- United States

- /

- Industrial REITs

- /

- NYSE:LXP

Assessing LXP Industrial Trust’s Valuation After Strong Q3 Earnings and Dividend Hike

Reviewed by Simply Wall St

LXP Industrial Trust (LXP) just wrapped up the third quarter with some strong numbers, reporting a sharp jump in both earnings and net income. In addition, the company bumped up its quarterly common dividend, a decision likely to catch investors’ attention.

See our latest analysis for LXP Industrial Trust.

LXP Industrial Trust’s latest jump in quarterly earnings and a fresh dividend hike have put a spotlight on the stock, and investors seem to be responding. Its share price has gained around 16% over the past three months and nearly 20% year-to-date. This positive momentum follows strong recent results and news of a planned stock split. However, zooming out, the 12-month total shareholder return of 7% suggests a more moderate long-term trajectory.

If you’re looking to broaden your investing horizons beyond LXP, now’s the perfect moment to explore fast growing stocks with high insider ownership.

With the share price rallying after upbeat results and a higher dividend, the big question now is whether LXP Industrial Trust is undervalued or if the market has already factored in all the good news, leaving little room for upside.

Most Popular Narrative: 11.2% Undervalued

LXP Industrial Trust’s fair value, according to the most widely followed narrative, stands notably higher than its last close price. This leads to a closer examination of the catalysts that support this bullish valuation outlook.

LXP’s focused capital recycling and portfolio repositioning toward high-quality, Class A, single-tenant facilities in supply-constrained, business-friendly states position the company to benefit from favorable supply-demand dynamics, translating to sustained net margin expansion and improved earnings quality.

Ever wondered why analysts believe LXP deserves a premium over its current market value? The narrative here highlights a future defined by significant margin moves, strategic property shifts, and a pace of growth that might be unexpected. Missing the real drivers behind this price target means missing the numbers that could change the outlook for LXP.

Result: Fair Value of $53.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, LXP’s reliance on large, single-tenant assets and exposure to shifting market rents could still challenge its long-term momentum and margins.

Find out about the key risks to this LXP Industrial Trust narrative.

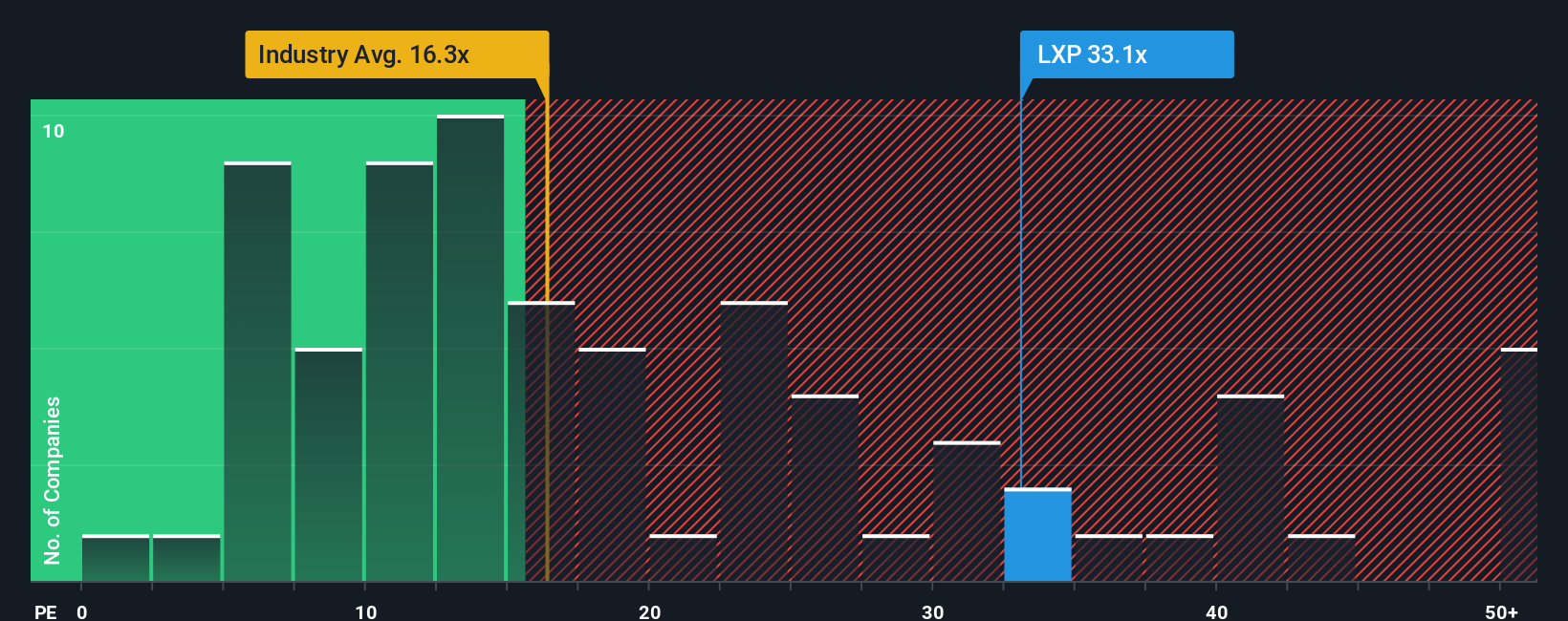

Another View: Multiples Highlight a Different Story

Looking at LXP Industrial Trust through its price-to-earnings ratio reveals a more cautious outlook. The stock trades at 25.6 times earnings, which is higher than both the industry average of 16.7 and a fair ratio estimate of 11.7. This premium suggests investors may be paying up for growth that could be difficult to deliver if market conditions shift. Does this signal additional risk, or is the market right to expect more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LXP Industrial Trust Narrative

If you see the story unfolding differently or want to dig into the data yourself, you can build your personal take in just a few minutes. Do it your way.

A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with just one stock when you could uncover a world of possibilities. Use these powerful tools to pinpoint opportunities that others might overlook right now.

- Capture the advantage of higher yields by checking out these 15 dividend stocks with yields > 3%, which consistently deliver payouts above 3% and reward patient shareholders.

- Jump ahead of market trends with these 26 AI penny stocks, which are driving rapid growth in artificial intelligence and transforming industries for the next decade.

- Unearth untapped value by seeking out these 872 undervalued stocks based on cash flows, which the market has yet to fully appreciate based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives