- United States

- /

- Health Care REITs

- /

- NYSE:MPW

A Look at Medical Properties Trust’s Valuation Following Dividend News and Refinancing Progress (MPW)

Reviewed by Simply Wall St

Medical Properties Trust (MPW) has captured investor attention following its recent announcement of a new regular dividend, as well as updates on improved liquidity and debt refinancing. These developments signal continued confidence in the company’s financial footing and stability.

See our latest analysis for Medical Properties Trust.

Momentum has clearly been building for Medical Properties Trust, with a 31% share price return over the last 90 days and a sharp 43% rise year-to-date, reflecting renewed optimism following recent refinancing wins and dividend news. However, while short-term gains have been impressive, the three- and five-year total shareholder returns remain firmly negative, underscoring the mixed longer-term picture for investors.

If you’re tracking market movers on the back of upbeat financial updates, now is a great moment to broaden your search and discover See the full list for free.

With shares rebounding sharply and analyst price targets remaining below the current market level, the question is whether Medical Properties Trust is truly undervalued or if the market has already priced in the recovery and future growth prospects.

Most Popular Narrative: 13.8% Overvalued

Medical Properties Trust’s most followed narrative puts its fair value at $5.07, whereas the last close was $5.77, suggesting that the current share price sits slightly above what analysts see as justified by the company’s fundamental outlook. This sets the stage for scrutiny over whether recent optimism is running ahead of the actual earnings potential.

Accelerated ramp-up of rental payments from newly installed operators on previously distressed hospital assets, demonstrated by a jump from $3.4 million to $11 million in cash rental income quarter over quarter and an expected annualized cash rent exceeding $1 billion by 2026, positions the company for significant near-term revenue and FFO improvement.

Want to know why the narrative remains bullish in the face of sector turbulence? There is one forecasted turnaround in profit margins and revenue driving the model’s projected value, but the biggest growth leap might surprise you. Unlock the full story and discover the hidden forces behind this provocative valuation call.

Result: Fair Value of $5.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming risks such as continued tenant concentration and unresolved asset impairments could quickly shift the narrative, especially if tenant transitions falter.

Find out about the key risks to this Medical Properties Trust narrative.

Another View: Discounted Cash Flow Model Points to Undervaluation

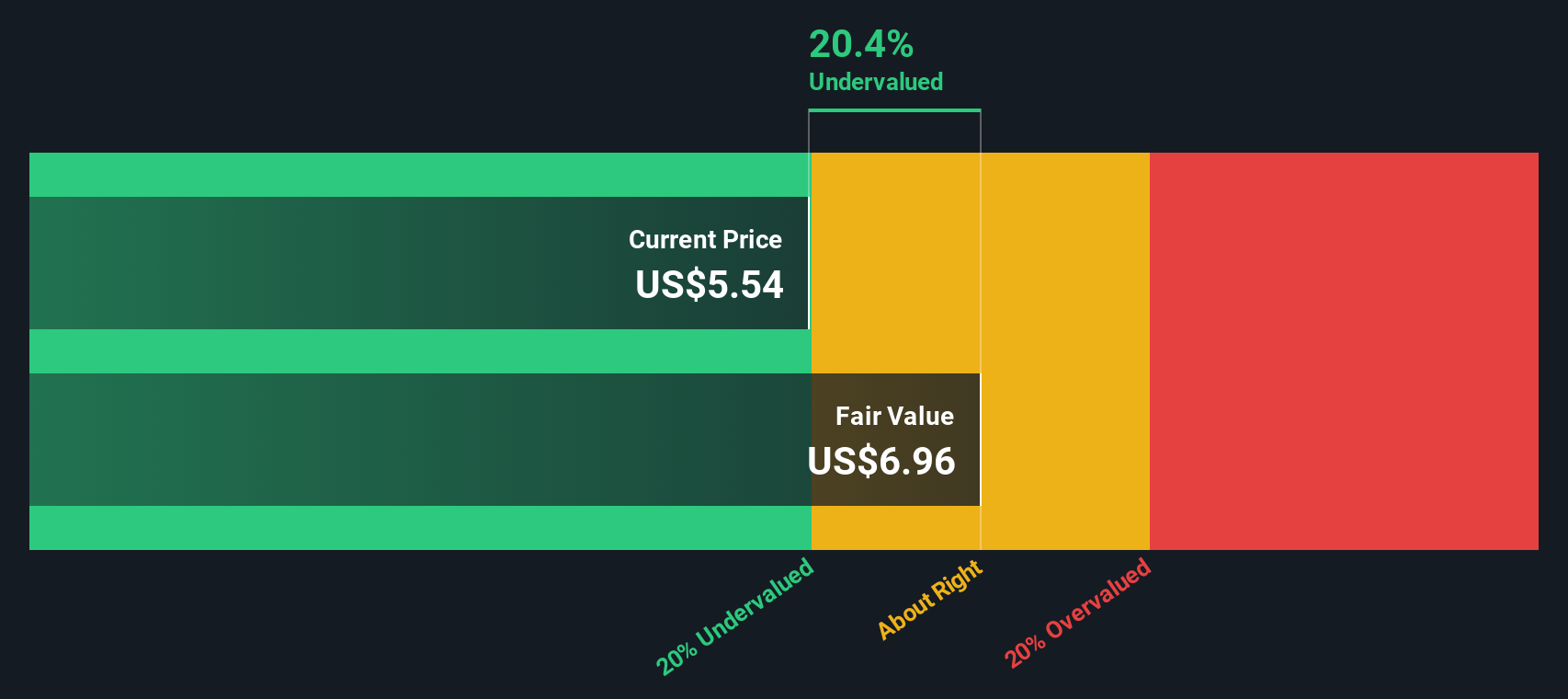

While the most watched valuation compares Medical Properties Trust as overvalued relative to its fundamentals, our DCF model takes a different stance. It suggests that shares are actually trading about 20% below fair value, highlighting a potential opportunity the market may be missing. Could the recovery momentum have even more room to run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you want to dig into the numbers yourself or approach the outlook from your own perspective, you can easily craft your own analysis in just a few minutes with Do it your way.

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Stock Ideas?

Smart investors never settle for just one opportunity. Keep your edge by scouting out off-the-radar stocks, fast-emerging trends, and solid dividend plays before others catch on.

- Jump on the momentum of AI breakthroughs and spot tomorrow’s leaders with these 25 AI penny stocks at the forefront of artificial intelligence and automation.

- Boost your returns by targeting reliable passive income. Start with these 15 dividend stocks with yields > 3% offering consistent yields above the competition.

- Unlock rare potential with these 3579 penny stocks with strong financials that have strong fundamentals and may be poised for outsized growth in rapidly evolving markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success