- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Is Digital Realty Still Attractive After Strong AI Data Center Gains?

Reviewed by Bailey Pemberton

- Wondering if Digital Realty Trust is actually a bargain at today’s price, or just another pricey data center REIT dressed up in AI hype? Let us unpack what the market is really paying for here.

- After a recent close around $163.78, the stock is up 4.7% over the last week but still down 3.6% over 30 days and 7.5% year to date, despite a strong 68.1% gain over 3 years and 50.8% over 5 years.

- Recent price moves have been driven by ongoing enthusiasm for data center and AI infrastructure, with Digital Realty inking new hyperscale and cloud connectivity deals that reinforce its role at the heart of digital traffic. At the same time, rising interest rate uncertainty and sector wide concerns about development costs have kept a lid on how aggressively investors are willing to re rate the shares.

- On our framework, Digital Realty scores a 3/6 valuation check. This suggests it looks undervalued on some metrics but not across the board. We will walk through what different valuation approaches say about the stock today and finish with a more intuitive way to think about its true long term value.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future adjusted funds from operations and then discounting those cash flows back into today’s dollars.

For Digital Realty Trust, the latest twelve month free cash flow sits at about $2.0 billion. Analysts expect this to rise steadily, with projections and extrapolations pointing to roughly $3.7 billion by 2029 and around $5.3 billion by 2035, based on a two stage Free Cash Flow to Equity model using Adjusted Funds From Operations. The near term forecasts come from analysts, while the outer years are Simply Wall St extrapolations that assume growth gradually slows as the business matures.

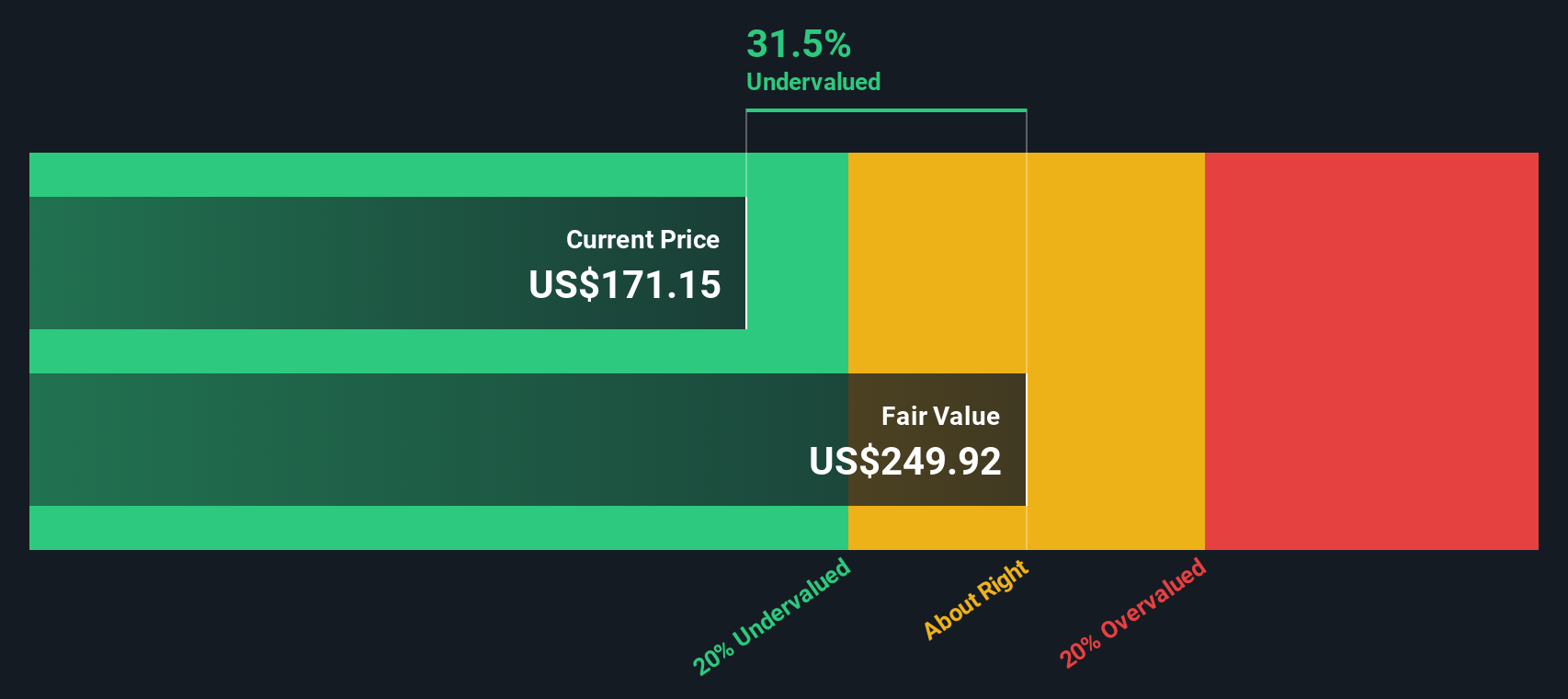

When those future cash flows are discounted back to today, the model arrives at an intrinsic value of about $237.04 per share. Compared to the recent price near $163.78, that implies the shares trade at roughly a 30.9% discount to estimated fair value, which indicates potential upside if the cash flow path plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 30.9%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Digital Realty Trust Price vs Earnings

