- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

Is CareTrust REIT Still a Bargain After Shares Jumped 41% in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if CareTrust REIT is truly a bargain or just getting started? You're not alone. With investor excitement rising, it’s the perfect time to ask.

- Shares have gained 41.2% year-to-date and have delivered a 136.5% total return over five years, which may indicate renewed growth or changing risk perceptions.

- Much of this momentum follows CareTrust REIT’s strategic acquisitions and expansion plans in the senior housing and healthcare real estate sectors. This signals management’s intent to capitalize on favorable demographic shifts and industry trends. Investors are also responding to bullish sentiment from analysts and sector-specific factors driving real estate investment trust interest.

- But is the current price justified? CareTrust REIT scores a 4 out of 6 on our undervaluation checks. Soon, we’ll break down what that means, how those checks stack up, and why there could be an even smarter way for you to size up its value by the end of this article.

Approach 1: CareTrust REIT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by forecasting its future adjusted funds from operations and then discounting those projections back to today's value. For CareTrust REIT, this method focuses on how much cash the company will generate over the next decade and beyond.

Analysts project CareTrust REIT’s free cash flow (FCF) to reach $517.1 million by the end of 2028, with further growth extrapolated through 2035. While only the next five years are anchored by analyst forecasts, additional years are estimated by extending current trends and demographic factors influencing the healthcare real estate sector.

