- United States

- /

- Health Care REITs

- /

- NYSE:HR

How Investors May Respond To Healthcare Realty Trust (HR) Dividend Cut and 2024 ESG Achievements

Reviewed by Sasha Jovanovic

- Healthcare Realty Trust recently released its seventh annual Corporate Responsibility Report, detailing a series of 2024 ESG achievements and announcing a reduction in its quarterly common stock dividend from US$0.31 to US$0.24 per share this past July.

- While enhanced sustainability reporting and an "A" rating for transparency may enhance stakeholder confidence, the dividend reduction points to ongoing financial pressures and a focus on maintaining operational flexibility.

- We'll explore how the dividend cut, aimed at improving financial flexibility, may impact Healthcare Realty Trust's long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Healthcare Realty Trust Investment Narrative Recap

To own shares of Healthcare Realty Trust, an investor needs conviction in the long-term, inelastic demand for outpatient medical office buildings and the company's ability to strengthen its balance sheet through asset recycling and operational improvements. The recently announced dividend cut is aimed at preserving cash, but it does not change the near-term catalyst, which is the need to execute on value-add leasing and asset enhancement programs, and it does not materially lessen the biggest operational risk: delays or setbacks in boosting occupancy and revenue.

The company’s extension of its US$1.5 billion revolving credit facility through 2030 stands out as the most relevant recent announcement tied to financial flexibility, particularly in light of the dividend reduction. This added liquidity helps address upcoming debt maturities and supports ongoing capital projects that are essential for driving rental income growth and achieving longer-term margin improvement targets.

However, investors should be aware that despite these steps to bolster financial flexibility, there remains a risk if asset integrations or occupancy improvements...

Read the full narrative on Healthcare Realty Trust (it's free!)

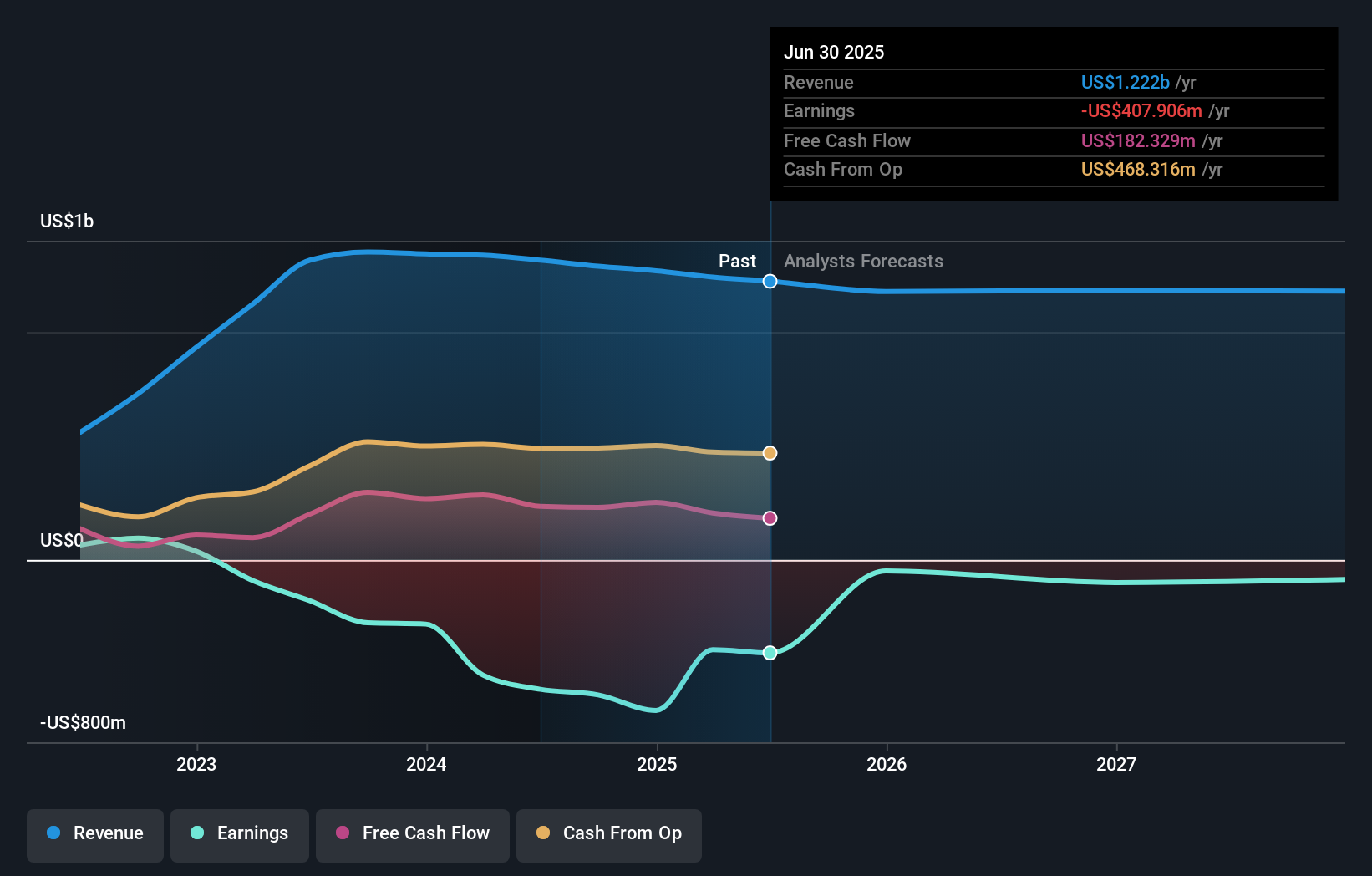

Healthcare Realty Trust's narrative projects $1.2 billion in revenue and $275.4 million in earnings by 2028. This requires a -1.2% yearly revenue decline and a $683 million increase in earnings from -$407.9 million.

Uncover how Healthcare Realty Trust's forecasts yield a $18.56 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Healthcare Realty Trust, ranging from US$18.56 to US$23.56, show opinions from two Simply Wall St Community members. While projections differ, many are watching how quickly leasing and occupancy gains can materialize across the company’s healthcare property portfolio, since delays can directly affect earnings and valuation outlooks.

Explore 2 other fair value estimates on Healthcare Realty Trust - why the stock might be worth just $18.56!

Build Your Own Healthcare Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Healthcare Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Healthcare Realty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HR

Healthcare Realty Trust

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives