- United States

- /

- Hotel and Resort REITs

- /

- NYSE:DRH

Assessing DiamondRock Hospitality (DRH) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for DiamondRock Hospitality.

While DiamondRock Hospitality’s share price has just climbed 16% over the past month, momentum seems to be building after a more modest stretch earlier in the year. The one-year total shareholder return sits at nearly 5%, so recent gains stand out in contrast to longer-term performance.

If this surge has you wondering what else could be on the move, it is a perfect chance to broaden your scope and spot fast growing stocks with high insider ownership.

With shares appreciating quickly and a strong run in recent weeks, investors are left to consider if DiamondRock Hospitality’s fundamentals still leave room for an attractive entry, or if the market is already anticipating further growth.

Most Popular Narrative: 1.8% Undervalued

DiamondRock Hospitality’s fair value, based on the most widely followed narrative, comes in just above its last close. This narrows the gap between price and perceived opportunity and spotlights the core assumptions that shape the current valuation debate.

The ongoing trend of millennials and Gen Z prioritizing travel experiences, combined with the expansion of flexible, remote, and hybrid work, is expected to increase both leisure and midweek bleisure demand. This should lift both occupancy and average daily rates, supporting topline revenue growth and a more resilient revenue base.

Curious about the financial bets behind this tiny undervaluation? Hidden in the narrative are bold projections for margin expansion, revenue growth, and a future profit multiple that could surprise even seasoned REIT watchers. Want a clear breakdown of the numbers that anchor this price? Peek inside and see what’s really driving analyst conviction.

Result: Fair Value of $9.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in leisure travel and elevated expense pressures in key urban markets could present challenges for DiamondRock Hospitality's path to sustained margin expansion.

Find out about the key risks to this DiamondRock Hospitality narrative.

Another View: What Do Ratios Say?

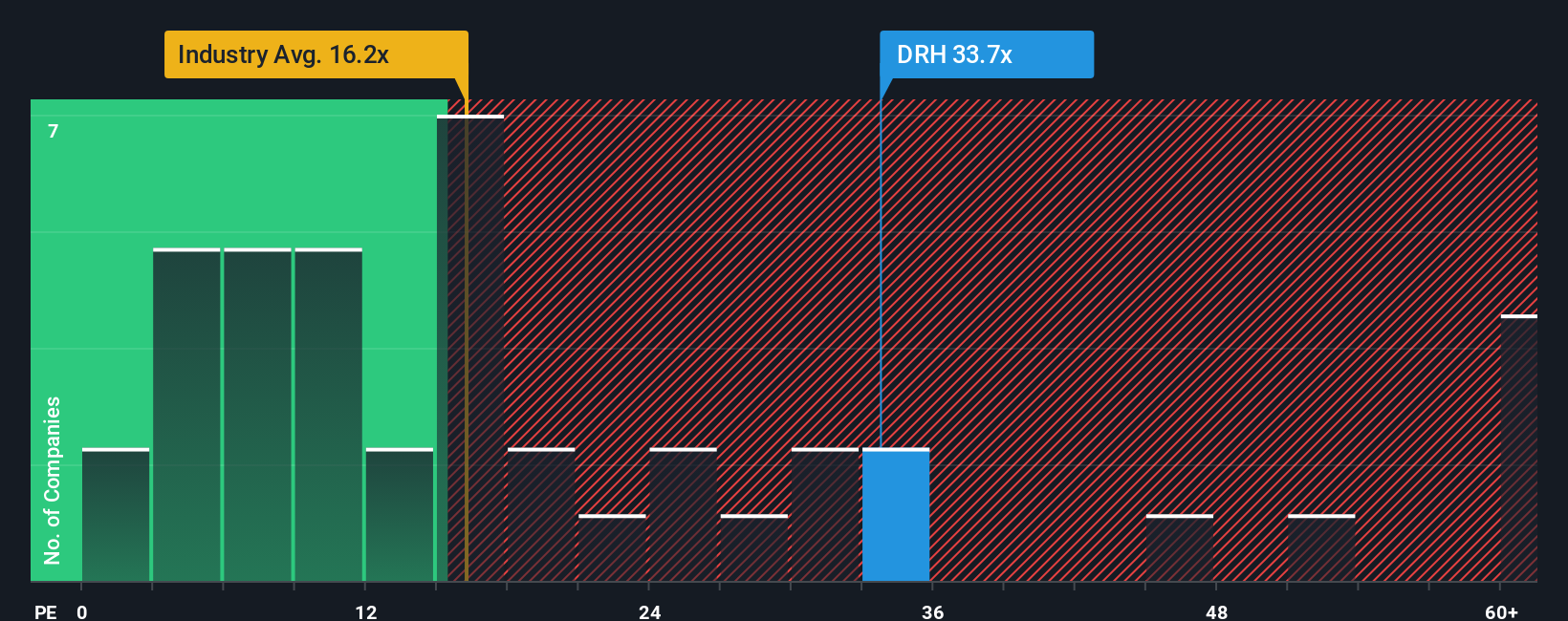

Looking at DiamondRock Hospitality through the lens of earnings, its price-to-earnings ratio stands at 33.7 times, which is markedly higher than the global hotel and resort REITs average of 16 times. Even compared to similar peers averaging 54.5 times, this suggests the shares are expensive for the sector. The fair ratio, estimated at 41.3 times, signals room for price adjustments in either direction if market expectations change. Does this premium pose a risk, or does it reflect confidence in future profit growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DiamondRock Hospitality Narrative

If you see things differently or want to analyze the numbers for yourself, you can construct your own take on DiamondRock Hospitality in just a few minutes, and Do it your way.

A great starting point for your DiamondRock Hospitality research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize opportunities others might overlook by using the Simply Wall Street Screener to find stocks aligned with emerging trends and robust fundamentals before the crowd catches on.

- Accelerate your search for future disruptors by checking out these 27 AI penny stocks. These companies are harnessing AI technologies to shape tomorrow's markets.

- Supercharge your portfolio with passive income by targeting these 15 dividend stocks with yields > 3%. This group provides attractive yields and financial resilience in today's market.

- Capitalize on digital transformation as you assess these 82 cryptocurrency and blockchain stocks. Here, blockchain and cryptocurrency players are redefining global finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRH

DiamondRock Hospitality

A self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets.

Good value with moderate growth potential.

Market Insights

Community Narratives