- United States

- /

- Residential REITs

- /

- NYSE:INVH

Does Invitation Homes Share Price Offer Opportunity After Latest Earnings and 14% Slide?

Reviewed by Bailey Pemberton

If you are holding or eyeing shares of Invitation Homes, you are probably asking yourself the big question right now: "Is it time to make a move?" After all, the stock's path over the past year has been a bit of a rollercoaster. A five-year return of 17.3% might catch your attention, but recent trends tell a different story, with shares slipping nearly 14% over the last year and dipping almost 10% year-to-date. Even so, the price has shown a flicker of resilience lately, nudging up 0.9% in the last week, despite broader market swings and shifting investor sentiment around real estate stocks.

Why the volatility? The single-family rental market keeps evolving, and as broader housing and interest rate headlines hit the wires, companies like Invitation Homes ride the waves of changing risk perception. Investors have been weighing the impact of higher borrowing costs along with shifting supply-demand dynamics in housing, all of which shape how Invitation Homes gets valued on Wall Street. Not all the news justifies the drops; sometimes, market reaction is simply driven by big-picture trends in real estate investment and inflation expectations.

When we run the numbers using different valuation methods, Invitation Homes scores a solid 4 out of 6, indicating the market may be undervaluing the company on two-thirds of the major checks. This is a promising signal, but raw scores alone are far from the full story. Let’s break down each of these approaches to see where the value truly lies, and stay tuned, as the best way to size up this stock might come through a different lens altogether.

Why Invitation Homes is lagging behind its peers

Approach 1: Invitation Homes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model focuses on forecasting a company’s future cash generation and then adjusting those estimates to reflect their present value. In this case, the DCF relies on adjusted funds from operations, which is particularly relevant for a real estate business like Invitation Homes that converts rental income into cash flow.

