- United States

- /

- Residential REITs

- /

- NYSE:ESS

Should Investors Reconsider Essex Property Trust After Recent Share Price Dip in 2025?

Reviewed by Bailey Pemberton

If you are considering what to do with Essex Property Trust stock right now, you are not alone. Many investors are weighing whether the recent dip is a sign of opportunity or cause for caution. After a three-year return of 32.5% and a five-year gain of 43.5%, Essex has clearly delivered for long-term investors. Lately, though, the story has been a little bumpier. The stock closed recently at $261.34, down 1.8% in the last week, 2.5% for the past month, and 6.5% year to date. Even over the last year, the stock is off by 5.9%.

What is behind these moves? Part of it is connected to changing perceptions about risk and reward in the real estate investment trust (REIT) sector. Broader market developments have put pressure on real estate stocks, as investors react to shifting interest rate expectations and gradually easing rental markets. While Essex continues to benefit from its focus on high-demand West Coast multifamily properties, changing macroeconomic trends are hard to ignore.

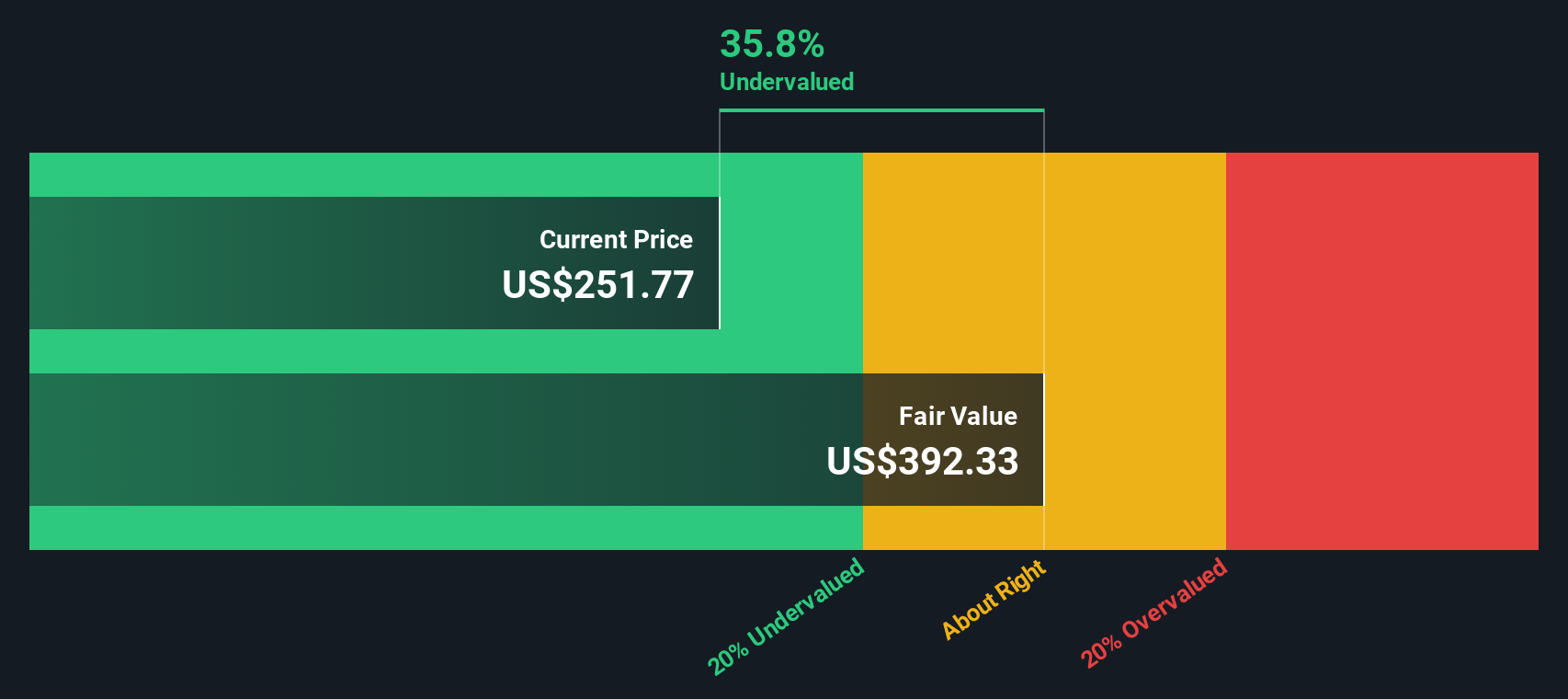

That brings us to valuation. Is now a good time to add to or start a position in Essex? According to our scorecard, Essex scores a 4 out of 6 on key undervaluation checks. This indicates it is undervalued by four different measures, pointing to an interesting setup for value-conscious investors.

Next, let’s break down the specific valuation methods and what they reveal about Essex Property Trust. We will then explore how combining these approaches can give you an even clearer picture of where the stock stands.

Approach 1: Essex Property Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate the true value of a company by forecasting its future cash flows and then discounting those cash flows back to today’s dollars. For Essex Property Trust, this analysis starts with its most recent free cash flow of $1.06 billion and extrapolates future performance based on analyst projections and reasonable long-term growth assumptions. The DCF model in this case utilizes a 2 Stage Free Cash Flow to Equity approach using adjusted funds from operations.

Estimates from analysts show Essex’s free cash flow is expected to decline slightly in the near term, reaching approximately $957.6 million by 2026. It is then projected to gradually rise to $1.25 billion by 2035, according to longer-term forecasts. These projections are discounted to reflect present value in today’s dollars.

Based on this methodology, the DCF model calculates an intrinsic value of $345.76 per share for Essex Property Trust. With the stock currently trading at $261.34, this implies the stock is trading at a 24.4% discount to its estimated fair value, indicating meaningful undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Essex Property Trust is undervalued by 24.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Essex Property Trust Price vs Earnings (PE)

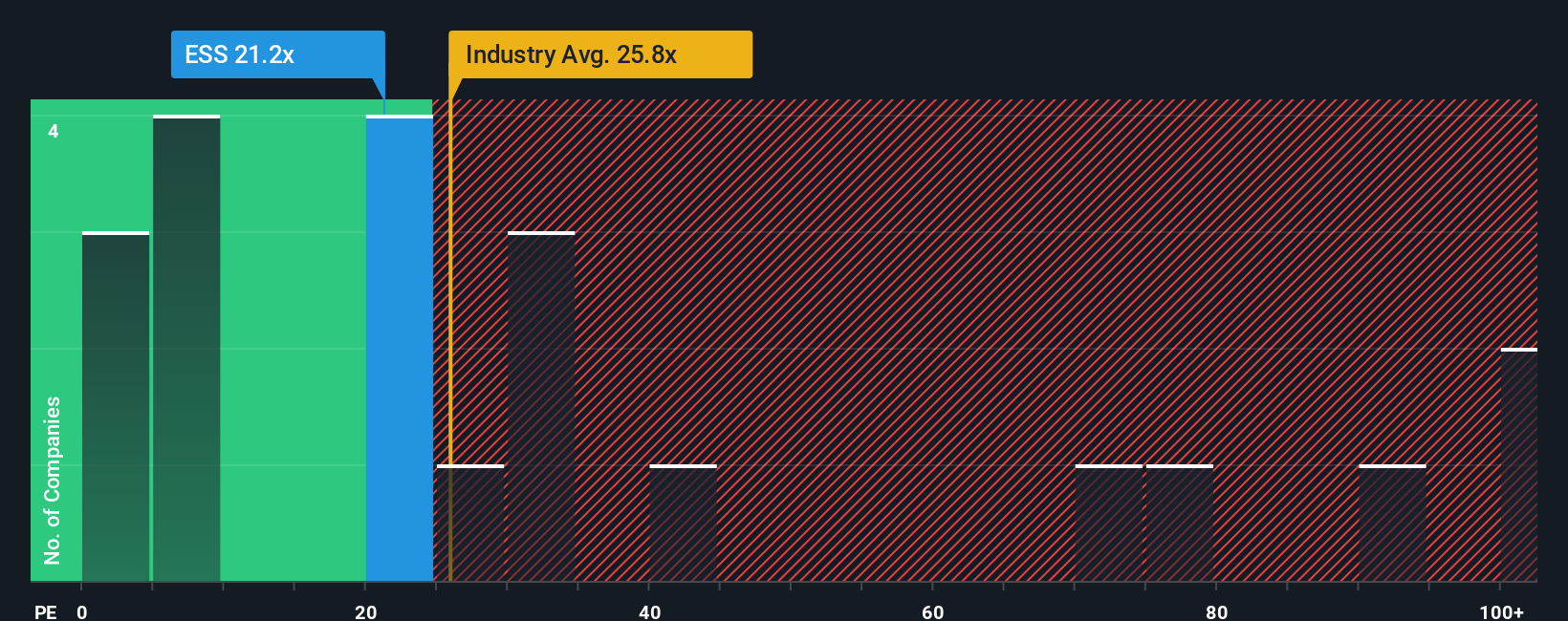

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Essex Property Trust. It helps investors understand how much they are paying for every dollar of earnings, making it a useful benchmark for comparing companies' valuations within the same industry.

A “normal” or “fair” PE ratio depends on factors like growth expectations and perceived risk. Higher growth rates or lower risk typically justify higher PE ratios, while slower growth or more uncertainty tend to result in lower multiples.

Currently, Essex Property Trust trades at a PE ratio of 21x. This is slightly above the Residential REITs industry average of 20.52x but well below the average of its public peers at 54.04x. These numbers provide some context, but they do not account for all of the drivers that can impact a fair valuation.

That is where the Simply Wall St “Fair Ratio” comes in. This proprietary metric goes beyond basic comparisons by factoring in Essex’s earnings growth outlook, profit margins, industry dynamics, market cap, and risk profile. In this case, the Fair Ratio for Essex is 24.40x, suggesting that a higher multiple is justified by the company's fundamentals and future prospects.

Comparing Essex’s current PE ratio of 21x to its Fair Ratio of 24.40x indicates the stock is undervalued based on the preferred multiple. It is trading below what would be expected for a company with its characteristics, supporting the idea that the shares may offer good value at these levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essex Property Trust Narrative

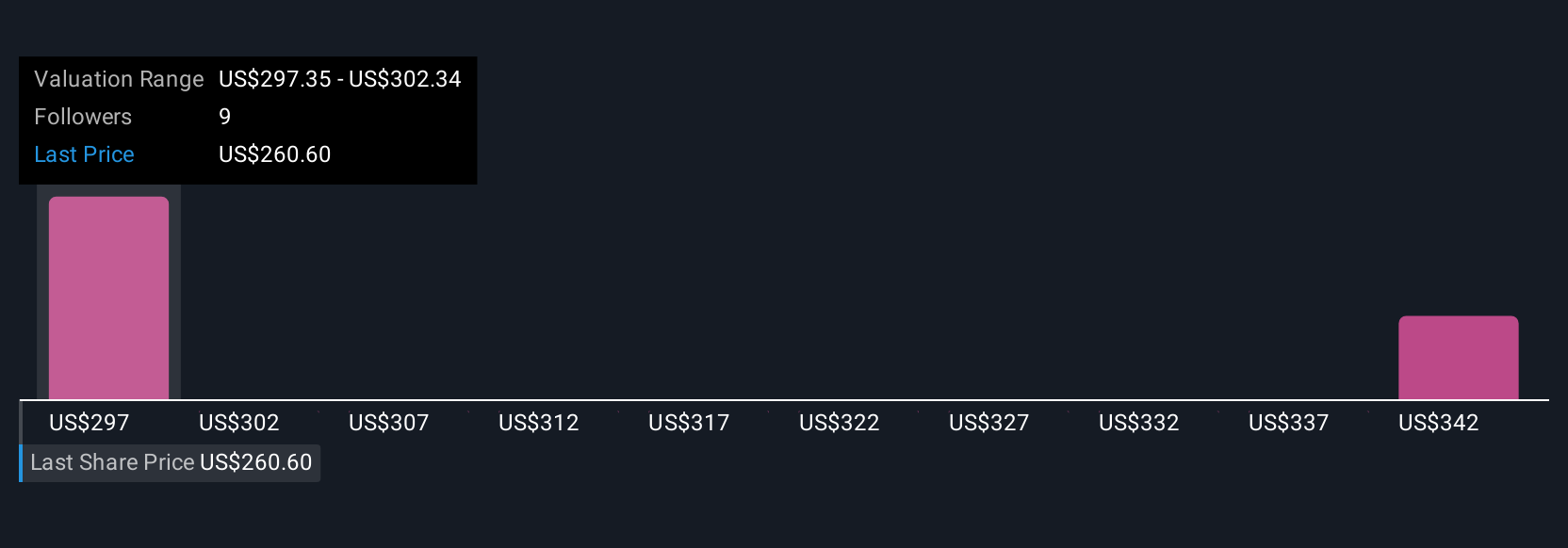

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful investment tool that lets you connect a company's story with your personal view of its future prospects, growth, and risks to a financial forecast and fair value estimate. Instead of just crunching numbers, a Narrative empowers you to express how you see Essex Property Trust’s journey through assumptions about its revenue, profit margins, and market outlook.

On Simply Wall St’s Community page, millions of investors can easily create and update their own Narratives for Essex, supporting smarter buy or sell decisions. A Narrative clearly shows when the Fair Value you calculate diverges from today’s market price, helping you decide if Essex is undervalued or overvalued according to your scenario rather than relying solely on consensus numbers.

Narratives are dynamic and automatically refresh with new developments like earnings, news, or industry changes, ensuring your investment thesis is always relevant. For example, one investor might see limited West Coast apartment supply boosting occupancy and set a higher fair value near $295.44, while another might focus on local regulatory headwinds and slower growth, resulting in a lower valuation closer to $262. This makes it easy to see how your expectations compare to both the market and other investors’ views, all in one place.

Do you think there's more to the story for Essex Property Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives