- United States

- /

- Residential REITs

- /

- NYSE:AVB

Does AvalonBay’s Share Price Slide Offer an Opportunity for Long Term Investors in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether AvalonBay Communities is a bargain or a value trap at around $178 a share, you are not alone. This stock has been catching the eye of income and value focused investors alike.

- Despite a tough backdrop for REITs, AvalonBay is down about 18.7% over the last year but still up 29.8% over five years, with the last month roughly flat at 0.4% and a small 2.2% pullback in the last week.

- Recent moves have been driven less by company specific shocks and more by shifting expectations around interest rates and the broader apartment REIT sector, as investors reassess how higher for longer borrowing costs affect property values and income streams. At the same time, headlines around resilient coastal rental demand and tight housing supply have helped support the longer term narrative for AvalonBay's portfolio.

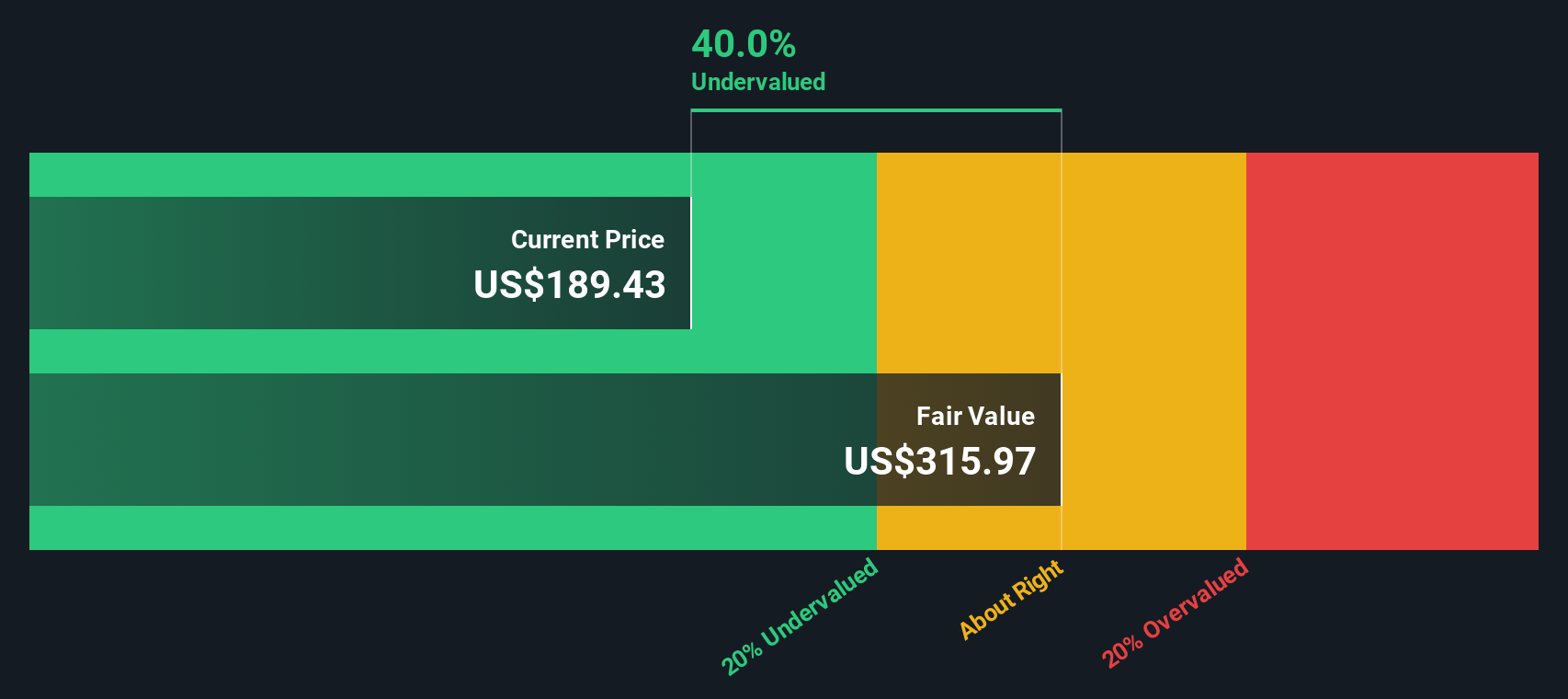

- On our framework, AvalonBay scores a 5 out of 6 valuation score. This suggests it screens as undervalued on most of the key checks we run. Next we will break down what that really means across different valuation methods, before finishing with a more intuitive way to think about what the market is pricing in.

