase of 9.18% year-to-date. Its total shareholder return over the past year came in at 8.45%, reflecting steady but unspectacular gains as investors reassess income REITs amid shifting rate expectations and dividend news.

If Realty Income’s momentum has you weighing new opportunities, now is the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With an impressive streak of steady returns and a current share price still trading at a discount to analyst targets, the key question now is whether Realty Income remains undervalued or if the market has already factored in its future prospects. Is there a real buying opportunity here, or are expectations already built into the current price?

Most Popular Narrative: 6.3% Undervalued

According to andre_santos, the narrative prices Realty Income at $61.26, just above the most recent market close of $57.43. This signals modest upside for those seeking value in dividend stocks. The approach uses calculation methods that anchor fair value in the company’s monthly pay-outs and their sustainability as the business anticipates slower growth years ahead.

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty and therefore will have a lower weight on the valuation.

Curious about the hidden formula that led to the fair value? The narrative’s anchor is a lower but robust forward dividend growth paired with a strict discount rate. Want to see the exact calculations and crucial financial levers that could shape the stock’s future? The full narrative reveals it all.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Realty Income faces uncertainties from potential interest rate increases and slowing property income growth. Both factors could weigh on future returns.

Find out about the key risks to this Realty Income narrative.

Another View: Multiples Raise a Caution Flag

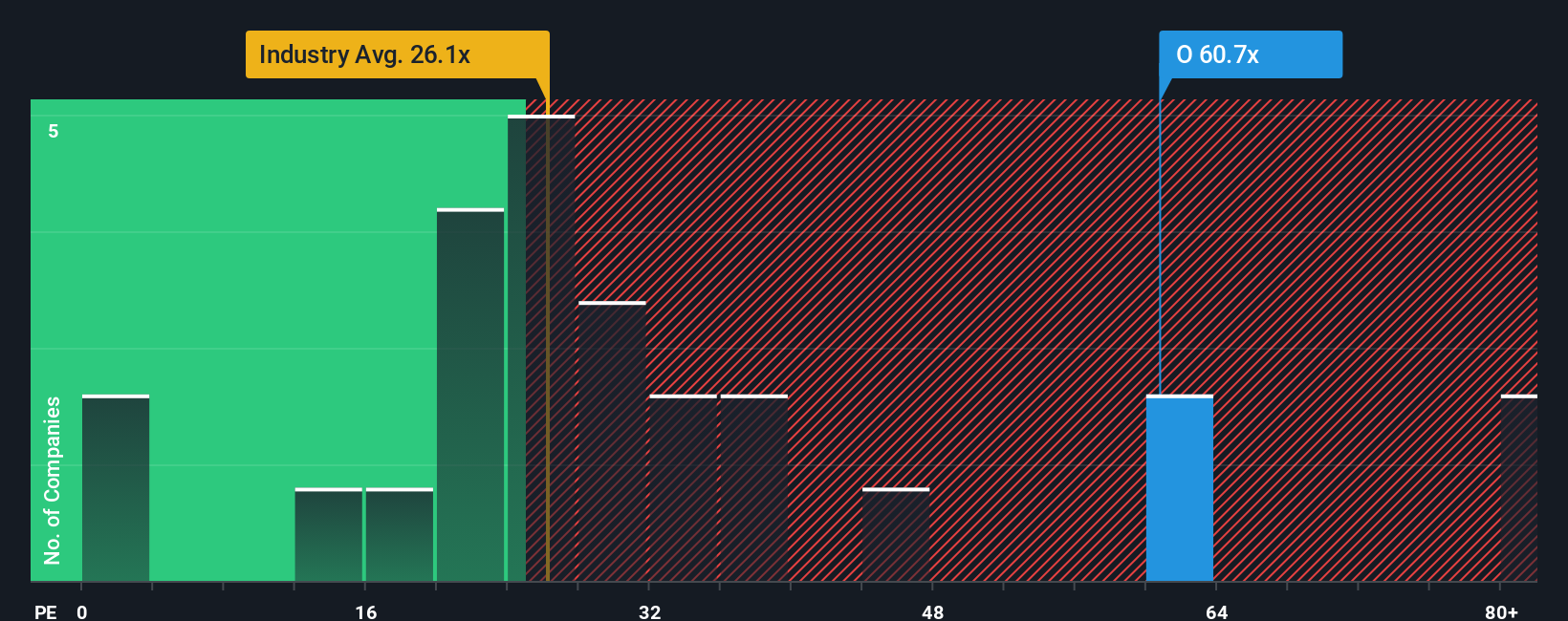

While the user narrative points to modest undervaluation, a comparison against the market’s standard earnings ratio suggests a different story. Realty Income’s current ratio stands at 54.9x, well above the US Retail REITs industry average of 26.9x, its peer group average of 32.6x, and the fair ratio of 34.6x. This gap implies that the stock is priced more expensively than similar companies, raising questions about valuation risk and whether investors are paying too much for expected stability.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If these perspectives don’t match your view or you’d rather dig into the numbers yourself, you can craft your own narrative for Realty Income in just a few minutes. Do it your way

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let a single stock define your strategy. Expand your horizons now and uncover surprising opportunities in sectors and trends others might overlook, right on Simply Wall Street.

- Spot high yields and consistent payers by checking out these 14 dividend stocks with yields > 3% featured for reliable income potential.

- Target early movers in transformative tech and position yourself for growth using these 25 AI penny stocks now gaining ground in artificial intelligence.

- Seize hidden market bargains with these 922 undervalued stocks based on cash flows, where strong financials meet prices below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026