- United States

- /

- Office REITs

- /

- NYSE:HIW

Highwoods Properties (HIW): Assessing Valuation After Charlotte Acquisition and Bank Loan Extension

Reviewed by Kshitija Bhandaru

Highwoods Properties (HIW) is making moves that investors are watching closely. The company just acquired the Legacy Union Parking Garage in Uptown Charlotte. This purchase supports core office buildings and signals a focused investment in its real estate portfolio.

See our latest analysis for Highwoods Properties.

Recent momentum around Highwoods Properties is attracting attention. Alongside the Legacy Union Parking Garage deal, management announced the extension of a $200 million bank loan, stretching its maturity to 2029 and reducing near-term debt pressures. Investors seem to be recognizing the company’s focus on core assets and improved flexibility. The share price is currently $31.74, with a 3.5% year-to-date gain and a one-year total shareholder return of nearly 5%, while its three-year total return stands out at an impressive 57%. Even as the pace of gains has slowed recently, the longer-term backdrop highlights durable progress.

If you’re interested in spotting more standouts in real estate and beyond, now is the perfect time to see what you might discover through fast growing stocks with high insider ownership

With recent acquisitions and improved financial flexibility, is Highwoods Properties positioned for a value-driven rebound, or are investors already factoring future growth into the current share price?

Most Popular Narrative: 3% Overvalued

With Highwoods Properties closing at $31.74 and the narrative’s fair value of $30.75, analysts currently see the shares edging above fair value. This sets up a debate over just how much future growth is priced in today.

Aging buildings and the need for continual asset modernization, including sustainability retrofits and elevated tenant improvements, will keep capital expenditures high over the next several years. This is expected to put sustained pressure on net margins and limit growth in cash flows.

Curious how heavy future investment and shifting market dynamics might tip the scales? The real consideration lies in the dramatic changes that analysts forecast for profits, growth rates, and market multiples. Explore what key assumptions are driving their valuation call.

Result: Fair Value of $30.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong leasing momentum or rising Sunbelt market demand could drive occupancy and rent growth. This could potentially challenge the current cautious outlook for Highwoods Properties.

Find out about the key risks to this Highwoods Properties narrative.

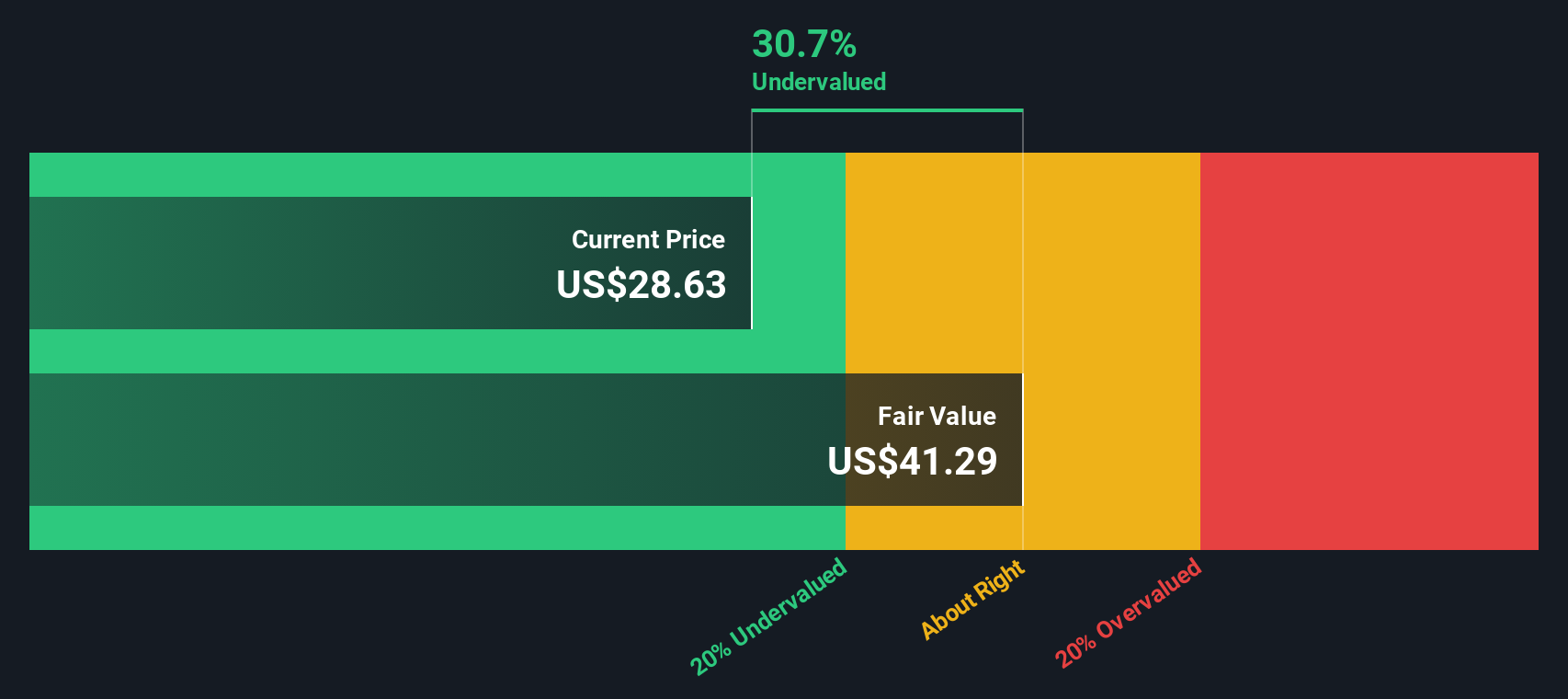

Another View: Our DCF Model Suggests Undervaluation

While analysts call Highwoods Properties slightly overvalued against their consensus price target, our DCF model estimates a fair value of $42.41 per share. This means the current price trades more than 25% below what our model considers the company’s long-term worth, which hints at potential upside. Could the market be too cautious, or is this a reflection of genuine risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Highwoods Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Highwoods Properties Narrative

If you have a different perspective or want to shape your own outlook based on the facts, you can build your own view in just a few minutes. Do it your way

A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't just stop with Highwoods Properties. Quickly find opportunities and avoid missing out on the next big thing by using these powerful, tailored screeners below.

- Maximize your yield potential by checking out these 19 dividend stocks with yields > 3% with reliable dividends above 3%.

- Get ahead in a rapidly transforming sector with these 25 AI penny stocks focused on artificial intelligence breakthroughs and technology innovation.

- Spot under-the-radar value with these 895 undervalued stocks based on cash flows that could be trading below their fair value based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE: HIW), fully-integrated office real estate investment trust (REIT) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives