- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

How Recent Essential Service Acquisitions and Dividend Hike at Four Corners (FCPT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In November 2025, Four Corners Property Trust announced several acquisitions totaling US$23.6 million, including automotive service and veterinary clinic properties, and declared a 3.2% quarterly dividend increase payable in January 2026.

- This series of acquisitions expands FCPT’s presence in essential service real estate, while the dividend increase highlights ongoing focus on shareholder returns.

- We’ll explore how FCPT’s expansion into essential service sectors as reflected in these acquisitions could influence the company’s investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Four Corners Property Trust Investment Narrative Recap

To invest in Four Corners Property Trust, you need to have confidence in the long-term resilience of essential service real estate and the company’s ongoing ability to diversify away from its casual dining core. The recent acquisitions in automotive and veterinary clinics provide incremental diversification and support this strategy, while the 3.2% dividend increase signals a continued focus on shareholder returns. These developments, however, have not materially reduced the key risk that high concentration in casual dining remains a major vulnerability, or altered the primary catalyst of increased portfolio diversification as a stabilizing force for earnings in the near term.

The acquisition of the five-property veterinary clinic portfolio is especially relevant, as it further shifts the company’s exposure toward sectors expected to be resistant to e-commerce and cyclical demand shifts. This move supports the catalyst of expanding into essential service categories and gradually reducing reliance on legacy restaurant tenants, potentially enhancing rental income stability over time. Taken together, these announcements reflect FCPT’s ongoing efforts to adjust to evolving market risks and opportunities.

But even as FCPT broadens its portfolio, investors need to be aware that concentration risk from its large restaurant exposure continues to...

Read the full narrative on Four Corners Property Trust (it's free!)

Four Corners Property Trust's outlook anticipates $344.5 million in revenue and $144.2 million in earnings by 2028. Achieving this would require 7.2% annual revenue growth and a $38.4 million increase in earnings from the current $105.8 million.

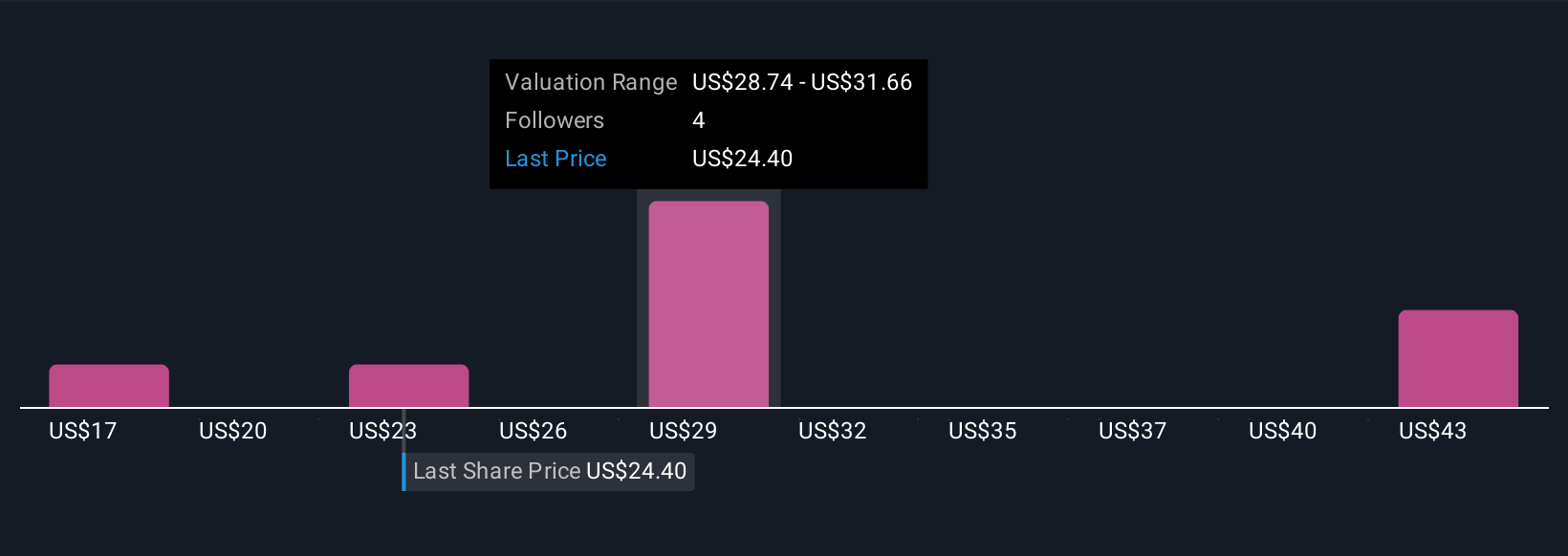

Uncover how Four Corners Property Trust's forecasts yield a $28.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Recent fair value estimates from four members of the Simply Wall St Community range from US$17.09 to US$43.32 per share. As you consider these differing views, keep in mind that FCPT’s push into essential service properties is viewed as a key catalyst for long-term revenue stability, an area where opinions and expectations can shape outcomes very differently.

Explore 4 other fair value estimates on Four Corners Property Trust - why the stock might be worth 29% less than the current price!

Build Your Own Four Corners Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Four Corners Property Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Four Corners Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Four Corners Property Trust's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCPT

Four Corners Property Trust

FCPT is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026