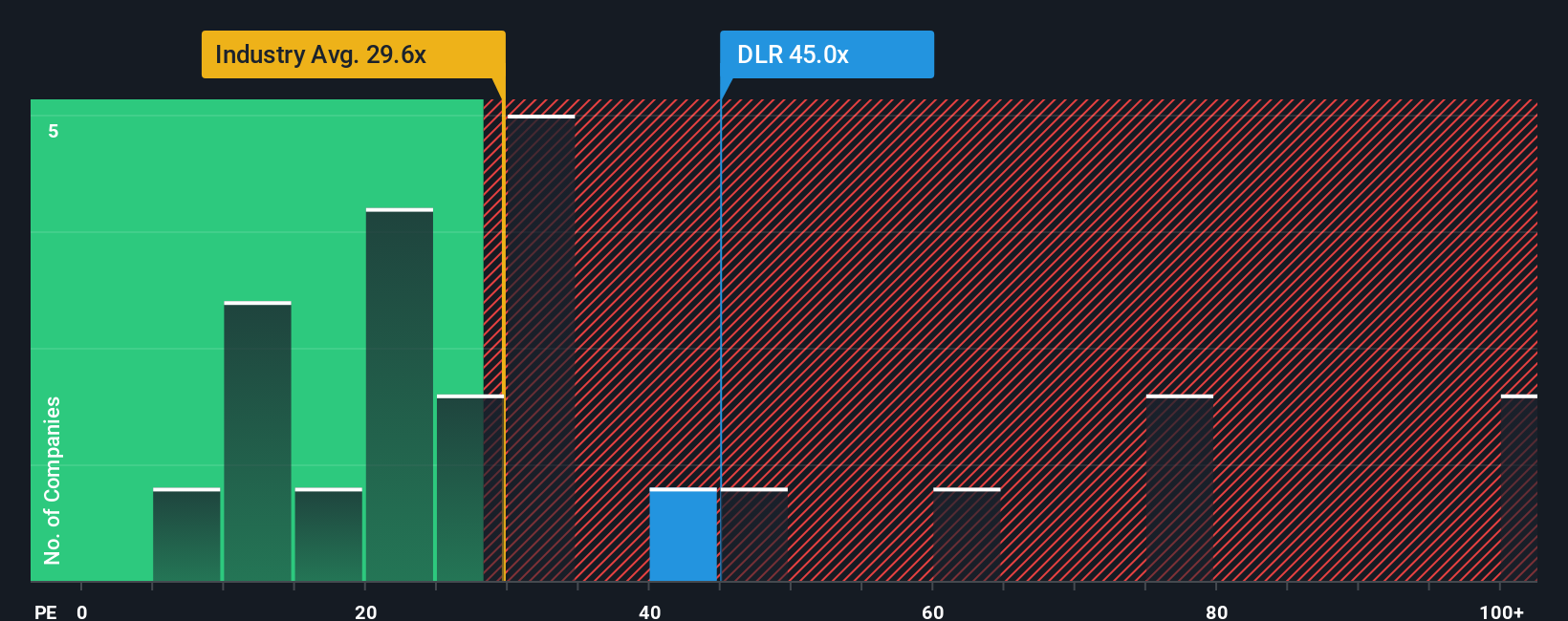

For profitable companies like Digital Realty, the price to earnings, or PE, ratio is a useful way to see how much investors are paying for each dollar of current earnings. A higher PE can be justified when a business has stronger growth prospects or lower perceived risk. Slower growth or higher risk usually warrants a lower, more conservative PE as a fair baseline.

Digital Realty currently trades on a PE of about 41.4x, which is well above the Specialized REITs industry average of roughly 16.8x and also higher than the peer average of around 33.9x. Simply Wall St goes a step further by estimating a Fair Ratio of 28.95x, which reflects what investors might reasonably pay given Digital Realty’s earnings growth outlook, margins, size, sector and risk profile. This Fair Ratio is more tailored than a simple comparison with peers or the broad industry, because it explicitly considers the company’s own growth runway and risk factors rather than assuming all REITs deserve similar multiples. On this basis, the current 41.4x PE stands meaningfully above the 28.95x Fair Ratio, suggesting the shares look overvalued on earnings today.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1453 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, an easy tool on Simply Wall St’s Community page that lets you connect your view of a company’s story to specific forecasts for revenue, earnings and margins. These forecasts then link to a Fair Value you can compare with today’s price to help you decide whether to buy or sell. Narratives update automatically as new news or earnings arrive. For Digital Realty Trust, one investor might build a bullish, AI driven Narrative that assumes double digit revenue growth and a Fair Value near $199.22. Another investor might take a more cautious view around power constraints and competition, assume slower growth and lower margins, and land closer to $110.45. This shows how different but clearly structured perspectives can coexist and give you a more dynamic, story driven way to act on your own convictions.

For Digital Realty Trust, here are previews of two leading Digital Realty Trust Narratives:

🐂 Digital Realty Trust Bull Case

Fair value: $199.22 per share

Implied discount to fair value: 18.0%

Forecast revenue growth: 12.98%

- Record leasing backlog, a new U.S. hyperscale fund, and a growing AI and cloud focused development pipeline are expected to drive long term revenue growth and cash flow visibility.

- Scale efficiencies, fixed escalators on renewal leases, and sustainability initiatives including green data centers and high renewable energy usage aim to support profitability, even as reported margins step down.

- Analysts see upside of about 13% versus the current share price, but note that overbuilding, higher financing costs, interest rate volatility, and competitive pressure could challenge the thesis if growth underdelivers.

🐻 Digital Realty Trust Bear Case

Fair value: $110.45 per share

Implied overvaluation versus fair value: 48.3%

Forecast revenue growth: 7.0%

- Even with powerful AI and cloud demand tailwinds, a more conservative view assumes mid single digit to high single digit revenue growth and modest margin expansion, leaving limited upside from here.

- Rising interest costs on a highly leveraged balance sheet, alongside elevated energy prices and intense competition from peers and hyperscalers, could compress returns if conditions stay tight.

- If P/FFO multiples move materially above historical norms or if supply growth and hyperscaler self build activity slow leasing momentum, the stock could appear expensive relative to its achievable cash flow growth.

Do you think there's more to the story for Digital Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026