- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

A Closer Look at Lineage (LINE) Valuation Following Recent Share Price Swings

Reviewed by Simply Wall St

Lineage (LINE) shares have experienced some movement lately, and investors might be wondering what is driving sentiment. The company’s stock dipped roughly 14% over the past month, raising questions about its current valuation and business outlook.

See our latest analysis for Lineage.

After a turbulent month, Lineage’s recent 7.99% seven-day share price rebound hints that investor sentiment may be shifting. Even as its year-to-date share price return stands at -38.62%, the 1-year total shareholder return remains firmly in the red at -41.95%. This suggests momentum is still trying to find its footing as markets weigh growth potential against ongoing risks.

If the action around Lineage sparked your curiosity, now is a perfect time to broaden your investing radar and discover fast growing stocks with high insider ownership

Given the mixed market reaction and a current share price well below analyst targets, is Lineage truly trading at a discount, or are investors already factoring in its future growth prospects? Is there a real buying opportunity here, or has the market priced it all in?

Price-to-Sales Ratio of 1.5x: Is it justified?

With Lineage trading at a price-to-sales ratio of just 1.5x, the stock appears significantly undervalued compared to industry peers and its own fair ratio benchmarks. At the last close price of $35.82, investors are paying far less per dollar of revenue than typical for similar companies.

The price-to-sales ratio measures how much the market values $1 of the company’s sales. It is especially relevant for businesses with unpredictable or negative profits, like Lineage, because it focuses attention on the company’s ability to generate revenue rather than net income.

In Lineage’s case, the 1.5x price-to-sales ratio is a fraction of the global industrial REITs industry average of 9x and the peer average of 10.8x. This points to a large value gap. Notably, this ratio also stands well below the estimated fair price-to-sales ratio of 2.5x. This could indicate room for the market to potentially re-rate the stock upwards.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales of 1.5x (UNDERVALUED)

However, continued net losses and slow revenue growth may challenge any sustained recovery, especially if operational improvements do not materialize quickly.

Find out about the key risks to this Lineage narrative.

Another View: What Does the SWS DCF Model Say?

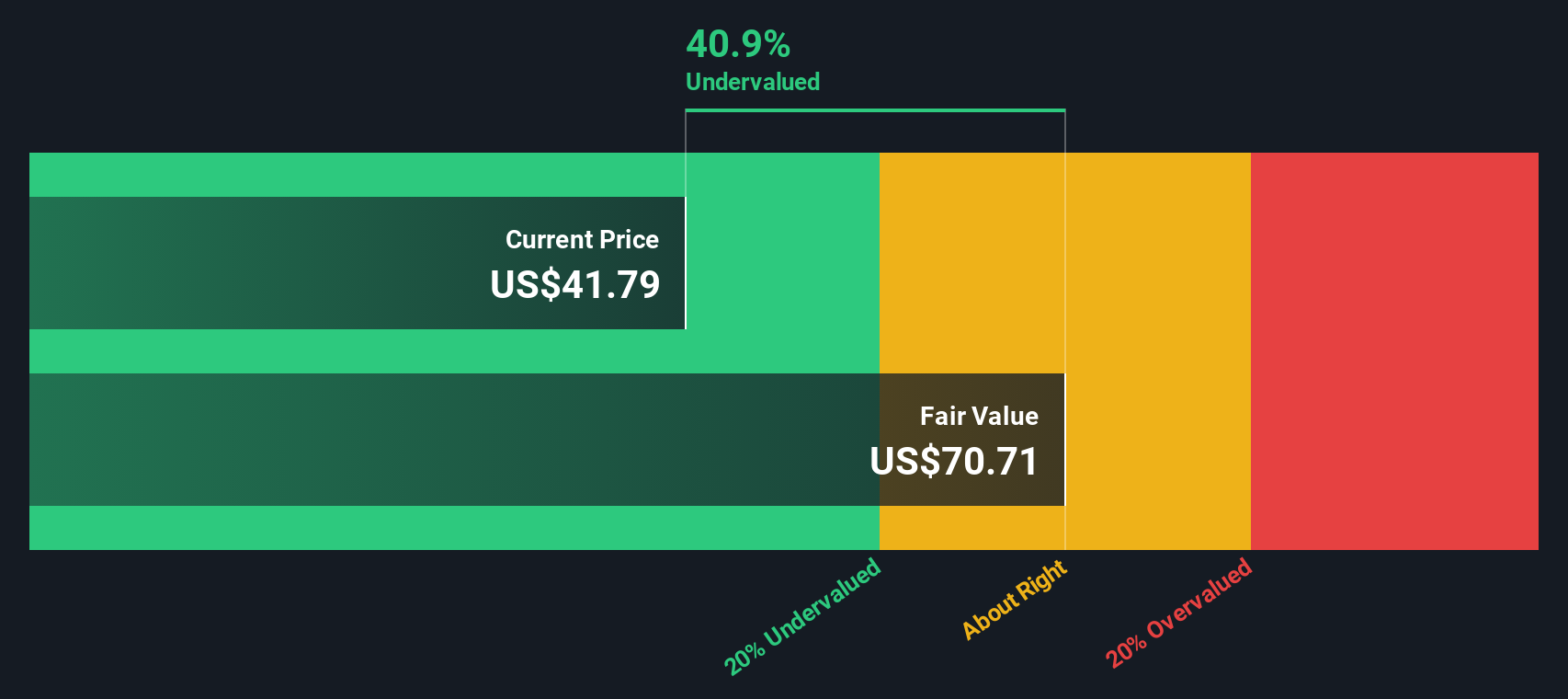

Taking a different approach, our DCF model currently estimates Lineage’s fair value at $62.42, which is about 42.6% above today’s price. This method looks ahead at projected cash flows, rather than sales. Could this deeper discount signal an even greater upside, or is it simply setting the bar too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, it is easy to craft your own investment story in just a few minutes. Do it your way

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only focus on one company, you could miss out on powerful trends and hidden gems. Let Simply Wall Street Screener spark your next winning move.

- Capture growth potential by scanning these 932 undervalued stocks based on cash flows where market mispricings could help you get in before broader recognition.

- Boost your dividend income by targeting strong yields in these 15 dividend stocks with yields > 3% with solid payouts surpassing 3%.

- Get ahead of the curve by seizing early-mover advantage with these 25 AI penny stocks set to shape the future of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.