- United States

- /

- Residential REITs

- /

- NYSE:EQR

How Investors May Respond To Equity Residential (EQR) Raising Guidance and Rebalancing Its Portfolio

Reviewed by Sasha Jovanovic

- In the past quarter, Equity Residential reported third-quarter 2025 normalized FFO per share of US$1.02, which met expectations and prompted the company to raise its annual guidance. The company also completed the acquisition of a 375-unit property in Arlington, TX for nearly US$103 million and sold two properties for about US$247.9 million combined, reflecting active portfolio adjustments.

- An interesting insight is that Equity Residential’s decision to both acquire and divest properties during the quarter highlights the management’s proactive approach to optimizing its real estate portfolio in response to shifting market conditions.

- Following management’s upward revision of its annual guidance, we’ll examine what this means for Equity Residential’s long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Equity Residential Investment Narrative Recap

To be a shareholder in Equity Residential, you need to believe that strong demand for urban, premium rental housing will support the company’s ability to manage through challenging economic cycles and evolving supply dynamics. The recent third-quarter results, meeting FFO expectations and leading to higher annual guidance, do not appear to materially shift the most relevant short-term catalyst, which remains rental pricing power in supply-constrained markets. The principal risk continues to be elevated new multifamily supply and rental concessions, which may challenge near-term revenue growth and net margins. Among recent announcements, the acquisition of a 375-unit property in Arlington, TX, alongside the divestment of two other properties, is directly tied to the company’s approach of actively managing its property portfolio. This maneuver is especially relevant given persistent market pressure from increased multifamily supply and regional price sensitivity, which could influence occupancy and lease growth rates over the near term. On the other hand, investors should be aware that continued softness in key job markets could...

Read the full narrative on Equity Residential (it's free!)

Equity Residential's outlook anticipates $3.5 billion in revenue and $669.9 million in earnings by 2028. This reflects a projected annual revenue growth rate of 4.3%, but a significant decrease in earnings, down $330 million from current earnings of $1.0 billion.

Uncover how Equity Residential's forecasts yield a $70.56 fair value, a 14% upside to its current price.

Exploring Other Perspectives

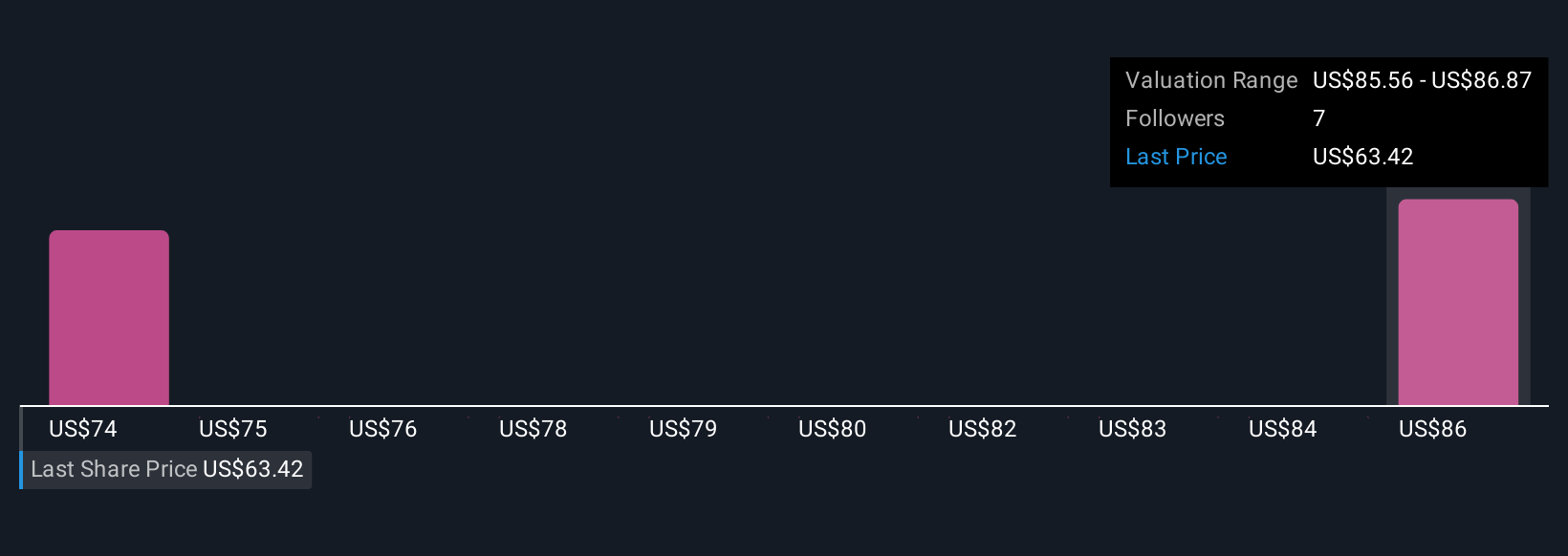

Simply Wall St Community members set fair values between US$70.56 and US$90.62 from just 2 analyses before the latest quarterly results. Views on new multifamily supply and rental concessions continue to weigh heavily, prompting you to review several investor perspectives.

Explore 2 other fair value estimates on Equity Residential - why the stock might be worth as much as 47% more than the current price!

Build Your Own Equity Residential Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equity Residential research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Equity Residential research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equity Residential's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026