- United States

- /

- Specialized REITs

- /

- NasdaqGS:FRMI

How Investors May Respond To Fermi (FRMI) Hybrid Cooling Push For Water-Smart 11GW Texas Energy Campus

Reviewed by Sasha Jovanovic

- Fermi America, in partnership with the Texas Tech University System, previously signed a non-binding MOU with cooling specialist MVM EGI Zrt. to engineer a next-generation hybrid cooling system for its planned 11-gigawatt private energy grid campus in West Texas, supporting combined-cycle gas and AP1000 nuclear units with construction of the first tower targeted for 2026.

- By centering water conservation through air-first hybrid cooling, closed-loop systems, and reclaimed water options, the collaboration aligns Fermi America’s long-term energy build-out with protection of the Ogallala Aquifer and regional community interests over a 99-year lease horizon.

- Next, we’ll explore how this focus on large-scale hybrid cooling and water conservation shapes Fermi America’s emerging long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Fermi's Investment Narrative?

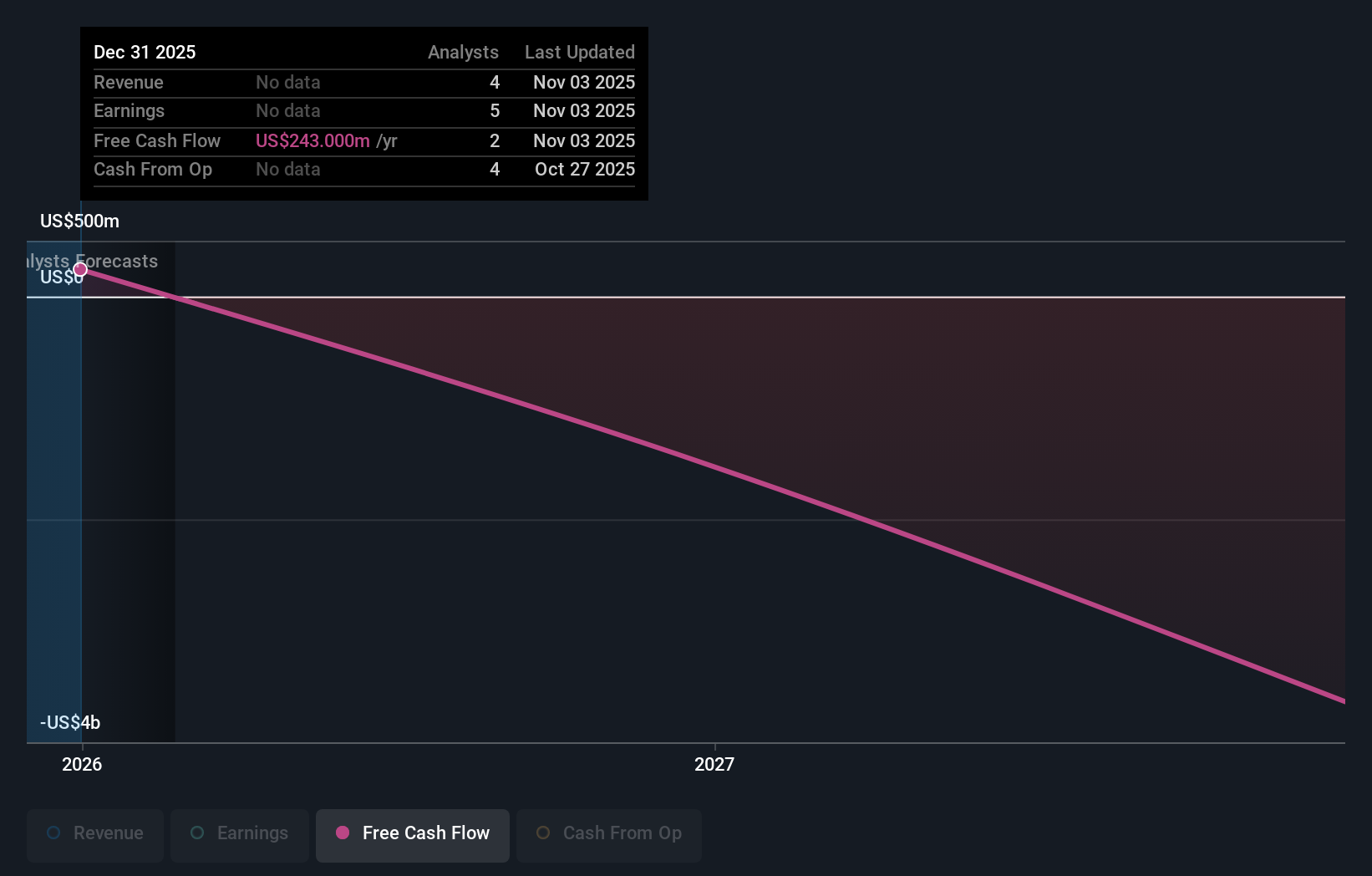

For anyone considering Fermi, the big picture to believe in is a very long-dated build-out of a private 11-gigawatt grid that can convert today’s heavy losses and lack of revenue into durable cash flows backed by contracted customers. Near term, the key catalysts remain execution milestones: turning the US$150 million AIAC into physical infrastructure, bringing the first 500 MW of gas capacity online in 2026, and locking in EPC terms for the AP1000 reactors. The new hybrid cooling MOU with MVM EGI slots into that story as an enabler rather than a financial swing factor right now; it clarifies the water and environmental pathway more than it alters the earnings outlook. Given the sharp recent share price decline and high volatility, the bigger risk is still that cost, schedule, or regulatory surprises stretch an already loss-making balance sheet.

However, investors should be aware of how project delays or overruns could pressure Fermi’s funding needs. Fermi's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 5 other fair value estimates on Fermi - why the stock might be worth less than half the current price!

Build Your Own Fermi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fermi research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Fermi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fermi's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRMI

Fermi

Fermi America (Nasdaq: FRMI) is pioneering the development of next-generation electric grids that deliver highly redundant power at gigawatt scale, required to create next-generation artificial intelligence.

Overvalued with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026