- United States

- /

- Residential REITs

- /

- NYSE:ESS

Essex Property Trust (ESS): Is the Stock Undervalued After Recent Quiet Trading?

Reviewed by Kshitija Bhandaru

See our latest analysis for Essex Property Trust.

The latest bump in Essex Property Trust’s share price follows a relatively quiet stretch, with little movement to suggest major momentum shifts either way. Over the past year, the total shareholder return has been slightly negative, but long-term investors have still seen solid cumulative gains over three and five years. This reflects more of a slow-burn growth story, rather than one driven by short-term sentiment.

If you want to broaden your approach beyond the usual suspects, now is a great moment to discover fast growing stocks with high insider ownership.

With shares still trading below analysts’ price targets and the stock offering a sizable discount compared to intrinsic value, the question arises: Is Essex Property Trust currently undervalued, or are markets already anticipating any future rebound?

Most Popular Narrative: 10.5% Undervalued

Essex Property Trust's narrative fair value is $295.44, which is close to 11% above the recent price of $264.47. Analysts are signaling a stronger future potential, even as today’s numbers reflect a short-term slowdown.

Limited new multifamily supply in the company's core markets (especially on the West Coast) is expected to sharply decline by 35% in the second half of 2025. This should reduce competitive pressure and drive higher occupancy and rent growth, positively impacting revenues and net operating income.

What’s powering this optimistic view? Behind the scenes are ambitious revenue projections, profit margin shifts, and a bold call on future earnings multiples. Curious about the unique forecasts that underpin this valuation? The full narrative lifts the lid on the numbers most investors never see.

Result: Fair Value of $295.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as local economic slowdowns or tighter rent controls. These factors could quickly undermine Essex’s pricing power and projected earnings growth.

Find out about the key risks to this Essex Property Trust narrative.

Another View: Is the Market Missing Something?

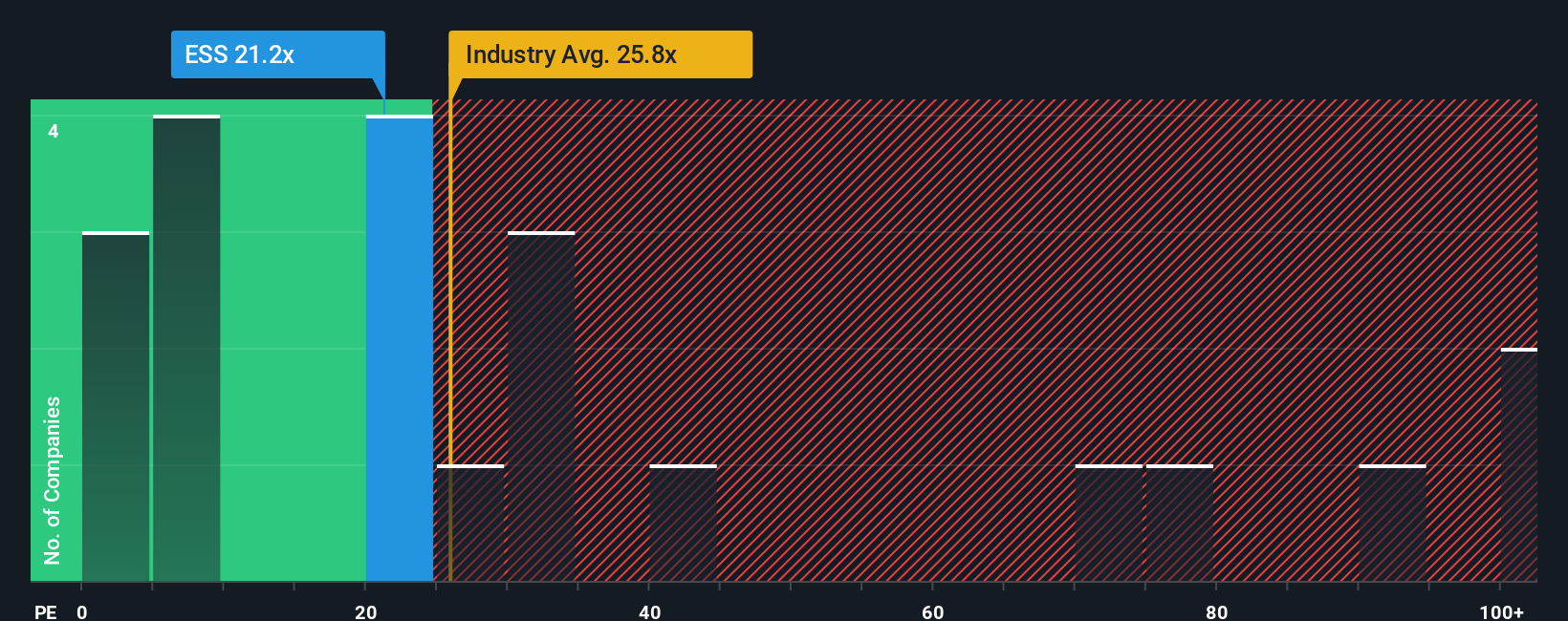

Looking at price-to-earnings, Essex trades at 21.3x, which is above the global residential REITs average of 20.5x but well below its peer average of 54.6x. Compared to a fair ratio of 24.4x, the stock appears reasonably priced, neither overly cheap nor expensive by this measure. Does this leave room for upside if market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Essex Property Trust Narrative

If you have a different perspective or enjoy hands-on analysis, you're free to build your own Essex Property Trust story in under three minutes. Why not Do it your way?

A great starting point for your Essex Property Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their research to a single stock. Expand your portfolio’s possibilities by taking action on timely opportunities others might overlook.

- Uncover fresh value opportunities by reviewing these 896 undervalued stocks based on cash flows based on real cash flow. This allows you to spot bargains before the crowd catches on.

- Supercharge your income strategy by investigating these 19 dividend stocks with yields > 3% with yields over 3%. This can add stable returns to your holdings.

- Stay ahead of disruptive innovation by evaluating these 26 quantum computing stocks, which is powering breakthroughs in computing and transforming industries for decades to come.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives