- United States

- /

- Retail REITs

- /

- NYSE:CURB

How Investors May Respond To Curbline Properties (CURB) Turning Profitable But Cutting Full-Year Outlook

Reviewed by Sasha Jovanovic

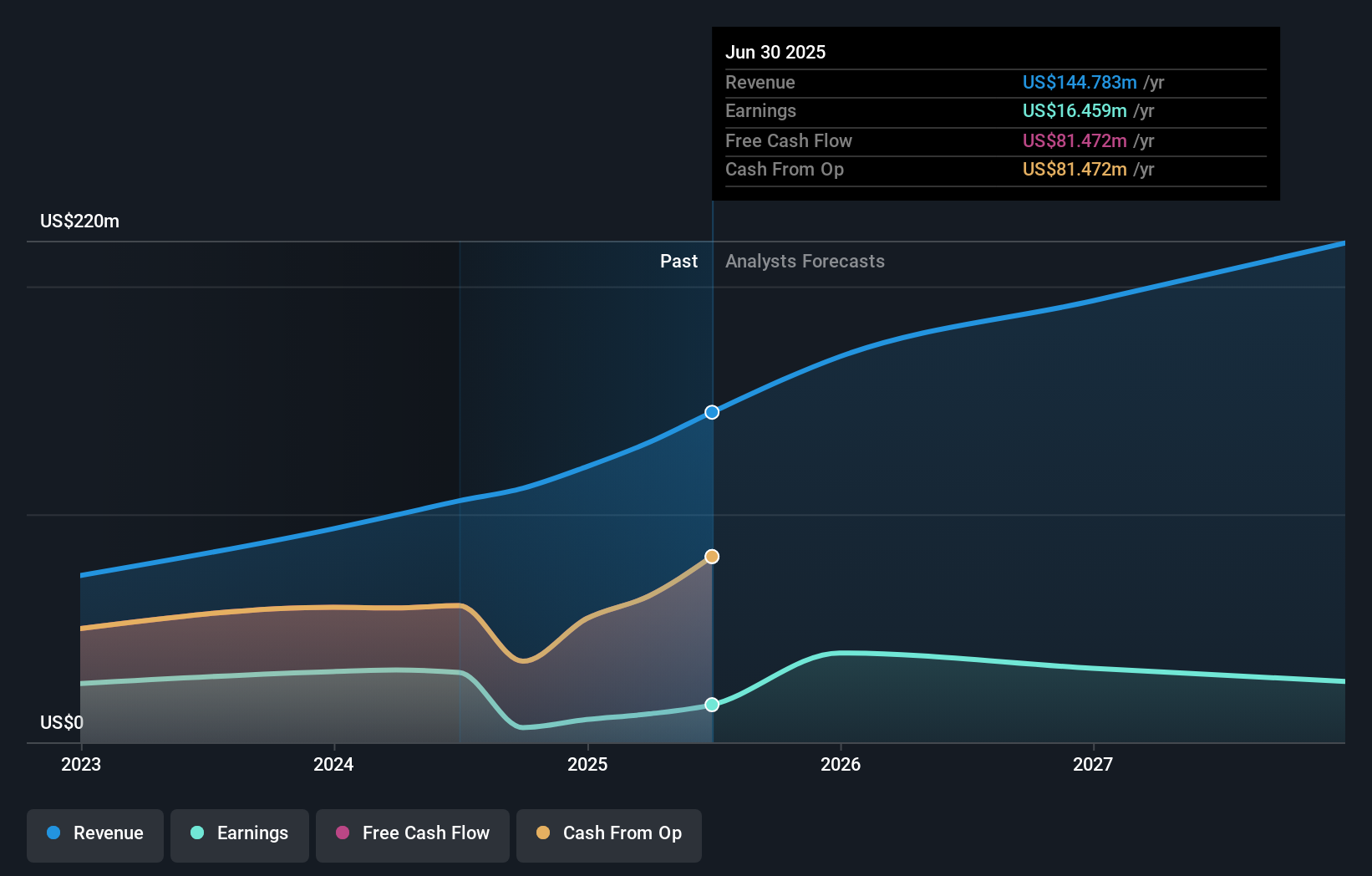

- Curbline Properties Corp. recently reported third-quarter 2025 results, showing a rise in quarterly sales to US$48.47 million and net income of US$9.35 million, compared to a net loss a year earlier.

- Despite moving to profitability, the company lowered its full-year earnings guidance, signaling a more cautious outlook for the remainder of 2025.

- With Curbline Properties balancing recent profitability against reduced guidance for the year, we'll explore how this shapes its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Curbline Properties' Investment Narrative?

To invest in Curbline Properties right now, you have to believe in the company's ability to sustain its swift rebound from losses while absorbing the recent cut to earnings guidance. The latest news shows a business achieving profitability and significantly higher sales, but management’s decision to lower full-year net income projections suggests short-term challenges could put pressure on upcoming results or weigh on future upside. This development may shake near-term optimism and pushes earnings momentum risk to the foreground, especially with a young board still finding its footing and rising executive pay muddying the outlook. At the same time, Curbline’s share buyback and recent dividend demonstrate efforts to support shareholder value, but a high price-to-earnings ratio and thin earnings coverage for its dividend remain on the risk list. The lowered guidance is likely to be a material shift in what drives investor focus over coming quarters. In contrast, board inexperience could become an even bigger issue if conditions tighten further.

Curbline Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Curbline Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Curbline Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curbline Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Curbline Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curbline Properties' overall financial health at a glance.

No Opportunity In Curbline Properties?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CURB

Curbline Properties

Curbline Properties is an owner and manager of convenience shopping centers positioned on the curbline of well-trafficked intersections and major vehicular corridors in suburban, high household income communities.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives