- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty (DLR): Valuation Check After India AI JV, NVIDIA Expansion and Schneider Electric Deal

Reviewed by Simply Wall St

Digital Realty Trust (DLR) just put a clear AI expansion roadmap on the table, pairing an $11 billion Indian joint venture with fresh NVIDIA collaboration and a hefty Schneider Electric supply deal to power future data center growth.

See our latest analysis for Digital Realty Trust.

Even with the India JV and new AI infrastructure deals grabbing headlines, Digital Realty Trust’s share price return has slipped this year, while its three year total shareholder return of 61.05% shows the longer term momentum is still very much intact.

If these AI driven moves have you thinking about where else growth and infrastructure are converging, it could be worth exploring high growth tech and AI stocks for more potential beneficiaries.

With revenue still growing, profits under pressure and the stock now trading at a steep discount to analyst targets, are investors overlooking Digital Realty’s next AI leg higher, or sensibly assuming future growth is already priced in?

Most Popular Narrative Narrative: 21.4% Undervalued

With Digital Realty Trust last closing at $156.50 versus a narrative fair value near $199, the valuation story leans firmly toward upside if assumptions hold.

The analysts have a consensus price target of $195.44 for Digital Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $140.0.

Curious how steady revenue expansion, thinner margins and a punchy future earnings multiple can still add up to upside potential? See which forward looking assumptions really drive that fair value.

Result: Fair Value of $199.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record pipelines still face execution risks, with potential oversupply in key U.S. markets and higher financing costs, both capable of denting that upside case.

Find out about the key risks to this Digital Realty Trust narrative.

Another Lens on Value

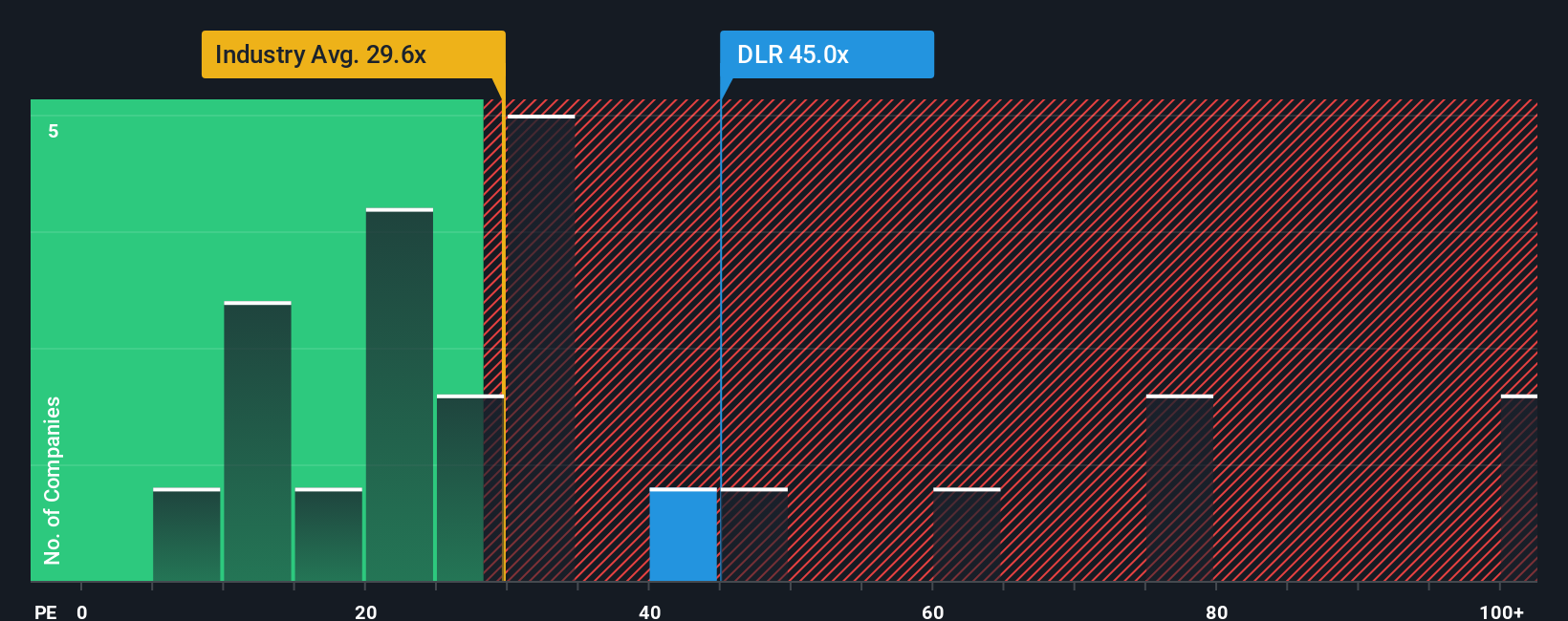

Multiples tell a different story. DLR trades on a 39.6x P/E versus 28.2x for US Specialized REITs and a fair ratio of 29x, which hints the market already prices in a lot of AI upside. Is that optimism, or valuation risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you are not fully convinced by this view, or prefer digging into the numbers yourself, you can quickly build a personalized story in just a few minutes: Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few fresh stock ideas with the Simply Wall Street Screener so you are not relying on just one AI beneficiary.

- Strengthen your portfolio with steady income by targeting these 14 dividend stocks with yields > 3% that can support long term compounding.

- Position yourself early in the next wave of innovation by focusing on these 24 AI penny stocks that may benefit from accelerating AI adoption.

- Upgrade your watchlist with potential bargains using these 933 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026