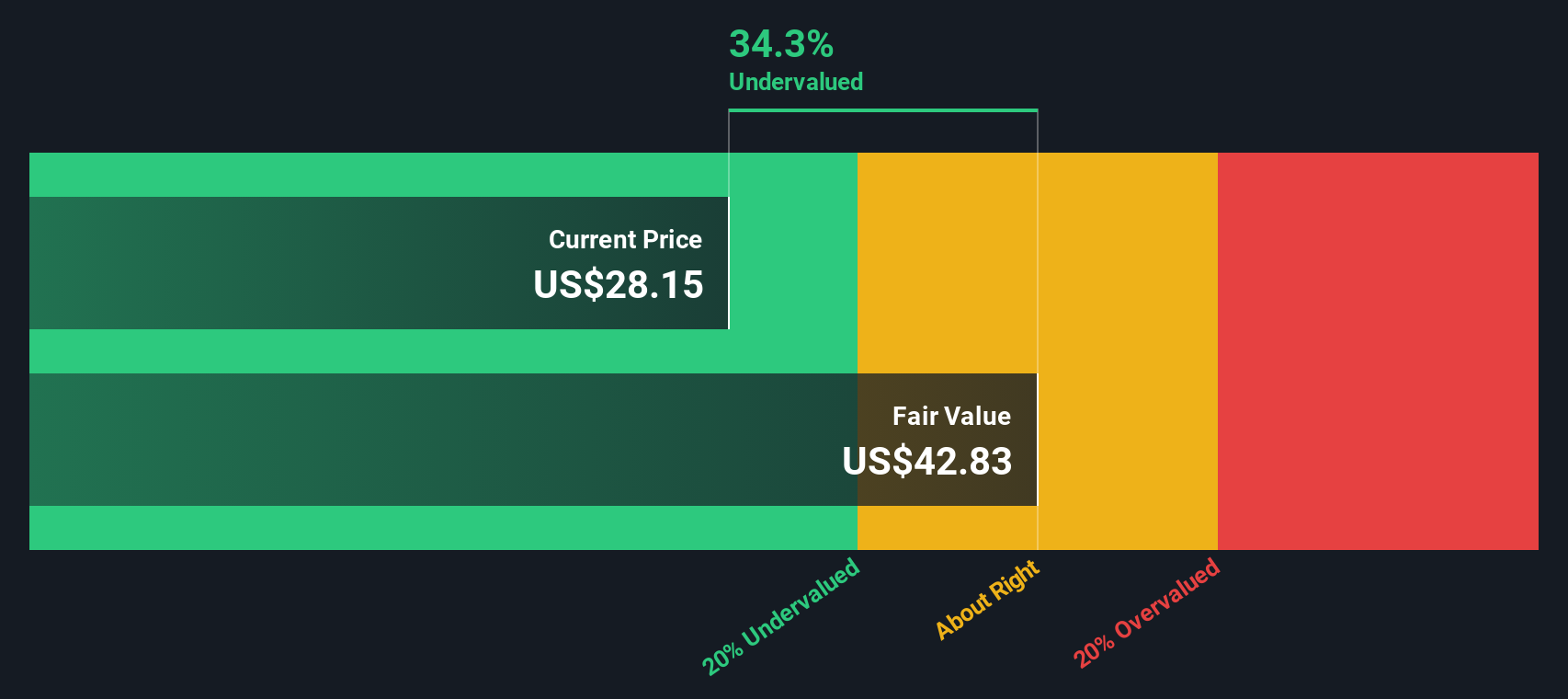

Currently, Invitation Homes produces annual Free Cash Flow of $986 million. Analyst expectations provide projections for the next five years, followed by longer-term estimates extrapolated by Simply Wall St. By 2029, Free Cash Flow is expected to reach about $1.2 billion, with continued moderate growth shown in subsequent years. Each year’s projected cash flow is adjusted back to today’s value to account for risk and the time value of money. This process forms the backbone of the DCF calculation.

The result: using this model, Invitation Homes has an estimated intrinsic value of $42.73 per share. With the DCF indicating the stock is trading at roughly a 33.5% discount to its fair value, the numbers suggest the market may be significantly undervaluing the company at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Invitation Homes is undervalued by 33.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Invitation Homes Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often a go-to measure for valuing profitable companies because it links a company's share price directly to its earnings per share. For established businesses like Invitation Homes, this ratio offers a clear window into how much investors are willing to pay for each dollar of current profit, balancing expectations of future growth with the risks involved.

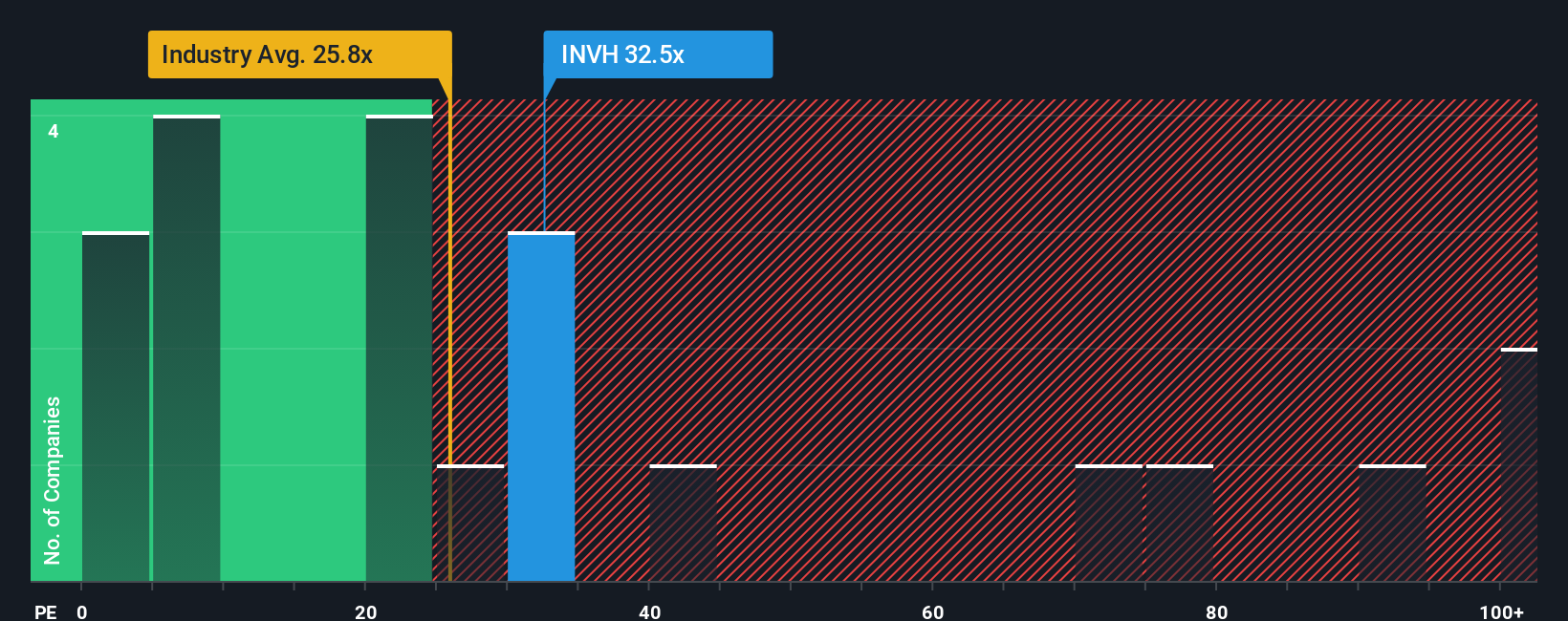

Growth potential and perceived risk both play a role in deciding what a "normal" or "fair" PE ratio should look like. Companies expected to expand quickly, or those viewed as safer bets, usually command higher PE multiples. Slower growth or higher risk can drag this ratio lower. Benchmarking Invitation Homes' current PE ratio of 32x against the industry average of 19.9x and a peer average of 49.9x shows that the market gives this company a premium over most in its category, but less than some of its fastest-growing rivals.

However, instead of only comparing against market averages, Simply Wall St introduces the "Fair Ratio." This proprietary metric adjusts for the specifics of Invitation Homes, including its projected earnings growth, industry nuances, profit margins, market cap, and risk profile. The Fair Ratio, set at 31.3x for Invitation Homes, paints a more nuanced picture that arguably reflects the true value investors should expect.

By weighing all those factors, the Fair Ratio approach avoids the pitfalls of simplistic comparisons and delivers a tailored view. Currently, with the stock trading at 32x, just a fraction above its calculated fair value of 31.3x, the market's pricing of Invitation Homes appears to be in line with expectations.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Invitation Homes Narrative

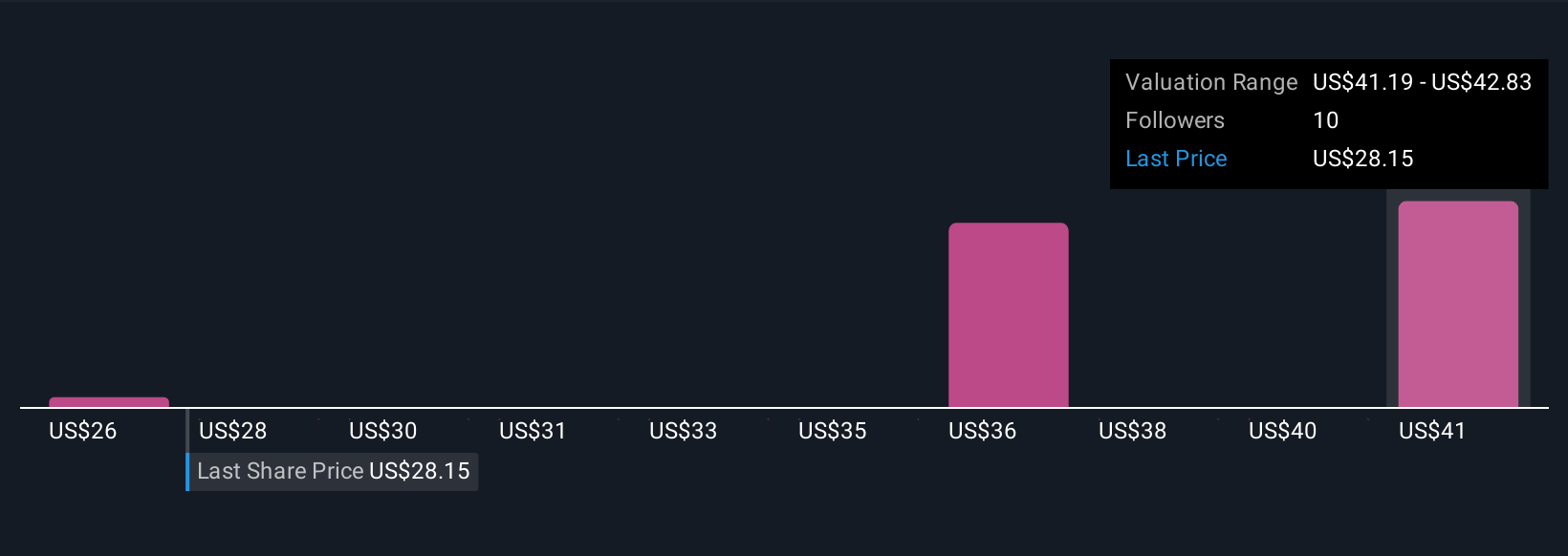

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just spreadsheets and statistics. It is your investment story, turning your assumptions about future revenue, earnings, and margins into a forecast and fair value that reflect your perspective on Invitation Homes. Narratives bridge the gap between a company’s story and the financial numbers, helping you connect the big picture to your own investment thesis and see how your outlook compares to others.

On Simply Wall St’s Community page, which is home to millions of investors, you can access and create Narratives with just a few clicks. By plugging in your own expectations for growth or margins, or exploring the dynamic Narratives already shared by others, you can instantly see a real-time fair value and compare it against the current share price to help guide your buy or sell decisions. Narratives are kept up to date automatically whenever news or earnings are released, so your view is always current.

For example, optimistic investors might highlight persistent housing demand and Sun Belt expansion, forecasting a fair value as high as $41.00. More cautious users could point to regulatory and expense risks, landing at a fair value of $32.00. This wide range shows how different Narratives shape what “fair” looks like for Invitation Homes.

Do you think there's more to the story for Invitation Homes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality homes with valued features such as close proximity to jobs and access to good schools.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives