- United States

- /

- Office REITs

- /

- NYSE:ESRT

A Fresh Look at Empire State Realty Trust (ESRT) Valuation After New Credit Facility and Major Office Lease Expansion

Reviewed by Simply Wall St

Empire State Realty Trust is taking steps to bolster its financial flexibility with a new amended and restated credit agreement. This agreement provides access to a larger unsecured term loan facility.

See our latest analysis for Empire State Realty Trust.

While this new credit agreement gives Empire State Realty Trust greater flexibility ahead, the company is also showing leasing momentum with recent tenant expansions at One Grand Central Place. Despite these positives, the 1-year total shareholder return is down 35.8% and the year-to-date share price return sits at -32.3%. This suggests renewed caution from investors as momentum has faded over the past several months, even as management secures major leases and strengthens its balance sheet.

If you’re keeping an eye on these kinds of moves, it’s worth taking a look beyond a single company and discovering fast growing stocks with high insider ownership.

With Empire State Realty Trust trading well below analysts' price targets, are investors overlooking the potential for a rebound, or is the current share price already taking into account all available growth prospects?

Most Popular Narrative: 23.2% Undervalued

Based on the most widely followed narrative, Empire State Realty Trust's fair value estimate of $8.97 stands well above the last close of $6.89. This gap highlights a scenario where the narrative sharply diverges from what the market is currently pricing in. This raises questions about the underlying story.

Robust leasing momentum for modern, amenity-rich office space, evidenced by 16 consecutive quarters of positive leasing spreads, rising occupancy, and longer lease terms, positions ESRT to grow revenue and drive higher net operating income as companies continue to prioritize high-quality, sustainable urban workplaces.

Curious about the projection that puts Empire State Realty Trust’s potential rebound in a different league? One bold assumption behind this narrative leans on the company’s ability to maintain tenant demand and deliver premium margins, even as sector trends shift. The full story reveals which performance metrics matter most and what pivotal targets could justify this sharp upside if they’re met.

Result: Fair Value of $8.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tourism declines or a sharp rise in costs could challenge Empire State Realty Trust’s growth outlook, even with its recent leasing strengths.

Find out about the key risks to this Empire State Realty Trust narrative.

Another View: What Do Market Ratios Say?

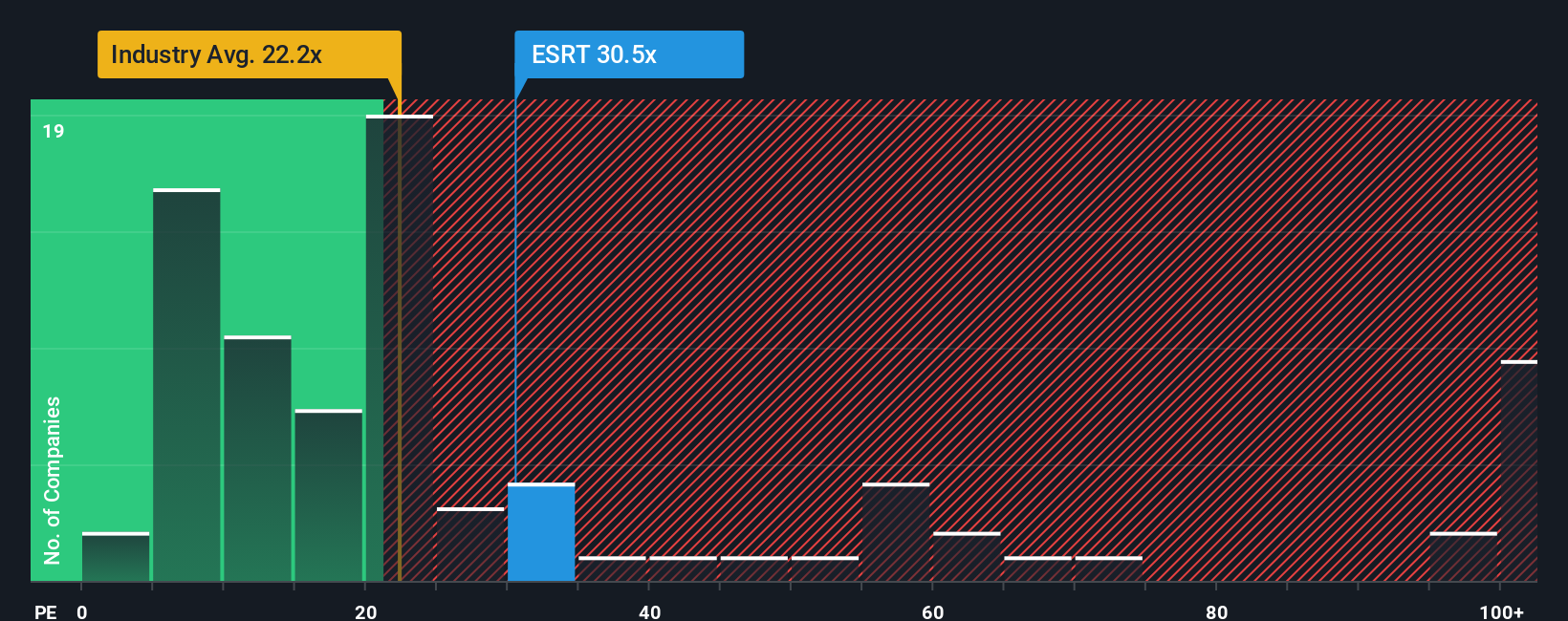

Looking at how Empire State Realty Trust is valued on earnings, the numbers tell a different story. Its price-to-earnings ratio stands at 33.2x, which is notably higher than the industry average of 22.2x and even above its fair ratio of 24.8x. This could signal the market is pricing in more risk or fewer near-term prospects than other office REITs. Could this premium point to hidden strengths, or does it highlight valuation risk that investors need to weigh?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Empire State Realty Trust Narrative

If you see things differently or want to dig into the data your own way, building your own perspective is quick and easy. Do it your way.

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Sharpen your strategy and target stocks with hidden upside, emerging tech, and standout yields using these powerful lists:

- Uncover dramatic potential by searching for these 3587 penny stocks with strong financials that have robust balance sheets and are primed for explosive market moves.

- Catch the surge in digital innovation when you scan these 27 AI penny stocks making waves in artificial intelligence breakthroughs and real-world applications.

- Amplify your returns and stabilize your income stream by zeroing in on these 18 dividend stocks with yields > 3% offering superior yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success