- United States

- /

- Specialized REITs

- /

- NYSE:AMT

A Look at American Tower’s (AMT) Valuation After Strong Revenue Growth and Cash Flow Concerns

Reviewed by Simply Wall St

American Tower (AMT) released its latest earnings on October 28, and reported revenue growth that surpassed market expectations. However, despite the stronger topline, the stock dropped 4% as cash flow measures trended lower year-over-year.

See our latest analysis for American Tower.

After a year marked by ups and downs, American Tower’s share price has essentially been treading water. It is up just 0.1% year-to-date, while the one-year total shareholder return sits at a disappointing -10.3%. Recent volatility likely reflects growing scrutiny on cash flow trends, even as revenue growth remains strong and deal momentum continues. Investors seem to be weighing the long-term growth story against short-term concerns about cash generation.

If this shift in sentiment makes you wonder what else is moving, now is a great time to expand your horizons and discover fast growing stocks with high insider ownership

With strong revenue gains, significant cash flows, and a sizable discount to analyst targets, the big question remains: Is American Tower undervalued at these levels, or is the market already pricing in future growth?

Price-to-Earnings of 28.9x: Is it justified?

At a current price-to-earnings (P/E) ratio of 28.9x, American Tower trades almost exactly in line with the broader US Specialized REITs industry average (28.7x), but well below its group of peers with an average P/E of 40.5x. The last close price was $181.27. This multiple suggests the market has tempered its growth expectations compared to peers.

The P/E ratio measures how much investors are willing to pay per dollar of earnings, reflecting both current profitability and future growth expectations. For a leading tower REIT with a global footprint and steady earnings, P/E acts as a key valuation benchmark that helps investors compare American Tower to similar businesses and alternatives in the sector.

The fact that American Tower’s P/E is lower than the peer group average could imply the stock is being underappreciated by the market, or that investors are factoring in risks specific to the company or sector. However, the stock still trades at a discount to the estimated fair P/E of 34.6x. This is a level that the market could recognize if growth drivers play out as anticipated.

Explore the SWS fair ratio for American Tower

Result: Price-to-Earnings of 28.9x (UNDERVALUED)

However, persistent cash flow pressures and any slowdown in annual revenue growth could quickly alter the outlook and challenge the case for undervaluation.

Find out about the key risks to this American Tower narrative.

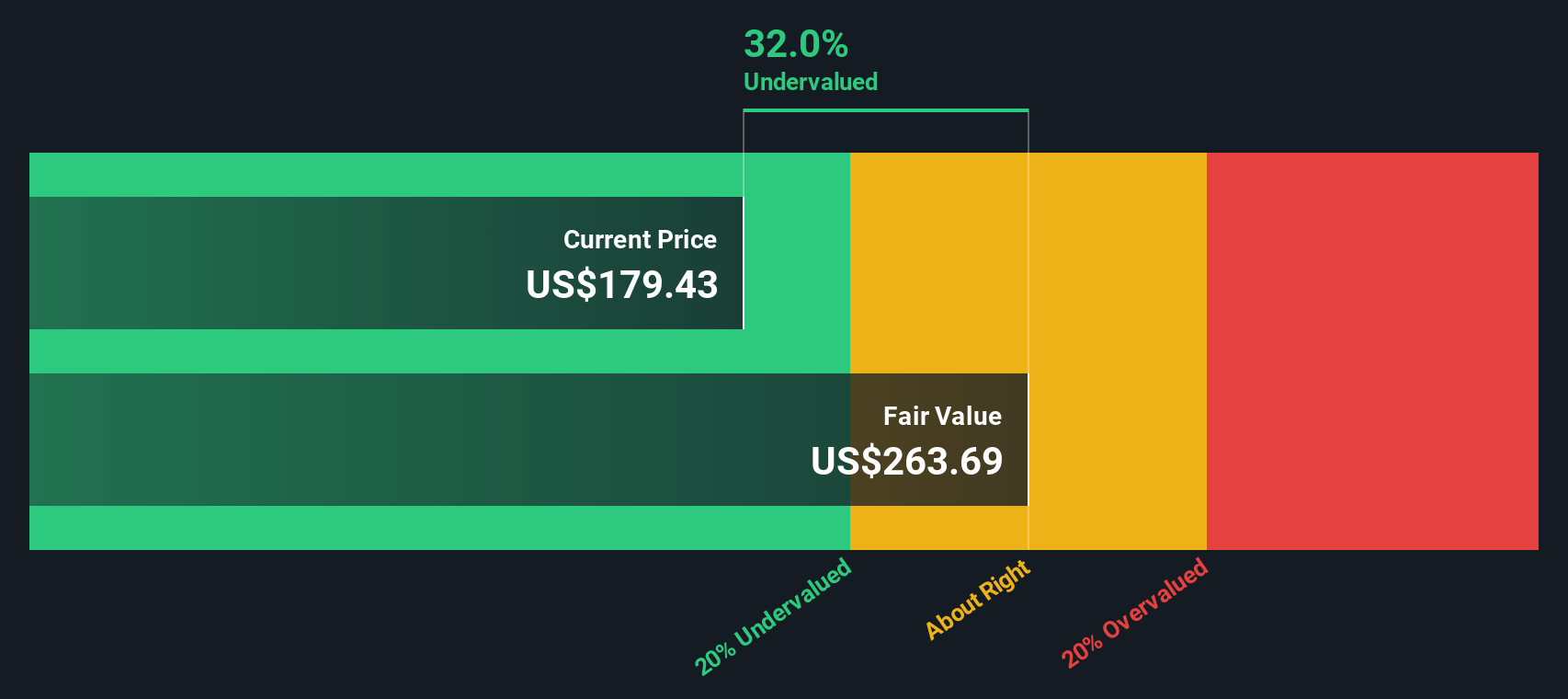

Another View: SWS DCF Model Suggests Further Upside

While the price-to-earnings ratio points to possible undervaluation, our DCF model provides an even stronger perspective. It estimates American Tower's fair value at $262.47 per share, which is 30.9% higher than the current price. Could the market be missing a bigger long-term opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Tower for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Tower Narrative

If you want to dig into the numbers yourself or take your own view, you can easily shape your own narrative in just minutes. Do it your way

A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to pass you by. Unlock the full potential of the Simply Wall Street Screener and find stocks set to shape tomorrow’s market.

- Accelerate your strategy with these 914 undervalued stocks based on cash flows featuring companies trading below their intrinsic value and offering potential for upside.

- Capture robust, recurring income by exploring these 15 dividend stocks with yields > 3%, which highlights stocks that deliver yields above 3% and reward patient investors.

- Ride the next tech wave by using these 25 AI penny stocks to identify businesses focused on artificial intelligence breakthroughs and disruptive technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026