- United States

- /

- Retail REITs

- /

- NYSE:FRT

Federal Realty (FRT) Margin Beat Sharpens Debate on Quality of Earnings and Growth Outlook

Reviewed by Simply Wall St

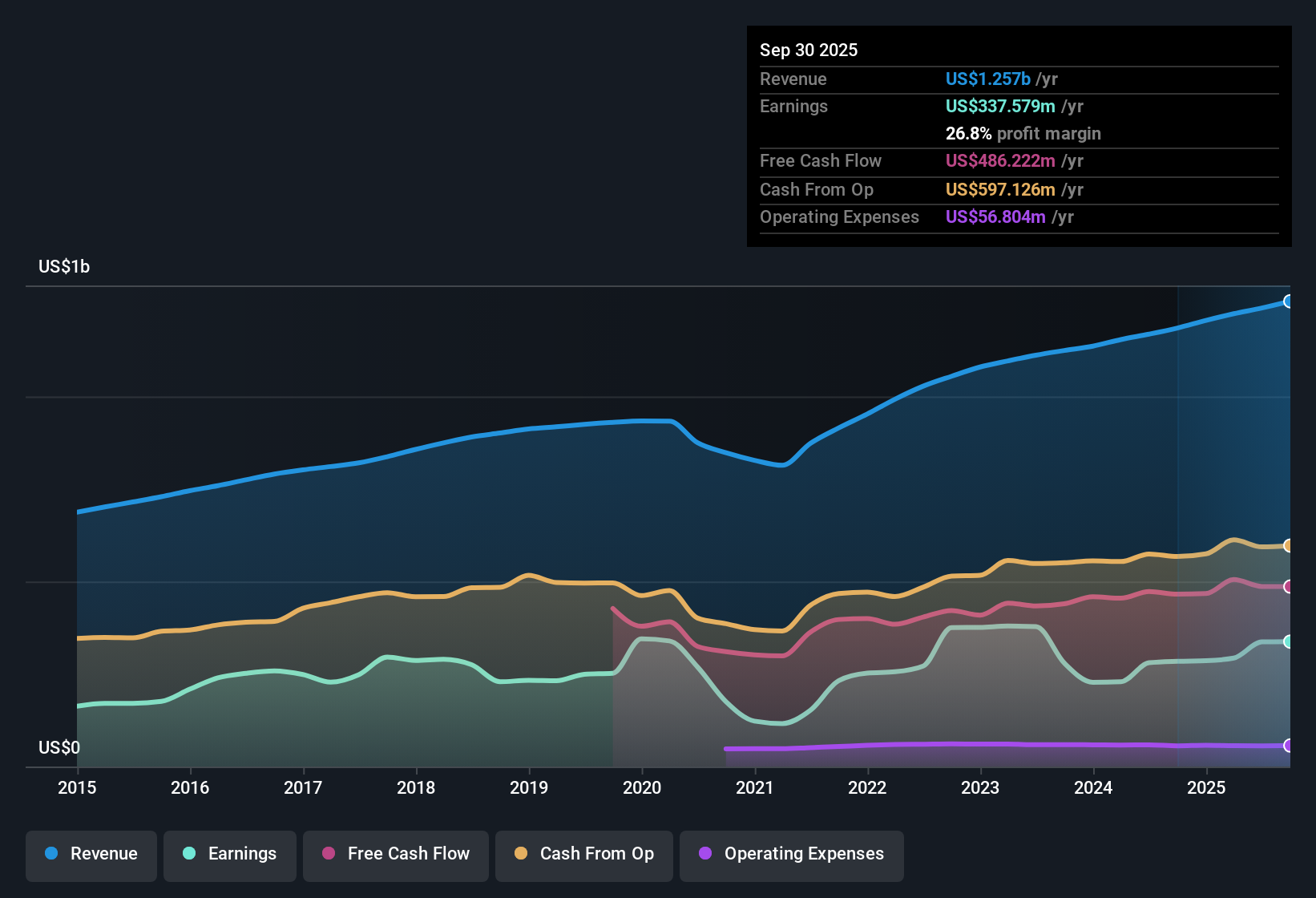

Federal Realty Investment Trust (FRT) booked a net profit margin of 27.2%, up from last year's 24%. The company delivered earnings growth of 20.1% over the past year, comfortably beating its five-year average growth of 10.1%. The recent $79.4 million one-off gain inflates the latest results, but investors will note the backdrop of consistent annual profit growth at 10.1% and a stock that trades at a discount to its sector on key valuation metrics.

See our full analysis for Federal Realty Investment Trust.The next section examines how these earnings compare to the main market narratives for FRT, highlighting where the latest results support the prevailing story and where they introduce new questions.

See what the community is saying about Federal Realty Investment Trust

Profit Margins Projected to Shrink from 27.2% to 21.5%

- Analysts see net margins falling from 27.2% now to 21.5% in three years, even as revenue is expected to grow 4.7% annually.

- According to the analysts' consensus view, the margin compression expected over the next few years creates tension with FRT’s reputation for earnings durability and disciplined capital management.

- Consensus notes proactive leasing and capital recycling have underpinned resilient margins and long-term cash flow. However, higher interest costs and persistent redevelopment needs now risk eroding those gains.

- The combination of slower-than-market revenue growth and shrinking margins tests whether their expansion beyond coastal markets will be enough to offset rising costs and muted hiring.

- The divergence between durable historical profits and the forecast margin squeeze leaves room for debate on what the “new normal” really is for FRT’s future earnings power. Analysts track this inflection closely in the full consensus narrative. 📊 Read the full Federal Realty Investment Trust Consensus Narrative.

Major One-Off Gain Skews $336.8 Million Earnings

- The latest 12-month profit includes a $79.4 million non-recurring gain, making up nearly a quarter of this year’s earnings.

- In the analysts' consensus view, depending on extraordinary gains to drive results complicates the case for sustainable earnings quality.

- While a five-year profit growth rate of 10.1% per year demonstrates past resilience, consensus flags that normalized profitability, once one-offs are stripped out, may not support aggressive future expectations.

- With a projected annual earnings decline of 1.4% ahead, skeptics argue that operational gains, rather than accounting windfalls, will be needed to reassure value-focused investors.

Shares Trade Below Sector; Valuation Hinges on Slower Growth Outlook

- Despite shares trading at $96.19, a discount to the sector’s average price-to-earnings multiple and to the analyst consensus price target of $110.39, growth expectations remain muted, with FRT’s 4.3% annual revenue growth forecast lagging the US market’s 10.3%.

- Analysts' consensus view spotlights this valuation gap, emphasizing that FRT’s relative value is supported by proven profit growth and strong dividends, but also balanced by clear headwinds.

- The market price implies skepticism about near-term growth, in contrast to analysts who see upside to $110.39 if margins and cash flows hold up.

- The risk is that downside to estimates, due to shrinking margins or rising costs, could close the gap in the wrong way, especially if the company cannot sustain high returns without special gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Federal Realty Investment Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Shape your unique perspective into a narrative of your own in just a few minutes: Do it your way.

A great starting point for your Federal Realty Investment Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite FRT’s resilient history, shrinking margins and reliance on one-off gains now challenge its outlook for sustainable earnings growth.

If steady, reliable performance is your priority, use stable growth stocks screener (2100 results) to find companies that consistently deliver durable revenue and profit expansion through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRT

Federal Realty Investment Trust

Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail-based properties located primarily in major coastal markets and select underserved regions with strong economic and demographic fundamentals.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives