- United States

- /

- Retail REITs

- /

- NYSE:CBL

Reassessing CBL & Associates Properties (CBL) Valuation After New Buy Rating and $25 Million Buyback Plan

Reviewed by Simply Wall St

CBL & Associates Properties (CBL) just picked up a fresh Buy rating, along with a new 25 million dollar share repurchase plan, a combination that puts management confidence and investor interest under the spotlight.

See our latest analysis for CBL & Associates Properties.

The upbeat Buy rating and new repurchase plan arrive as momentum is already improving. A 1 month share price return of 16.23 percent and a 1 year total shareholder return of 23.86 percent suggest sentiment is steadily rebuilding after recent insider trading noise.

If this kind of rebound has your attention, it could be a good moment to compare CBL with fast growing stocks with high insider ownership and see what other stories the market is starting to notice.

With shares still trading at a sizable discount to the 45 dollar target and intrinsic value estimates, the key question now is whether CBL remains mispriced or if the market is already pricing in its recovery story.

Price-to-Earnings of 8.9x: Is it justified?

On a Price to Earnings ratio of 8.9 times, CBL & Associates Properties looks materially cheaper than peers, despite its recent share price recovery.

The Price to Earnings multiple compares what investors pay today with the company’s current earnings, a key yardstick for income generating real estate businesses. For a Retail REIT with positive net income and strengthening margins, this ratio helps signal whether the market is rewarding or discounting those earnings.

In CBL’s case, the 8.9 times multiple sits well below the estimated fair Price to Earnings ratio of 18.6 times. This implies the market is valuing each dollar of CBL earnings at less than half the level suggested by the fair ratio. Against the wider US Retail REITs industry at 26.4 times and a peer average of 55.8 times, CBL’s current valuation looks deeply compressed. This leaves substantial room for the multiple to move closer to levels implied by the fair ratio if sentiment continues to improve.

Explore the SWS fair ratio for CBL & Associates Properties

Result: Price-to-Earnings of 8.9x (UNDERVALUED)

However, risks remain, with sharply negative net income growth and reliance on aggressive leasing, where any slowdown could quickly challenge the recovery narrative.

Find out about the key risks to this CBL & Associates Properties narrative.

Another View: What Does Our DCF Say?

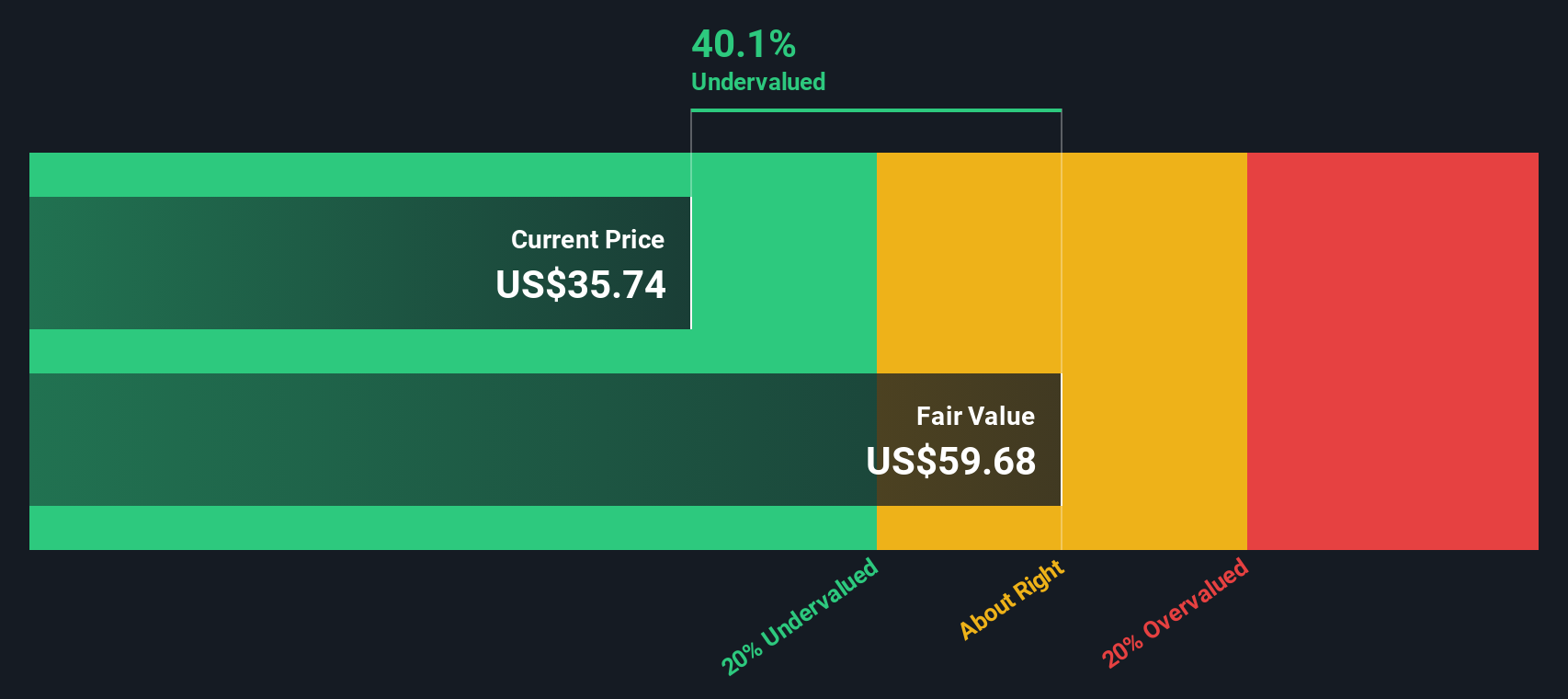

While the low Price to Earnings ratio hints at value, our DCF model also suggests upside. With CBL trading around 40 percent below our 59.55 dollar fair value estimate, the cash flow view still points to undervaluation. However, it is uncertain how long that gap can realistically persist.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CBL & Associates Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CBL & Associates Properties Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a personalized view in just a few minutes: Do it your way.

A great starting point for your CBL & Associates Properties research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work now, because the next standout opportunity may already be in reach if you move quickly and focus on the right filters.

- Capture income potential by targeting reliable payers with these 15 dividend stocks with yields > 3%, where yields and fundamentals come together for investors who want more than just price gains.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks, focusing on companies using artificial intelligence to reshape industries and long term growth prospects.

- Strengthen your watchlist with value focused opportunities using these 906 undervalued stocks based on cash flows, built to spotlight stocks that look cheap relative to their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBL

CBL & Associates Properties

Headquartered in Chattanooga, TN, CBL Properties owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026