- United States

- /

- Retail REITs

- /

- NYSE:O

How Investors Are Reacting To Realty Income (O) Raising Capital After 665th Consecutive Monthly Dividend

Reviewed by Sasha Jovanovic

- Earlier this month, Realty Income Corporation announced the declaration of its 665th consecutive monthly dividend and filed for a follow-on equity offering of up to 150 million common shares to raise funds for general corporate purposes such as property investments and debt repayment.

- The company's ability to maintain uninterrupted monthly dividends for over three decades highlights its reputation for income stability and robust financial management within the real estate investment trust (REIT) sector.

- We’ll examine how Realty Income’s sustained dividend record and recent capital-raising activity may influence its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Realty Income Investment Narrative Recap

To invest in Realty Income, you need to believe in the company’s long-term ability to generate stable, growing rental income from its extensive real estate portfolio and to sustain regular monthly dividends. The announcement of a follow-on equity offering and continued monthly dividend payments reinforces the income stability narrative, and neither event appears to materially shift the most important near-term catalyst, which remains ongoing portfolio growth; nor does it substantially alter the main risk, which lies in the rising exposure to foreign currency and European market conditions.

Among recent developments, the third quarter earnings report stands out, with steady growth in revenue and net income despite a slightly lowered full-year guidance. In the context of Realty Income's push for further portfolio expansion, especially internationally, these results suggest operational resilience but also highlight the importance of managing geographic risk as overseas investments increase.

But even as monthly dividends continue as expected, investors should not overlook the heightened foreign currency and regulatory exposure that comes with...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $6.2 billion in revenue and $1.6 billion in earnings by 2028. This requires 4.1% yearly revenue growth and a $691.9 million increase in earnings from the current $908.1 million.

Uncover how Realty Income's forecasts yield a $63.45 fair value, a 11% upside to its current price.

Exploring Other Perspectives

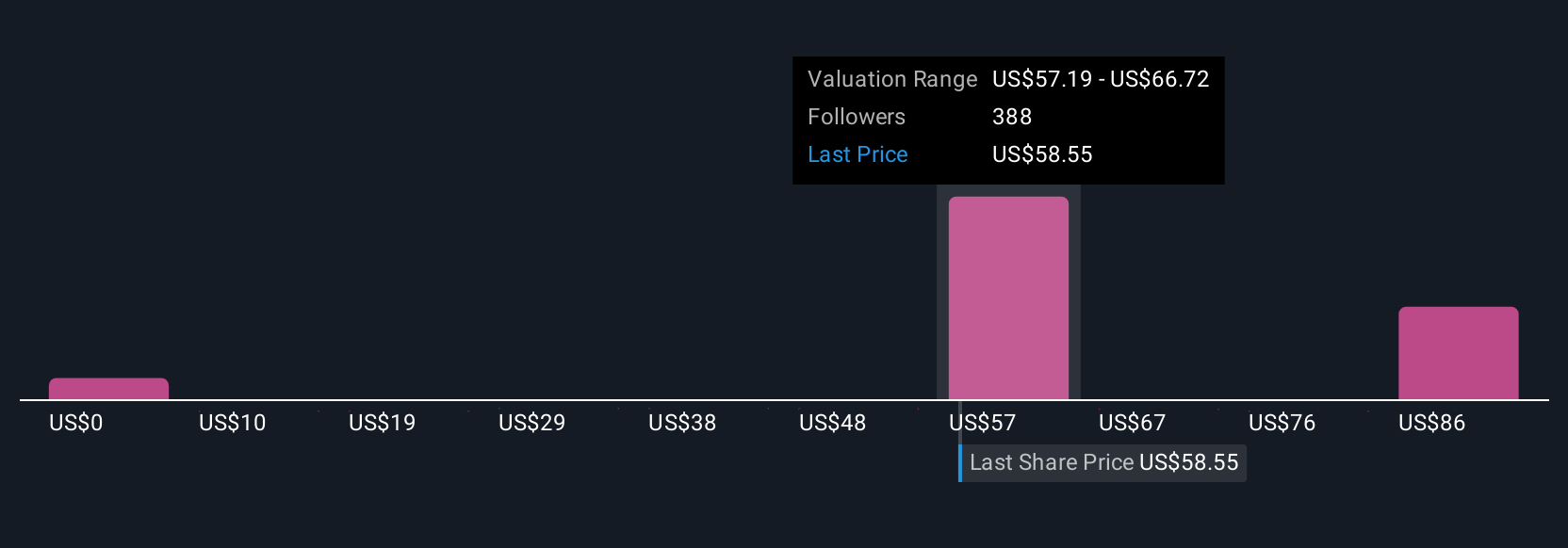

Seventeen fair value estimates from the Simply Wall St Community range from US$56 to US$96.86, showing sharply different outlooks. With Realty Income’s higher European investment concentration, your own view on international risk may strongly influence what you think the company is worth.

Explore 17 other fair value estimates on Realty Income - why the stock might be worth as much as 69% more than the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives