- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

How Investors Are Reacting To CareTrust REIT (CTRE) Expanding Into Senior Housing Operations With $40 Million Acquisition

Reviewed by Sasha Jovanovic

- On December 1, 2025, CareTrust REIT, Inc. announced it had acquired three senior living communities in Texas for approximately US$40 million, adding 270 assisted living and memory care units to its portfolio as part of its first investment in the senior housing operating portfolio (SHOP) platform.

- This acquisition not only broadens the company’s direct exposure to the senior housing sector, but also allows CareTrust to participate in property-level performance, with occupancy at the time of acquisition reported at 86% and management provided by Sinceri Senior Living affiliates.

- We'll examine how CareTrust's entry into direct senior housing operations could shape its investment narrative and future growth profile.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

CareTrust REIT Investment Narrative Recap

To hold CareTrust REIT, investors generally need confidence in the company's ability to efficiently integrate new assets while managing the risks and costs associated with rapid expansion. The recent Texas senior living acquisition adds direct exposure to senior housing operations, a key short-term catalyst, but does not substantially alter the major risk: integrating new properties without operational missteps or value-dilutive deals remains a primary concern as the portfolio grows.

Of CareTrust's recent announcements, the September acquisition of two UK care homes for US$27 million stands out for its relevance. Like the Texas deal, it reflects ongoing portfolio diversification into senior care segments and geographic markets, with both strategies dependent on the company’s ability to realize expected synergies without eroding margins or earnings due to integration costs and scale challenges.

However, investors should be aware that, in contrast to the optimism around growth opportunities, rapid expansion...

Read the full narrative on CareTrust REIT (it's free!)

CareTrust REIT's narrative projects $649.2 million in revenue and $460.9 million in earnings by 2028. This requires 20.2% yearly revenue growth and a $241.6 million earnings increase from current earnings of $219.3 million.

Uncover how CareTrust REIT's forecasts yield a $39.55 fair value, a 6% upside to its current price.

Exploring Other Perspectives

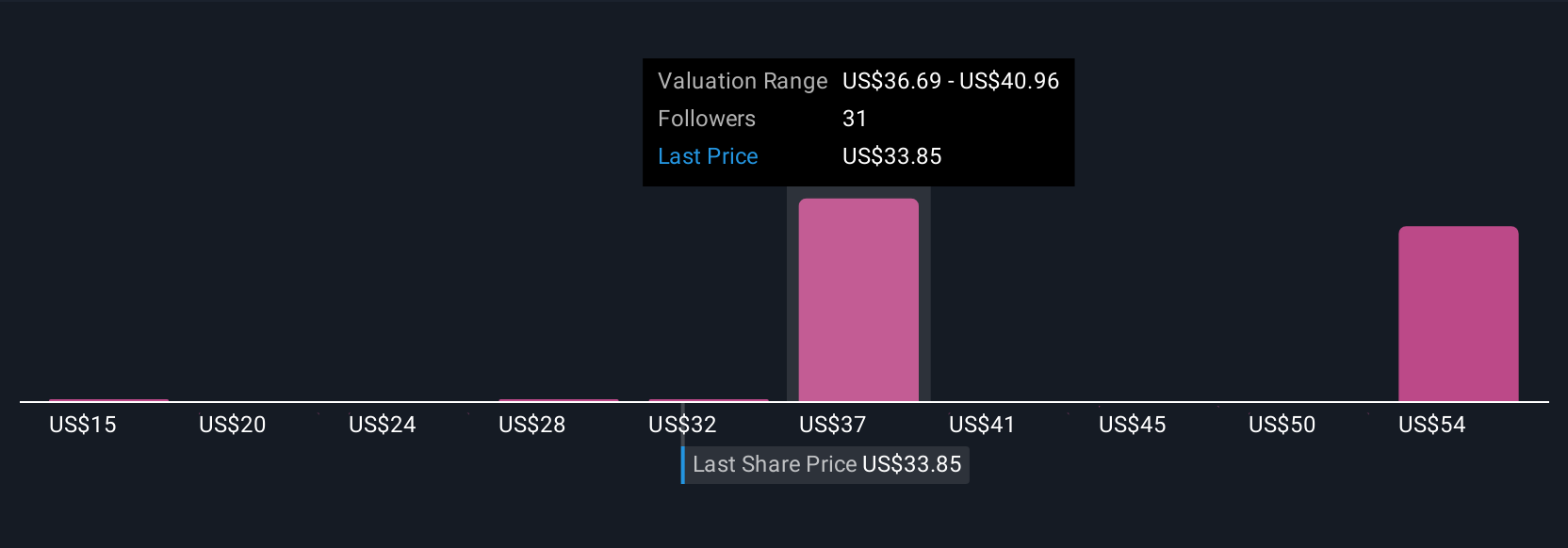

Nine different fair value estimates from the Simply Wall St Community range from US$15.35 to US$57.31 per share. While opinions on CareTrust’s value differ widely, the risk of integration challenges during fast portfolio growth could materially influence future outcomes so consider a range of possible perspectives before investing.

Explore 9 other fair value estimates on CareTrust REIT - why the stock might be worth less than half the current price!

Build Your Own CareTrust REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareTrust REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareTrust REIT's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026