- United States

- /

- Health Care REITs

- /

- NYSE:AHR

Why American Healthcare REIT (AHR) Is Up 7.3% After Raising 2025 Guidance and Posting Strong Q3 Results

Reviewed by Sasha Jovanovic

- Earlier in November 2025, American Healthcare REIT raised its full-year guidance, increasing projected net income, same-store net operating income growth, and earnings per share while reporting significant increases in both revenue and profitability for the third quarter.

- The company paired these improvements with significant property acquisitions, above-90% occupancy rates in senior housing, and continued execution on operational initiatives across its portfolio.

- Now, we will explore how the raised guidance and strong operating results may shape American Healthcare REIT's investment narrative going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

American Healthcare REIT Investment Narrative Recap

To be a shareholder in American Healthcare REIT, investors need confidence in a long-term demand surge for senior housing and skilled nursing, underpinned by demographic shifts and tight new supply. The company’s recent raised guidance confirms robust short-term momentum, supported by revenue and profitability gains, though the primary catalyst remains sustaining high occupancy and rate growth in the Trilogy and senior housing portfolios. The main risk now is whether double-digit growth can persist as these segments approach full occupancy; the recent news affirms strength, but doesn't remove the challenge of tough upcoming year-over-year comparisons.

Among the latest developments, American Healthcare REIT not only lifted its full-year 2025 guidance but also reported a Q3 2025 same-store net operating income growth of 16.4%. This announcement directly supports the growth narrative, as it signals both operating discipline and resilience ahead of potentially more difficult comparisons in late 2025, which remains a key issue for short-term performance.

By contrast, investors should be aware that as occupancy across major segments nears historical averages, the challenge of sustaining elevated growth rates will...

Read the full narrative on American Healthcare REIT (it's free!)

American Healthcare REIT is projected to generate $2.7 billion in revenue and $203.0 million in earnings by 2028. This outlook depends on annual revenue growth of 7.8% and a $235.8 million increase in earnings from the current level of -$32.8 million.

Uncover how American Healthcare REIT's forecasts yield a $46.92 fair value, a 5% downside to its current price.

Exploring Other Perspectives

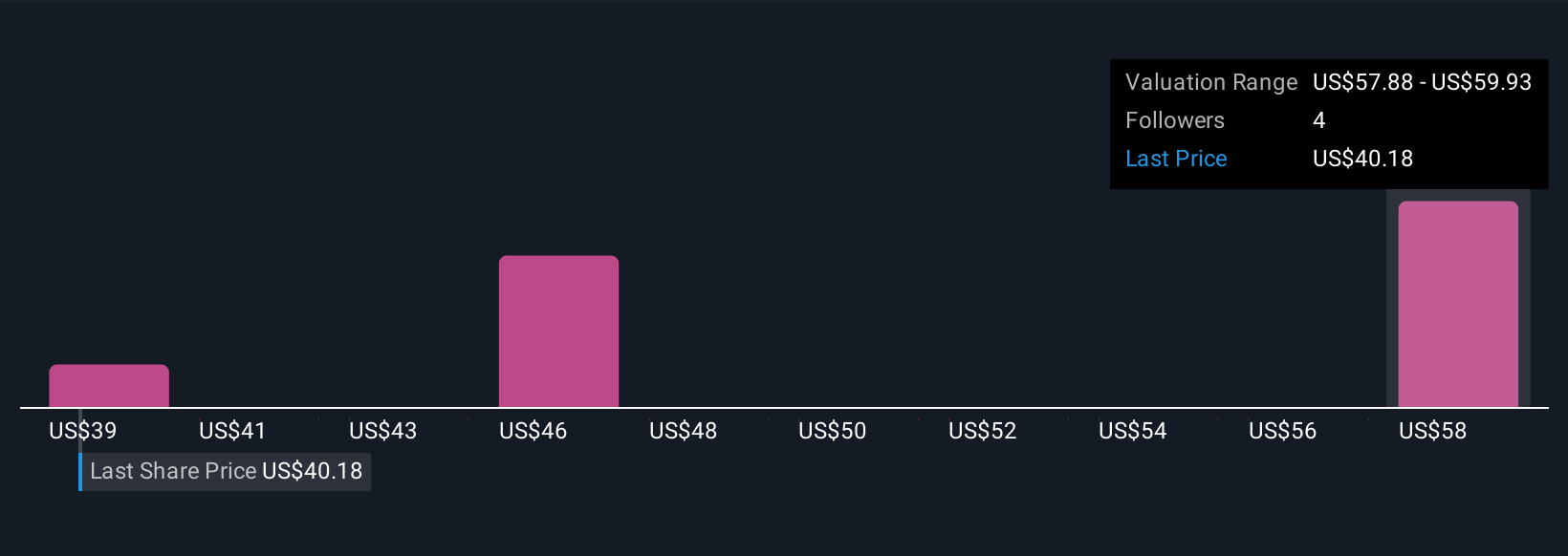

Three Simply Wall St Community members valued American Healthcare REIT between US$39.37 and US$51.84 per share. While clinical demand drivers remain positive, many investors are weighing if the slowing incremental growth as properties reach full occupancy could reshape expectations going forward.

Explore 3 other fair value estimates on American Healthcare REIT - why the stock might be worth 20% less than the current price!

Build Your Own American Healthcare REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Healthcare REIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Healthcare REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Healthcare REIT's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A Maryland-based self-managed REIT, owns and operates a diversified portfolio of clinical healthcare real estate across the U.S., U.K., and the Isle of Man.

Fair value with moderate growth potential.

Market Insights

Community Narratives