Find out why AvalonBay Communities's -18.7% return over the last year is lagging behind its peers.

Approach 1: AvalonBay Communities Discounted Cash Flow (DCF) Analysis

The DCF model estimates what AvalonBay Communities is worth today by projecting its future adjusted funds from operations, treating these as free cash flows to equity, and discounting them back to a present value in dollars.

AvalonBay generated about $1.56 billion of free cash flow over the last twelve months, and analyst estimates in this article assume this will grow steadily over time. For example, the projected free cash flow used here rises to roughly $1.72 billion by 2029, with longer term estimates extending that trajectory out to 2035 based on conservative growth assumptions beyond the formal analyst horizon.

Adding up these discounted cash flows gives an estimated intrinsic value of about $286.69 per share. Versus a market price around $178, the DCF output used in this analysis implies the stock is roughly 37.9% undervalued. This indicates, within the assumptions of the model, that the market price is below the value of the cash flows AvalonBay is expected to generate from its apartment portfolio.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AvalonBay Communities is undervalued by 37.9%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: AvalonBay Communities Price vs Earnings

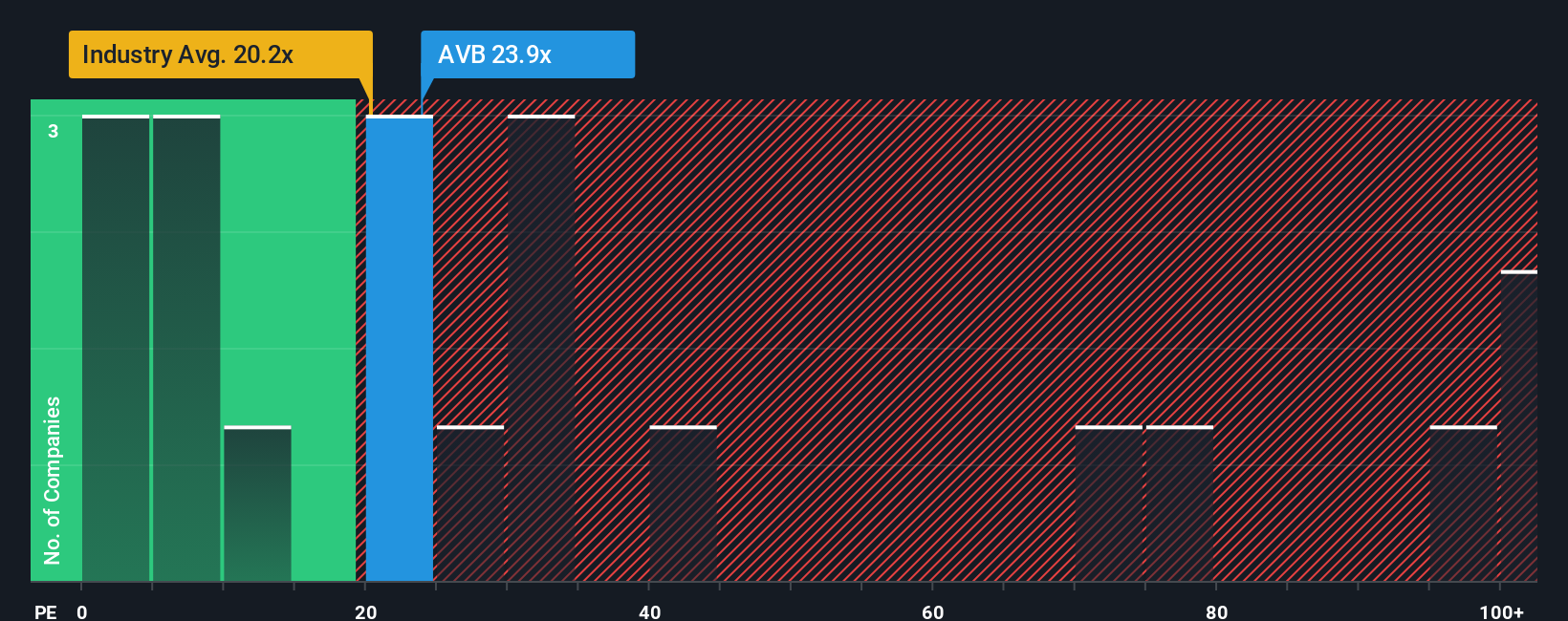

For a profitable, established REIT like AvalonBay Communities, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It ties together expectations for future growth with the level of risk investors are prepared to accept.

In general, faster growing and lower risk companies justify higher PE ratios, while slower growth or higher uncertainty tends to cap what the market will pay. Today, AvalonBay trades on a PE of about 21.6x, which is slightly above the broader Residential REITs industry average of roughly 19.5x but below the peer group average near 36.9x. This suggests the market is giving it a modest quality or growth premium without pushing it into expensive territory.

Simply Wall St’s proprietary Fair Ratio framework goes a step further than simple peer or industry comparisons. It estimates what a “normal” PE should be for AvalonBay, given its earnings growth outlook, profit margins, risk profile, industry and market cap. For AvalonBay, the Fair PE Ratio is around 27.9x, higher than the current 21.6x. That gap indicates the shares may be undervalued relative to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

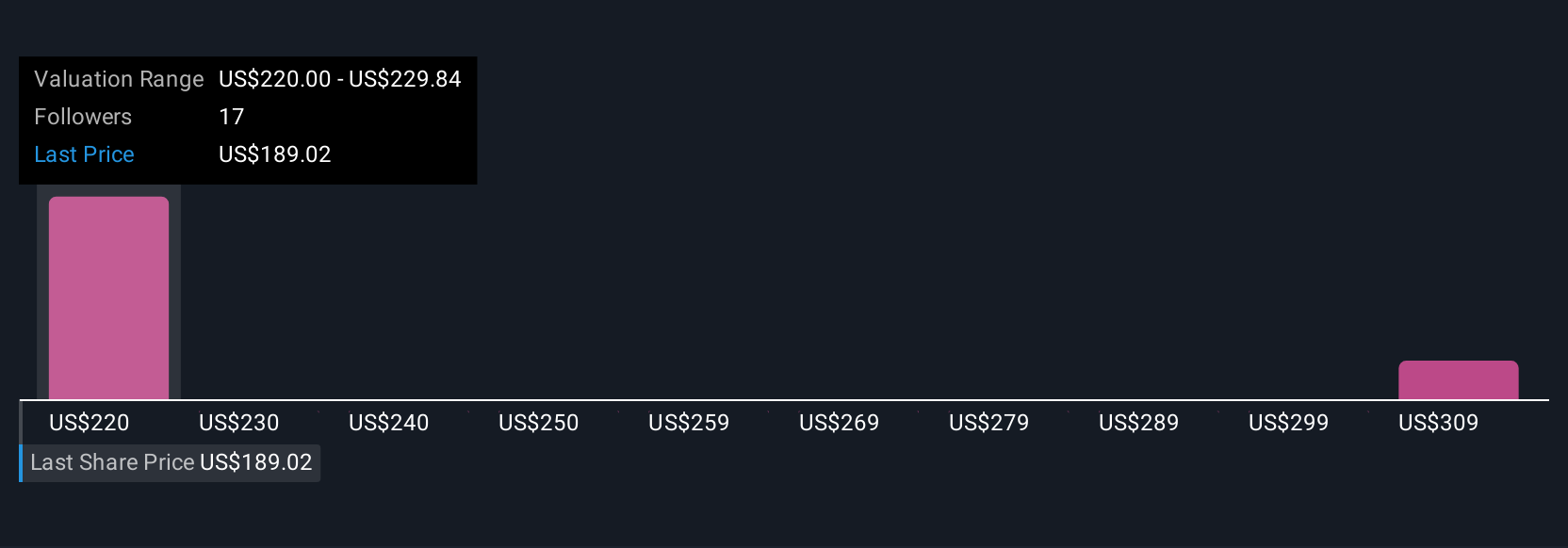

Upgrade Your Decision Making: Choose your AvalonBay Communities Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of AvalonBay Communities business to a concrete forecast and fair value by telling a story behind the numbers, such as your assumptions for future revenue, earnings and margins. On Simply Wall St’s Community page, Narratives let millions of investors turn these stories into live financial models, so you can see how your expectations translate into a fair value estimate and then compare that to today’s share price to decide whether AvalonBay looks like a buy, hold or sell to you. Because Narratives update as new data arrives, such as changes in the analyst consensus fair value from around $199 at the bearish end to roughly $249 at the bullish end, they stay aligned with fresh news, earnings and sector shifts while still reflecting your own perspective.

Do you think there's more to the story for AvalonBay Communities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVB

AvalonBay Communities

A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026