- United States

- /

- Retail REITs

- /

- NYSE:O

Assessing Realty Income (O) Valuation as Its Share Price Lags While Fundamentals Improve

Reviewed by Simply Wall St

Realty Income (O) has quietly lagged the broader market over the past 3 months, even as its fundamentals keep improving. With the share price drifting, investors are asking whether this dividend REIT now offers a better entry point.

See our latest analysis for Realty Income.

Over the past year, Realty Income has quietly delivered a solid positive year to date share price return while its longer term total shareholder returns have been more modest. This suggests momentum is improving but not euphoric as investors reassess interest rate and income risks.

If Realty Income has you rethinking your income portfolio, it could be worth scanning for fast growing stocks with high insider ownership to spot other under the radar opportunities with aligned management incentives.

With earnings still growing, shares trading at a double digit discount to analyst targets, and an implied intrinsic discount near 40 percent, is Realty Income quietly becoming a value opportunity, or is the market already discounting future growth?

Most Popular Narrative Narrative: 6.4% Undervalued

According to andre_santos, the narrative fair value of 61.26 dollars sits modestly above Realty Income's last close at 57.32 dollars, hinting at quiet upside driven by dividends.

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.

Want to see how a classic dividend workhorse still lands above today’s price? The narrative leans on disciplined growth, slowing momentum, and a surprisingly rich income stream. Curious which long run assumptions make that combination add up to a higher fair value?

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower dividend growth or higher for longer interest rates could compress valuations and challenge the case for modest upside from here.

Find out about the key risks to this Realty Income narrative.

Another Lens On Value

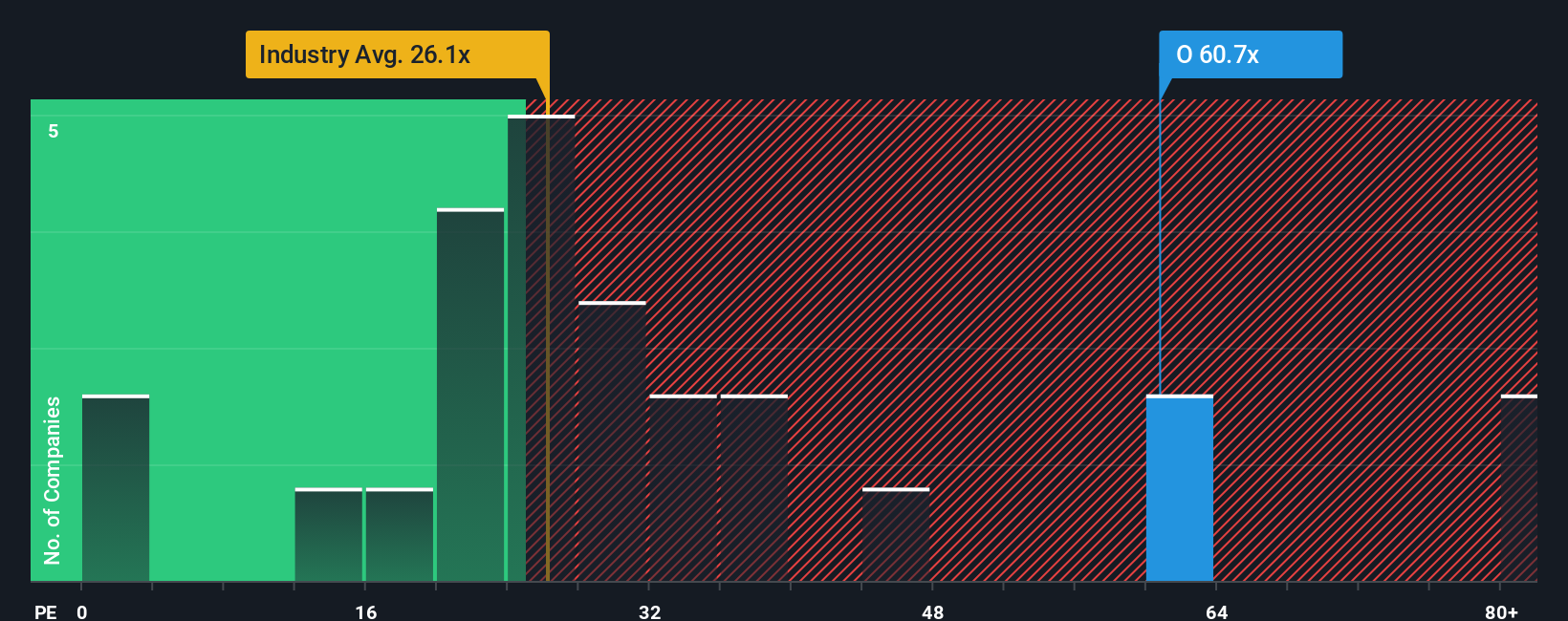

While the narrative points to modest undervaluation, our price to earnings work paints a sharper picture of risk. Realty Income trades on 54.8 times earnings versus 31.5 times for peers and a fair ratio of 34.6, suggesting investors are paying up heavily for stability.

That premium may be fine if growth and dividends stay rock solid. However, it also limits upside if sentiment turns, or if income names fall out of favor again. How much multiple risk are you really willing to hold for a 5 to 6 percent yield?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you see the numbers differently or want to test your own assumptions, you can build a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next shortlist by scanning focused stock sets on Simply Wall Street that match how you actually like to invest.

- Target steadier cash flow by reviewing these 15 dividend stocks with yields > 3% that combine meaningful yields with business models built to keep paying.

- Position ahead of the next tech wave by checking out these 27 AI penny stocks poised to benefit from accelerating demand for intelligent software and automation.

- Stack the odds in your favor by screening these 901 undervalued stocks based on cash flows where prices still trail the strength of their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026