- United States

- /

- Specialized REITs

- /

- NYSE:CUBE

Could Analyst Downgrade Signal a Shift in CubeSmart's (CUBE) Urban Market Strategy?

Reviewed by Sasha Jovanovic

- Earlier this year, CubeSmart was downgraded by KeyBanc Capital Markets, which expressed concerns about the company’s future growth prospects and expense trends despite its improved earnings guidance and recent capital markets activities.

- This shift in analyst sentiment follows a period of mixed ratings and comes as CubeSmart’s major urban markets continue to support its financial performance while markets like Miami and Phoenix face revenue pressures.

- We'll analyze how KeyBanc's cautious outlook on CubeSmart's growth and expenses could alter the company's investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CubeSmart Investment Narrative Recap

To be a CubeSmart shareholder, you need to believe that resilient demand in dense urban markets and disciplined expense control can offset near-term pressures from softer Sunbelt revenues and slowing move-in rates. KeyBanc’s recent downgrade, driven by expense growth concerns and subdued guidance for 2026, highlights these opposing forces but does not materially alter the central short-term catalyst: stabilized occupancy and persistent demand in top-performing metro regions. The biggest current risk remains prolonged weakness in same-store revenue growth, especially if recovery in challenged regions lags expectations.

Among recent company actions, CubeSmart’s issuance of US$450.0 million in new senior notes stands out. This development reinforces the company’s financial flexibility, supporting ongoing operations and giving CubeSmart capacity to respond to both operational challenges and acquisition opportunities as tighter market conditions persist. However, the underlying risks in underperforming regions and a cautious tone from analysts suggest shareholders should continue tracking regional performance trends and cost controls closely.

On the flip side, investors should not overlook the ongoing pressures in Sunbelt markets, which may linger longer than many anticipate and could...

Read the full narrative on CubeSmart (it's free!)

CubeSmart's narrative projects $1.3 billion revenue and $369.9 million earnings by 2028. This requires 4.5% yearly revenue growth and a $4.9 million decrease in earnings from the current $374.8 million.

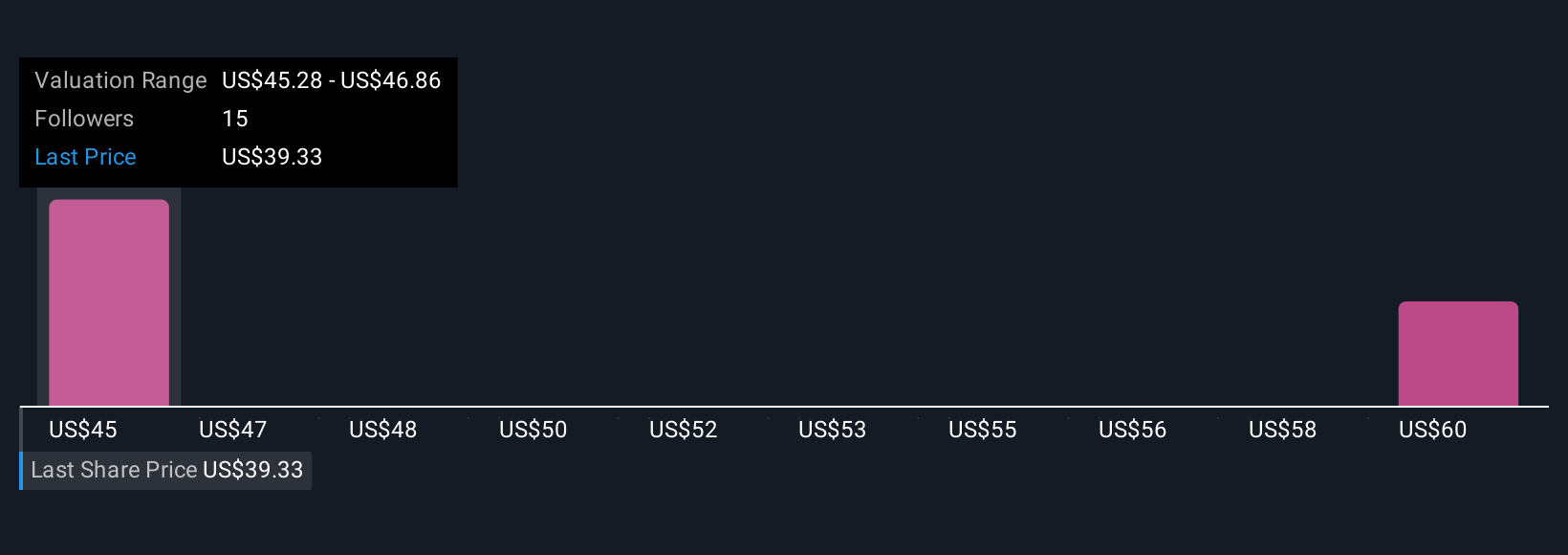

Uncover how CubeSmart's forecasts yield a $45.28 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for CubeSmart ranging from US$45.28 to US$57.06 per share. While some see significant upside, the risk of a drawn-out revenue and occupancy recovery in Sunbelt markets remains a concern for future performance, making it essential to examine a variety of viewpoints.

Explore 2 other fair value estimates on CubeSmart - why the stock might be worth as much as 56% more than the current price!

Build Your Own CubeSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CubeSmart research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CubeSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CubeSmart's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBE

CubeSmart

A self-administered and self-managed real estate investment trust.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives