- United States

- /

- Specialized REITs

- /

- NYSE:EXR

A Look at Extra Space Storage’s (EXR) Valuation Following New $600 Million Joint Venture Announcement

Reviewed by Simply Wall St

Extra Space Storage (NYSE:EXR) is making headlines after announcing a major partnership with Blue Vista Capital Management and UBS’s UGA RE business. The goal is to build a $600 million self-storage portfolio across the United States. This collaboration leverages EXR's strengths as the largest operator in the sector and expands its reach while securing additional capital for future growth.

See our latest analysis for Extra Space Storage.

The buzz around Extra Space Storage lately is not just about new partnerships; the stock price tells an important part of the story. After announcing its $600 million joint venture, EXR’s share price has experienced some short-term volatility and is currently down 10.7% year-to-date, with a one-year total shareholder return of -18.8%. While recent momentum has faded, the company’s strong sector positioning and ambitious growth moves may influence a longer-term recovery if investor sentiment changes.

If this self-storage expansion has you curious about what else is out there, it might be time to broaden your search and discover fast growing stocks with high insider ownership

But with the stock now trading at a significant discount to analyst targets, investors may wonder whether Extra Space Storage represents an undervalued opportunity for those willing to be patient, or if the market is anticipating slower growth in the future.

Most Popular Narrative: 15.2% Undervalued

Extra Space Storage’s current price is well below the narrative's fair value estimate, suggesting a significant disconnect between the market and consensus expectations. The narrative sets up investors to focus on unique industry drivers that could justify a higher valuation.

The increase in ancillary income streams (notably tenant insurance and management fees), combined with a rapidly expanding third-party management platform, leverages growing demand from small businesses and online retailers seeking inventory or commercial storage. This boosts fee-based revenue and expands earnings with minimal incremental capital.

Want to know why analysts think this stock could break out? The fair value hangs on a blend of rising alternate revenues and margin expansion. Find out which assumptions might unlock even greater upside for Extra Space Storage. Read the full story and see what has everyone talking.

Result: Fair Value of $155.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high property tax expenses or continued muted revenue growth could undermine earnings and challenge expectations for Extra Space Storage's recovery.

Find out about the key risks to this Extra Space Storage narrative.

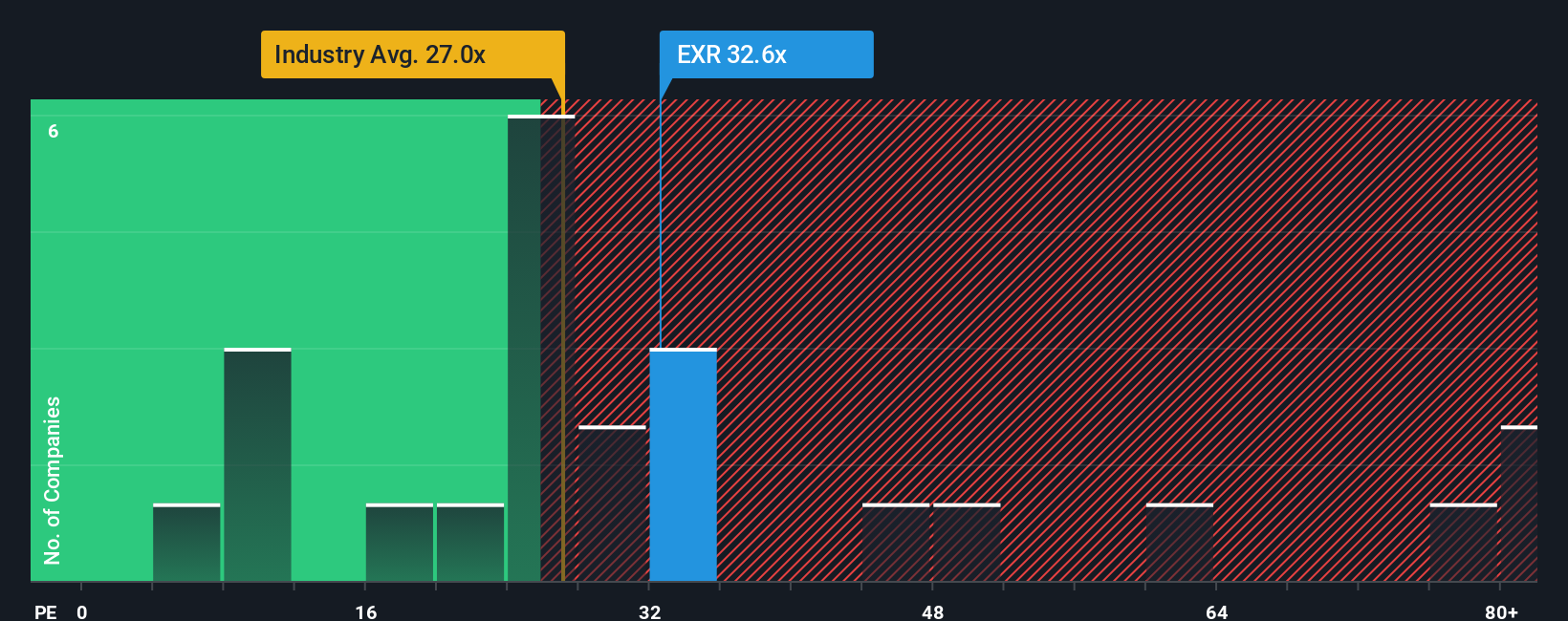

Another View: Relative Value Signals a Premium

Looking from a different angle, Extra Space Storage trades at a price-to-earnings ratio of 29.6x. This is higher than the US Specialized REITs industry average of 28.7x and above peers at 27.7x. The fair ratio is 32.4x, suggesting the stock's premium may leave limited room for upside if market sentiment shifts. Is the risk now tilted more toward a value trap or a rebound from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Extra Space Storage Narrative

If you have a different perspective or enjoy hands-on analysis, you can dive into the data and build your own view in just minutes. Do it your way.

A great starting point for your Extra Space Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities slip by. Use the Simply Wall Street Screener to uncover stocks with huge potential and shape your portfolio for future growth.

- Spot companies redefining patient care and innovation by checking out these 30 healthcare AI stocks, which is packed with leaders in medical technology and AI-driven breakthroughs.

- Unlock reliable income streams with these 14 dividend stocks with yields > 3%, offering strong yields and a chance to build long-term wealth even in volatile markets.

- Catalyze your growth with these 25 AI penny stocks, powering tomorrow’s smartest industries and harnessing the latest in automation and data-driven solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extra Space Storage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXR

Extra Space Storage

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026