- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Assessing LTC Properties (LTC): Is There More Value After Recent Momentum?

Reviewed by Simply Wall St

See our latest analysis for LTC Properties.

With shares up 4% over the past month and a year-to-date share price return of just over 7%, LTC Properties is showing hints of renewed momentum. Despite plenty of ups and downs, long-term investors have seen a 30% total shareholder return over five years. This suggests the latest move is part of a broader story rather than just a short-term bounce.

If you’re interested in uncovering more opportunities within the same space, our Healthcare Stocks Screener makes it easy to discover other REITs and operators leading the way in health and senior care. See the full list for free.

LTC’s solid financial results and modest discount to analyst targets have some investors wondering whether the recent uptick signals an undervalued opportunity, or if the market is already factoring in the REIT’s future growth prospects.

Most Popular Narrative: 3.6% Undervalued

With LTC Properties closing at $36.49 and the consensus narrative indicating a fair value near $37.83, the current price is close to the perceived intrinsic value. This leaves some additional upside on the table for investors seeking value in this REIT.

LTC's aggressive push to expand its SHOP (Senior Housing Operating Portfolio) footprint through acquisitions of newer, stabilized senior housing assets positions the company to capitalize on the increasing demand for institutional senior care as the U.S. population ages. This strategy may drive future revenue and NOI growth.

The company's ability to recycle capital out of older skilled nursing assets through portfolio sales and potential loan prepayments, and redeploy proceeds into higher-yielding, modern properties, enhances rent growth potential and operating efficiency. These factors support higher net margins and potential long-term NAV growth.

Want a closer look at the strategy powering this REIT’s value call? The narrative zeroes in on bold growth bets in senior living and ambitious efficiency targets. Find out what numbers back those moves—some projections might surprise you.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative faces headwinds if acquisition prices surge or if rising debt costs squeeze margins, potentially undermining LTC’s growth outlook.

Find out about the key risks to this LTC Properties narrative.

Another View: Multiple-Based Valuation Raises Caution

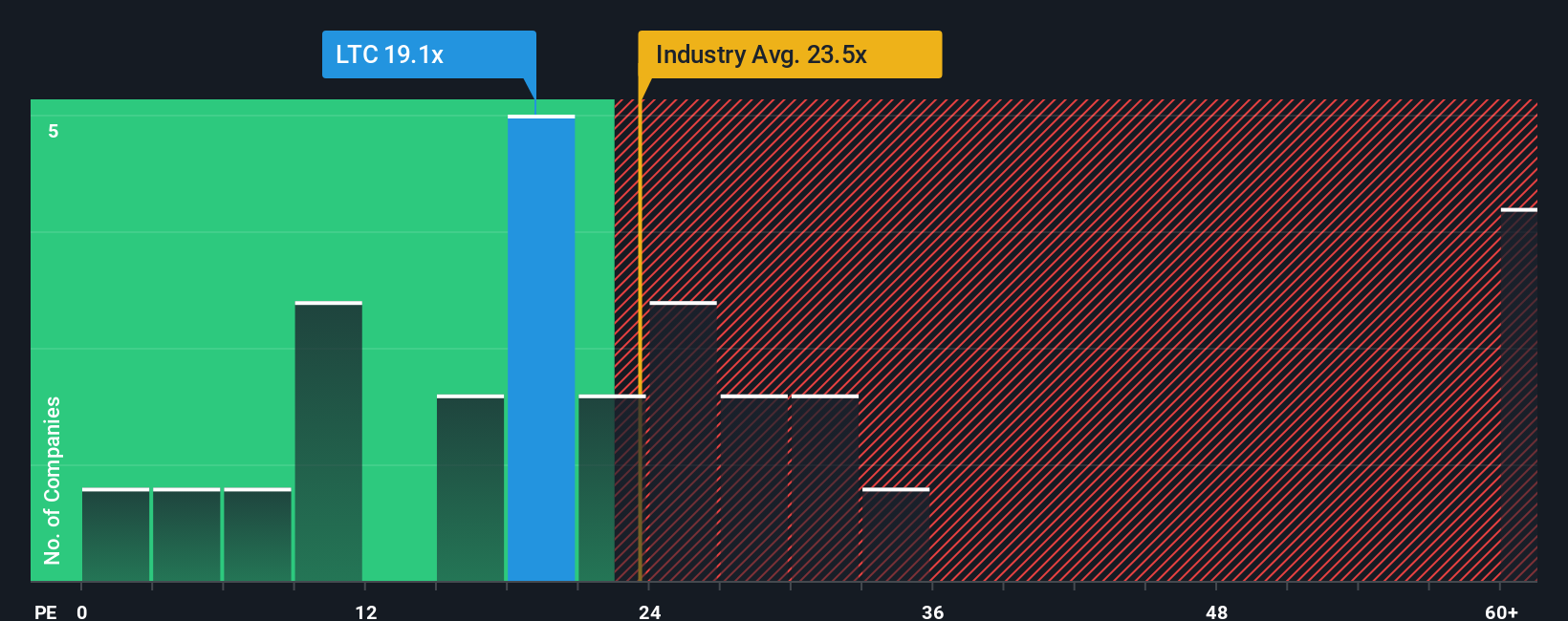

While the fair value estimate suggests LTC Properties is undervalued, looking at the company’s price-to-earnings ratio tells a different story. LTC’s current ratio stands at 52.3x, compared to an industry average of 25.9x, a peer average of 27.6x, and a fair ratio of 41x. This significant gap signals that the stock is expensive versus both the market and its own fundamentals, increasing the risk if growth expectations fall short. Could the valuation premium be justified, or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LTC Properties Narrative

Sometimes the numbers tell a different story depending on your perspective, so if you’d rather dive into the data and craft your own take, you can build your narrative in just a few minutes. Do it your way.

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities slip by. Simply Wall Street’s powerful screener unlocks stocks making waves across the market. You owe it to your portfolio to check these out:

- Tap into the steady income potential offered by these 15 dividend stocks with yields > 3%, delivering yields above 3% for consistent returns in shifting markets.

- Ride the momentum of innovation by checking out these 25 AI penny stocks, where artificial intelligence is fueling the next wave of growth leaders.

- Take control of your value hunt with these 920 undervalued stocks based on cash flows, featuring quality companies trading below their intrinsic worth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026