- United States

- /

- Specialized REITs

- /

- NasdaqGS:FRMI

Can Project Matador’s Momentum Redefine Fermi’s (FRMI) Role in the AI Power Race?

Reviewed by Sasha Jovanovic

- Fermi America recently received preliminary approval from the Texas Commission on Environmental Quality for 6 GW of clean natural gas-based power generation at Project Matador, alongside announcing a US$150 million Advance in Aid of Construction Agreement with its first prospective client and securing key infrastructure partnerships and local economic incentives.

- This regulatory progress and rapid infrastructure build-out mark a significant move toward meeting America's AI-driven energy needs while supporting community development and sustainability commitments.

- We'll explore how Project Matador's regulatory approval and infrastructure agreements may impact Fermi's investment narrative amid the escalating AI energy race.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Fermi's Investment Narrative?

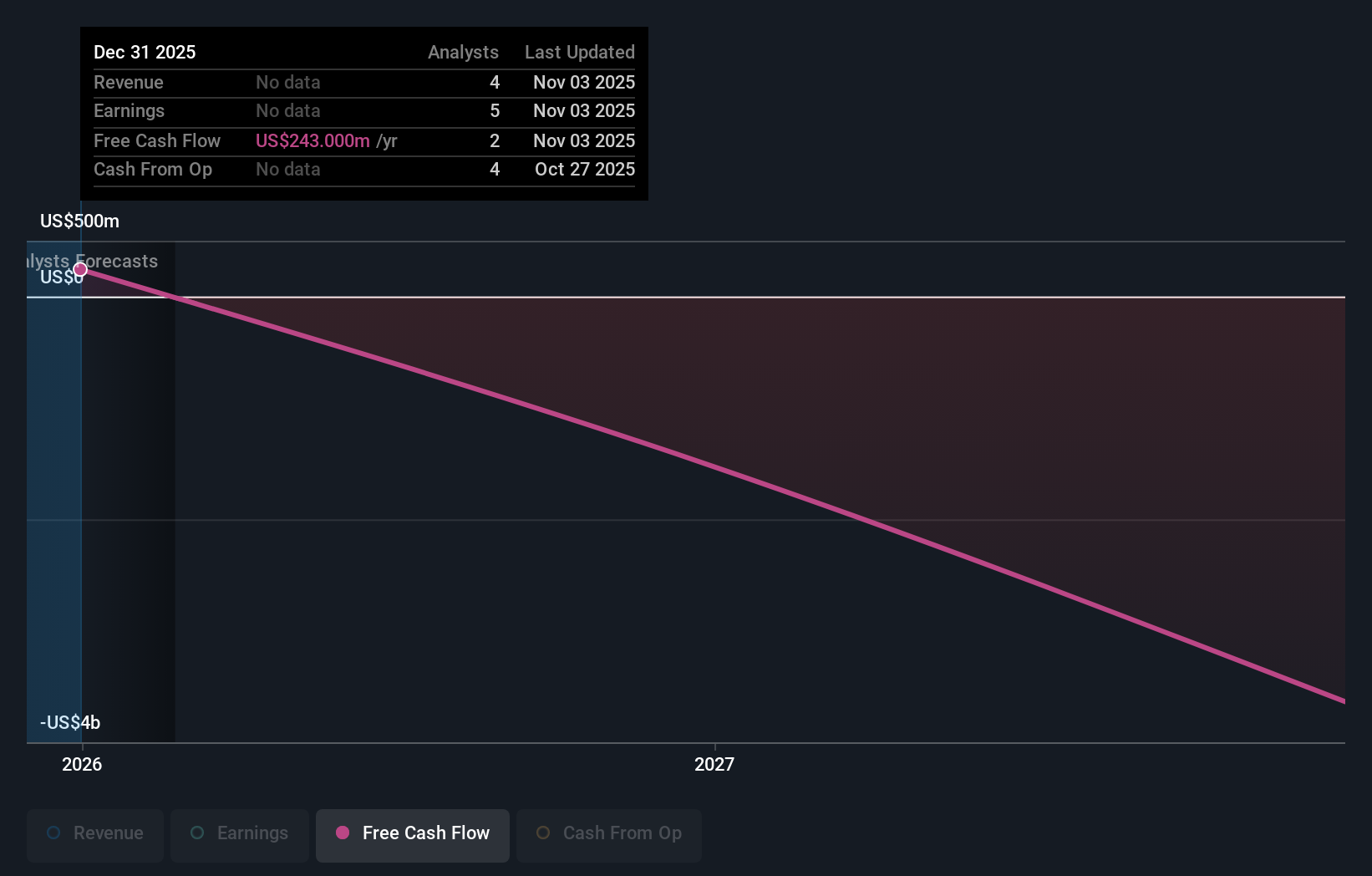

For Fermi shareholders, the central investment thesis now centers on whether the company can translate its breakthrough momentum in regulatory and infrastructure milestones into commercial reality, particularly in the rapidly evolving AI energy sector. This month's preliminary approval for 6 GW of clean natural gas generation at Project Matador, coupled with a US$150 million upfront construction deal from its first major client, represents tangible progress on key short-term catalysts, namely, building credibility, securing foundational revenue, and initiating major energy infrastructure. Compared to earlier concerns about regulatory hurdles and strategic execution, these developments appear materially positive, potentially accelerating timelines for revenue generation and strengthening Fermi's negotiating position with new clients and partners. That said, investors must still weigh persistent risks like operational execution, public input on final approvals, and the company's inexperienced management, which remain front of mind given last month's share price declines.

Yet, public scrutiny and management inexperience could shape what comes next for Fermi.

Exploring Other Perspectives

Explore 5 other fair value estimates on Fermi - why the stock might be worth as much as 60% more than the current price!

Build Your Own Fermi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Fermi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fermi's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRMI

Fermi

Fermi America (Nasdaq: FRMI) is pioneering the development of next-generation electric grids that deliver highly redundant power at gigawatt scale, required to create next-generation artificial intelligence.

Weak fundamentals or lack of information.

Similar Companies

Market Insights

Community Narratives