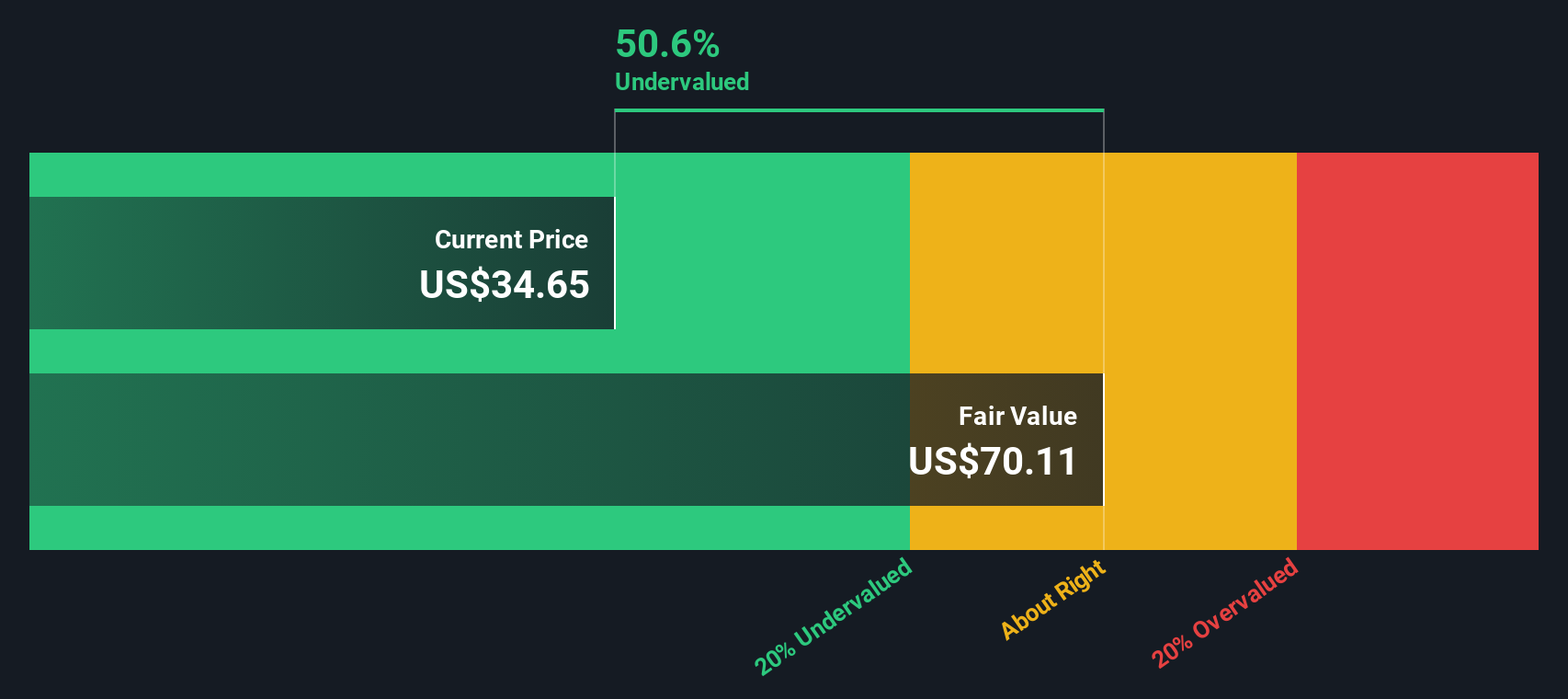

Based on this model, the estimated intrinsic value for CareTrust REIT is $57.42 per share. With a current share price notably below this estimate, the DCF model indicates that the stock is trading at a 34.8% discount to its underlying value. This suggests considerable upside potential for investors who believe in the company's ongoing growth and strategic execution.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CareTrust REIT is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: CareTrust REIT Price vs Earnings

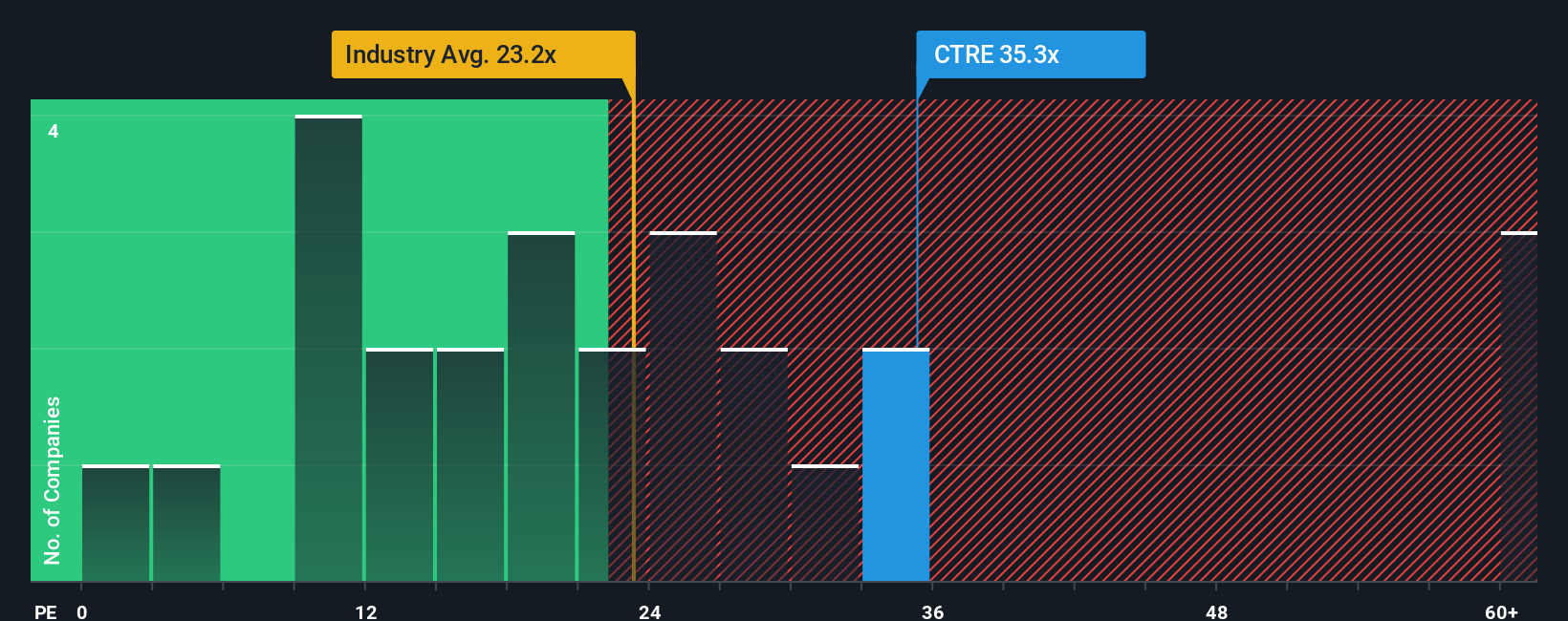

The Price-to-Earnings (PE) ratio is a highly useful metric for evaluating profitable companies like CareTrust REIT. It represents the price investors are willing to pay for each dollar of current earnings, making it especially relevant when steady profitability is evident. Since CareTrust REIT reports reliable earnings, the PE ratio gives a clear snapshot of how the market values its profit stream.

Growth expectations and perceived risk play a big role in shaping what a normal or fair PE should look like. Higher growth potential usually commands a premium, resulting in a higher PE ratio. Conversely, more risk or lagging growth can justify a lower multiple.

Currently, CareTrust REIT trades at a PE ratio of 32.1x. For context, the Health Care REITs industry average is much lower at 25.9x, and the company’s immediate peers average an even richer 59.3x. These comparisons give useful reference points but do not factor in all of CareTrust’s unique characteristics.

That is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio in this case, 39.6x, estimates what CareTrust REIT’s PE should be considering not just its sector and peer group, but also its actual earnings growth, profit margins, market cap, and risk profile. This comprehensive view avoids the pitfalls of simple industry or peer benchmarks.

Comparing CareTrust’s current PE of 32.1x to its Fair Ratio of 39.6x suggests the stock may be undervalued by this measure. The market appears to be discounting its growth or relative safety compared to what the data actually supports.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CareTrust REIT Narrative

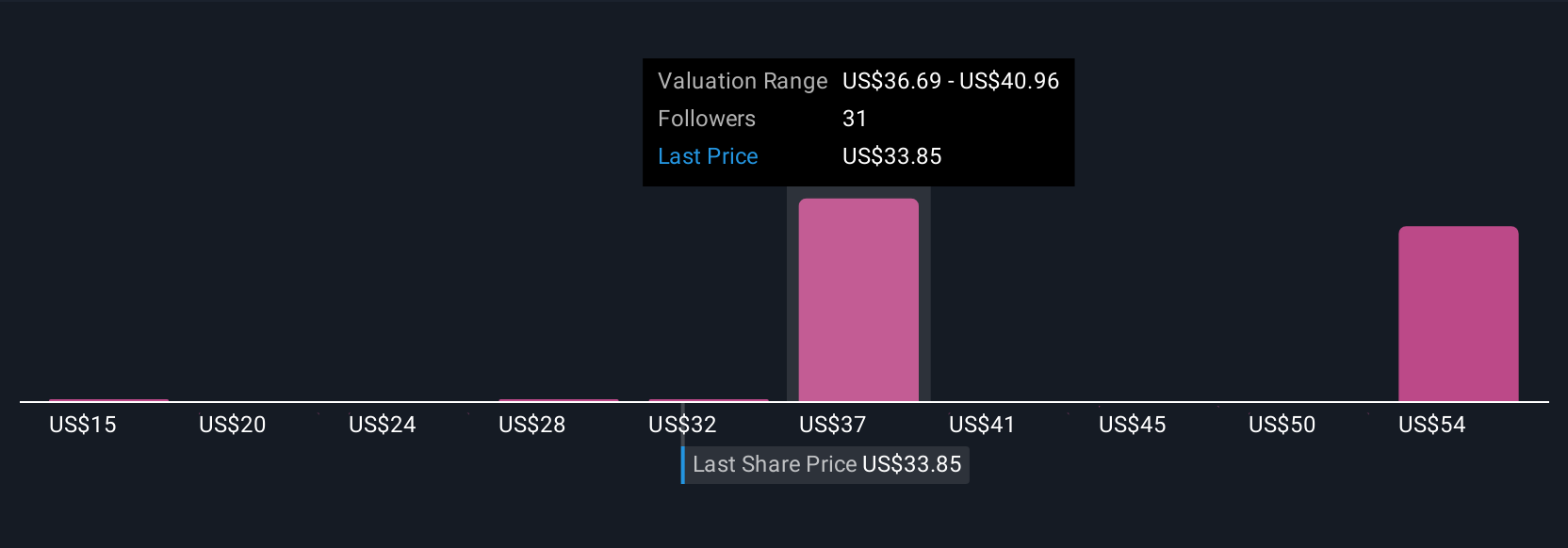

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, combining the numbers, such as forecasts for revenues, earnings, and margins, with your real-world perspective on the company's future. By tying together what you believe about CareTrust REIT's growth, risks, and strategic direction, Narratives connect the company’s story with a custom financial forecast and ultimately a fair value.

Unlike traditional models, Narratives are an intuitive tool available to everyone on Simply Wall St’s Community page, where millions of investors share and adjust their views. They help you quickly decide whether to buy or sell by comparing your own Fair Value estimate to the current share price. In addition, Narratives update automatically when major events happen, such as fresh earnings releases or big news, keeping your analysis relevant and actionable.

For instance, one Narrative for CareTrust REIT assumes fast international expansion and steady margin growth, leading to a fair value of $39.00. Another highlights risks with UK integration and industry regulation, resulting in a more cautious fair value of $33.00. Narratives make it easy to see the diverse perspectives among investors and empower you to make more informed, confident decisions.

Do you think there's more to the story for CareTrust REIT? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success