- United States

- /

- Software

- /

- NYSE:XZO

Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

As December begins, the U.S. stock market has experienced a pullback, with major indices like the Dow Jones and S&P 500 closing lower amid a risk-off sentiment that also affected big tech and crypto-tied shares. Despite these broader market challenges, small-cap stocks often present unique opportunities for investors due to their potential for growth and innovation in diverse sectors. In this landscape, identifying companies with strong fundamentals and strategic insider actions can provide valuable insights into promising investment opportunities within the small-cap space.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.6x | 2.5x | 49.48% | ★★★★★★ |

| Shore Bancshares | 10.3x | 2.8x | 41.61% | ★★★★★☆ |

| Business First Bancshares | 10.2x | 2.6x | 49.25% | ★★★★★☆ |

| Wolverine World Wide | 16.0x | 0.8x | 40.57% | ★★★★★☆ |

| Peoples Bancorp | 10.4x | 1.9x | 44.82% | ★★★★★☆ |

| First United | 9.9x | 3.0x | 45.16% | ★★★★★☆ |

| S&T Bancorp | 11.4x | 3.9x | 37.30% | ★★★★☆☆ |

| Farmland Partners | 6.3x | 7.8x | -84.84% | ★★★★☆☆ |

| Citizens & Northern | 13.3x | 3.3x | 32.54% | ★★★☆☆☆ |

| Omega Flex | 17.0x | 2.7x | 7.92% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Armada Hoffler Properties (AHH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Armada Hoffler Properties operates as a real estate company focusing on office, retail, and multifamily properties, along with general contracting and real estate services, with a market capitalization of approximately $1.17 billion.

Operations: Armada Hoffler Properties generates revenue primarily from its General Contracting and Real Estate Services, Retail Real Estate, and Office Real Estate segments. The company has experienced fluctuations in its gross profit margin, peaking at 48.25% in Q4 2021 before declining to 26.98% by Q3 2024. Operating expenses have been a significant cost component, reaching $121.17 million in Q3 2024, impacting net income margins which were negative at -0.35% during the same period but improved to positive figures subsequently.

PE: 35.3x

Armada Hoffler Properties, a smaller company in the market, shows potential for growth despite recent financial challenges. Earnings are projected to increase by 22.78% annually, although interest payments currently exceed earnings coverage. Recent insider confidence is evident as insiders purchased shares within the last year. The company's real estate assets faced a $350K impairment in Q3 2025, yet they maintain strong leasing activity with Atlantic Union Bank's new lease at Town Center Virginia Beach.

- Get an in-depth perspective on Armada Hoffler Properties' performance by reading our valuation report here.

Gain insights into Armada Hoffler Properties' past trends and performance with our Past report.

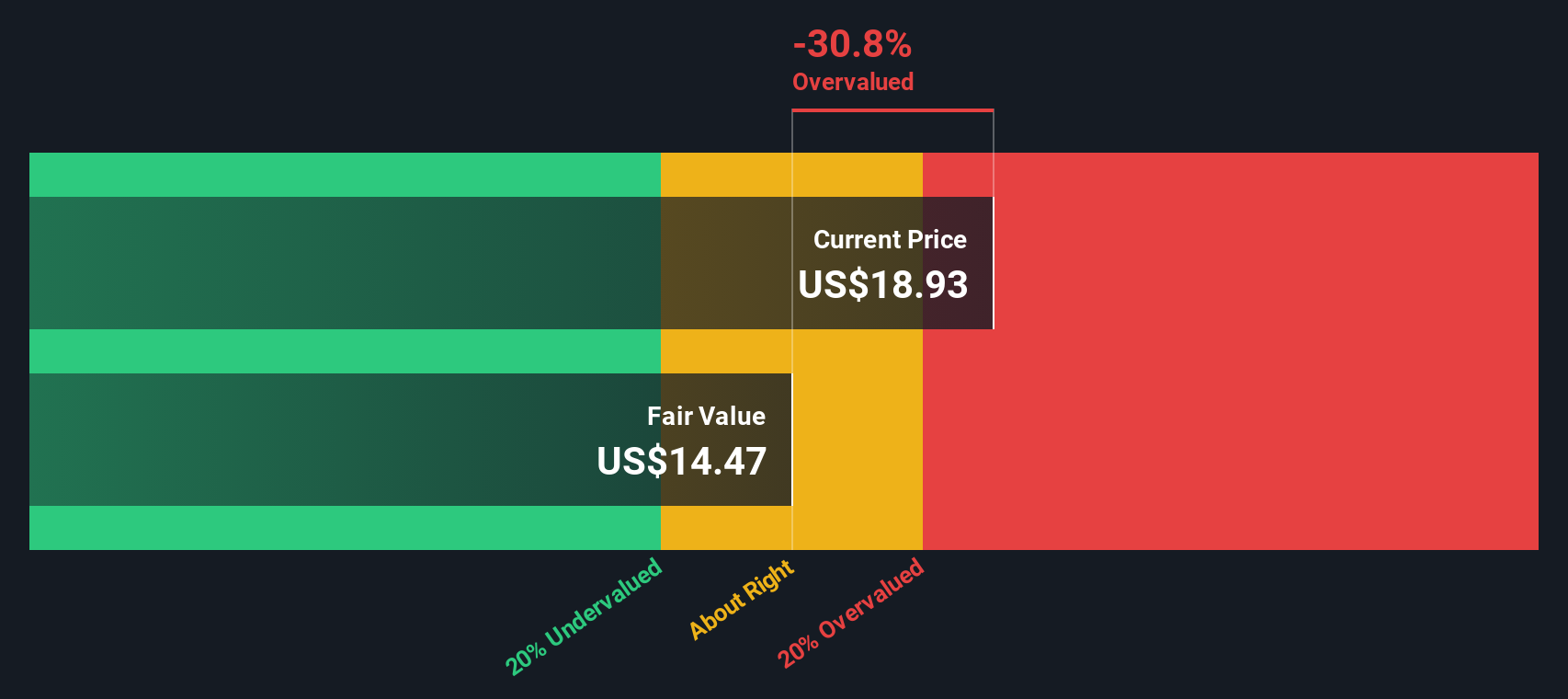

Utz Brands (UTZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Utz Brands is engaged in the manufacturing, distribution, marketing, and sale of snack food products with a market cap of approximately $2.34 billion.

Operations: The company generates revenue primarily from the manufacturing, distribution, marketing, and sale of snack food products. In recent periods, gross profit margin has shown an upward trend reaching 35.11% by late 2024. Operating expenses are largely driven by sales and marketing costs which have been significant over time. Despite fluctuations in net income margin, the company has experienced periods of positive net income in recent quarters.

PE: 151.8x

Utz Brands, a snack company with a market capitalization under US$5 billion, recently participated in the Stephens Annual Investment Conference on November 18, 2025. The company's financial position shows interest payments are not well covered by earnings, relying solely on external borrowing for funding. However, insider confidence is evident as insiders have been purchasing shares throughout 2025. This activity suggests potential optimism about future growth despite current challenges in their financial structure.

- Click to explore a detailed breakdown of our findings in Utz Brands' valuation report.

Assess Utz Brands' past performance with our detailed historical performance reports.

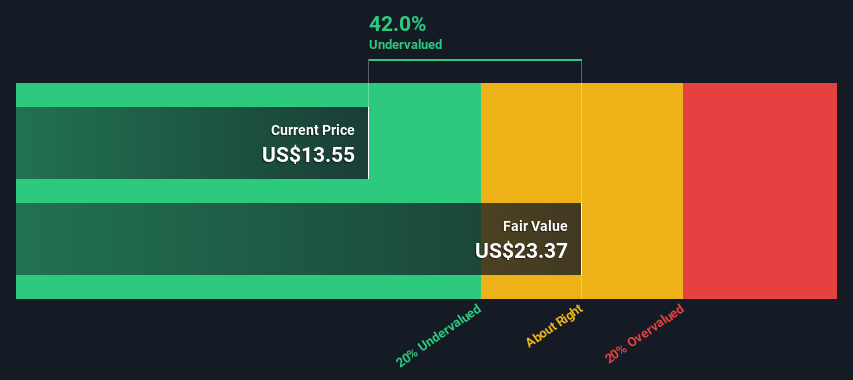

Exzeo Group (XZO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exzeo Group operates in the insurance industry, focusing on property and casualty segments, with a market cap of $2.45 billion.

Operations: Exzeo Group generates revenue primarily from its Property & Casualty insurance segment. The company's gross profit margin has been consistently at 100% since 2022, indicating a complete coverage of cost of goods sold by revenue. Operating expenses, particularly general and administrative costs, have been substantial, impacting net income margins which turned positive in recent periods.

PE: 31.4x

Exzeo Group recently completed a US$168 million IPO, offering 8 million shares at US$21 each, signaling potential growth with insider confidence. CEO & Chairman Pareshbhai Patel's purchase of 50,000 shares for US$1.05 million in November 2025 underscores their belief in the company's prospects. Despite relying on external borrowing for funding, Exzeo anticipates a robust earnings growth of 39% annually. The recent amendments to its bylaws and articles align with the public offering strategy, enhancing corporate governance as it navigates future opportunities.

- Take a closer look at Exzeo Group's potential here in our valuation report.

Understand Exzeo Group's track record by examining our Past report.

Summing It All Up

- Embark on your investment journey to our 80 Undervalued US Small Caps With Insider Buying selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exzeo Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XZO

Exzeo Group

Provides turnkey insurance technology and operations solutions to insurance carriers and agents.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026