- United States

- /

- Industrial REITs

- /

- NYSE:LXP

How Investors Are Reacting To LXP Industrial Trust (LXP) Dividend Hike and Upgraded 2025 Guidance

Reviewed by Sasha Jovanovic

- LXP Industrial Trust recently reported strong third-quarter 2025 results, announced a 3.7% increase in its regular quarterly common share dividend to US$0.14 per share, and revised its full-year net income guidance to US$0.25–US$0.26 per diluted common share.

- This combination of higher profitability, improved dividend outlook, and updated financial guidance reflects both robust current performance and management's confidence in its earnings trajectory.

- We'll assess how LXP's dividend increase might shift analyst expectations and the company's investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

LXP Industrial Trust Investment Narrative Recap

To be a shareholder in LXP Industrial Trust, you need to believe in the ongoing demand for modern logistics and industrial properties amid evolving supply chains. The recent dividend increase and higher earnings underscore management’s confidence; however, near-term portfolio vacancy risk remains the central catalyst for the stock, while concentration in single-tenant assets continues to be the most prominent risk. Based on current disclosures, these news items do not materially shift the biggest catalyst or top risk for LXP at this time.

Among the recent news, the 3.7% increase in LXP’s quarterly common dividend to US$0.14 per share stands out. This move is consistent with LXP's focus on rewarding shareholders and reflects short-term earnings strength, but dividend sustainability could be challenged if elevated vacancy rates or re-leasing delays worsen the pressure on occupancy and cash flow. Yet, the improved payout signals confidence as management navigates a shifting market environment.

But while management’s optimism is clear, investors should also be aware of the ongoing risk tied to LXP’s concentrated exposure to large single-tenant move-outs and the trouble of re-leasing those big-box spaces in case...

Read the full narrative on LXP Industrial Trust (it's free!)

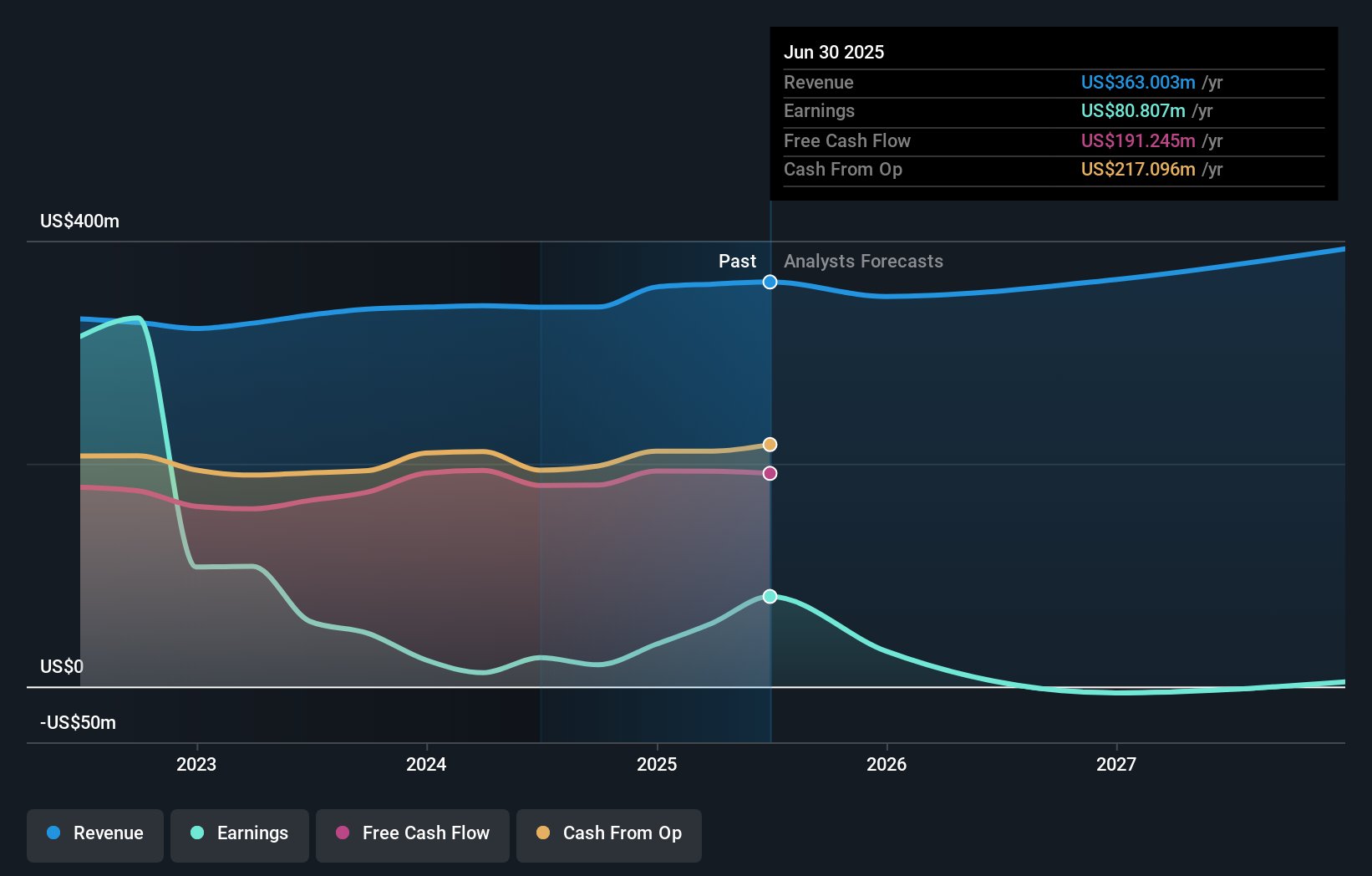

LXP Industrial Trust is expected to generate $417.6 million in revenue and $3.1 million in earnings by 2028. This outlook is based on an anticipated annual revenue growth rate of 4.8%, but also forecasts a steep drop in earnings, decreasing by $77.7 million from current earnings of $80.8 million.

Uncover how LXP Industrial Trust's forecasts yield a $10.64 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community member valuations for LXP range from US$6.02 to US$10.64 across 2 fair value estimates. With some calling out vacancy and re-leasing risk, investor opinions can widely differ so be sure to consider several viewpoints.

Explore 2 other fair value estimates on LXP Industrial Trust - why the stock might be worth 37% less than the current price!

Build Your Own LXP Industrial Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free LXP Industrial Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LXP Industrial Trust's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives