- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Does the Recent Expansion News Signal a Value Opportunity for Equinix in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Equinix is truly a bargain or if the market has just caught up with its story? Let’s break down what is really driving interest in the shares right now.

- The stock is down 2.0% over the past week and has dropped 13.3% in the last month, translating to a significant 22.3% decline year-to-date, which may point toward shifting market sentiment and evolving risk perceptions.

- Recent news has focused on Equinix’s ongoing investment in global data center infrastructure and new expansion partnerships across key markets. These developments have fueled debate among analysts about whether the company is setting up for future growth or facing increased industry competition.

- When it comes to valuation, Equinix scores a 3 out of 6 on our standard value checks. Let’s dig into the most popular ways to assess its worth, and stay tuned to discover an even smarter way to judge its value at the end of this article.

Find out why Equinix's -22.2% return over the last year is lagging behind its peers.

Approach 1: Equinix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates what a company is really worth by forecasting how much cash it will generate in the future, then discounting those totals back to reflect today’s dollars. For Equinix, this model is based on adjusted funds from operations and uses a two-stage method to project value over the coming decade.

Currently, Equinix generates Free Cash Flow (FCF) of about $3.4 Billion. Based on analyst estimates and proprietary modeling, FCF is projected to grow steadily, reaching approximately $5.5 Billion by 2029 and $7.5 Billion by 2035. It is worth noting that analyst forecasts only cover the next five years; after that, Simply Wall St extrapolates based on broader sector trends to provide a fuller picture.

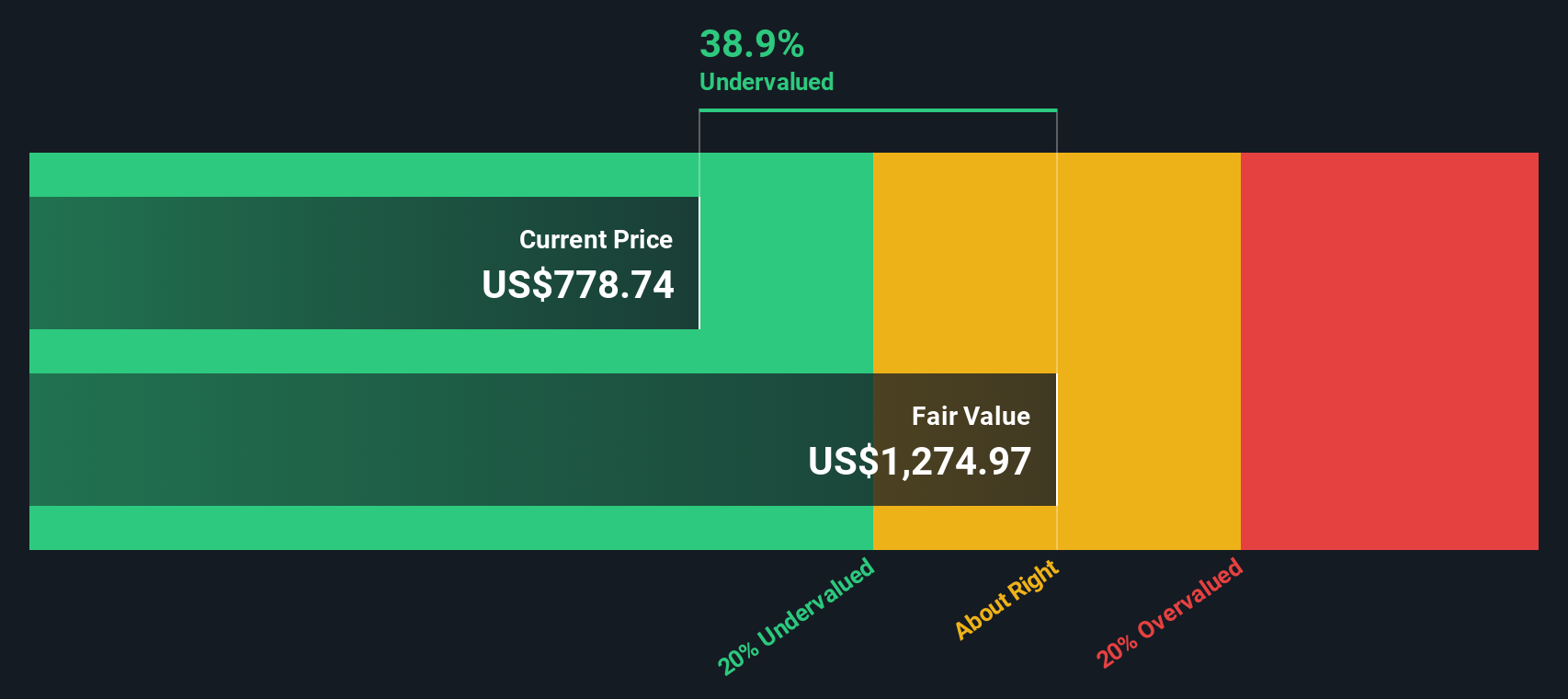

By summing and discounting these future FCF projections back to the present, the DCF model estimates Equinix’s intrinsic value at $1,243 per share. This valuation implies the stock is trading at a 41.0% discount to its projected worth, indicating that shares are currently undervalued based on cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equinix is undervalued by 41.0%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Equinix Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like Equinix. It reflects how much investors are willing to pay for a dollar of current earnings. For established firms generating steady profits, the PE ratio offers a simple yet powerful way to gauge whether the stock price aligns with underlying performance.

What counts as a “fair” PE varies across industries and companies and is shaped by expectations for earnings growth, perceived risks, and how much certainty investors demand for future profits. Typically, businesses with higher growth prospects or less risk can justify higher multiples, while slower-growing or riskier companies trade on lower PE ratios.

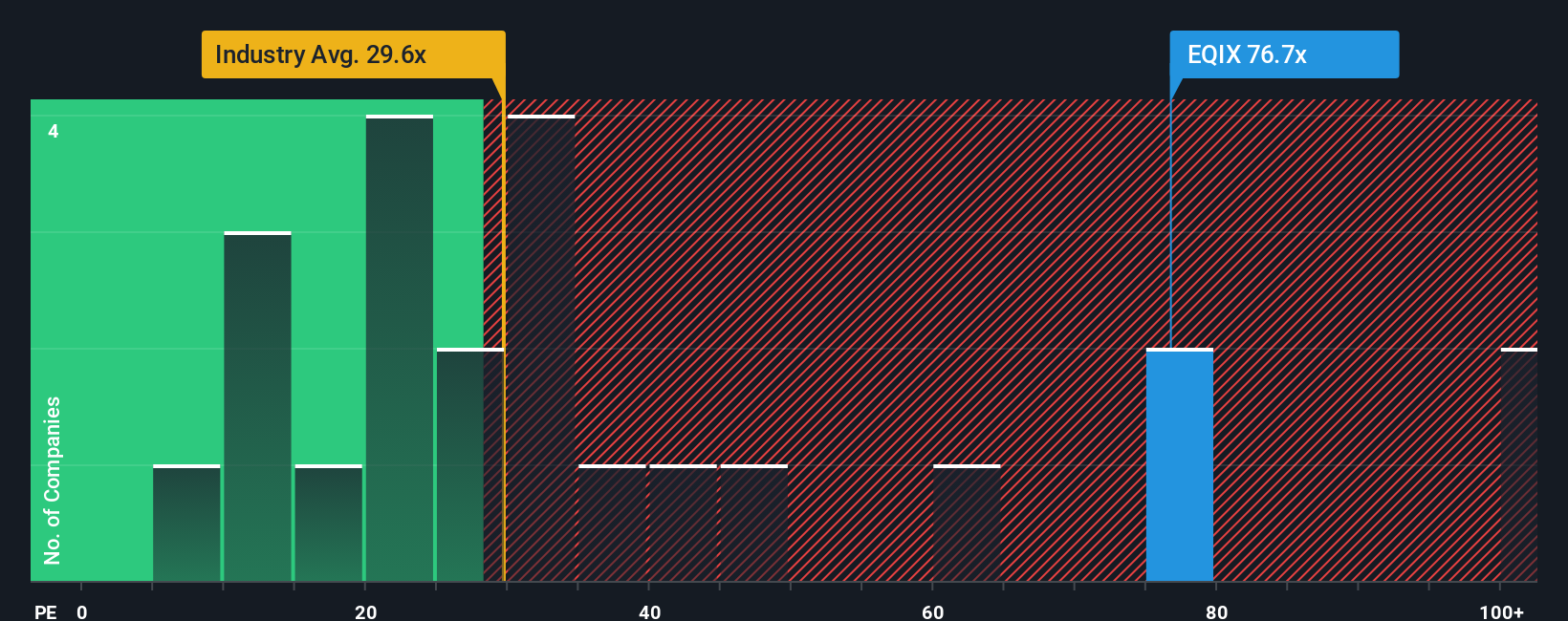

Right now, Equinix trades at a PE ratio of 67.2x. This is substantially above both the Specialized REITs industry average of 16.7x and the peer average of 30.7x. This underscores its premium valuation within the sector. However, Simply Wall St’s Fair Ratio for Equinix is calculated at 33.7x, which adjusts for factors like its earnings growth outlook, industry dynamics, profit margins, market cap, and risk profile. This proprietary “Fair Ratio” provides a more nuanced benchmark than raw peer or industry comparisons because it takes into account the unique aspects driving Equinix’s business and valuation.

Comparing the actual PE ratio of 67.2x to the Fair Ratio of 33.7x, the stock appears to be overvalued based on its earnings and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equinix Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are simple, accessible investment stories that help you connect your expectations about a company, such as its future revenues, earnings, and margins, with a financial forecast and a fair value estimate tailored to your view.

Rather than relying on a single PE, DCF, or analyst target, Narratives empower you to define your own perspective by articulating the business drivers you believe will shape Equinix’s future, and see how those assumptions translate into a Fair Value. Available on Simply Wall St’s Community page and used by millions of investors, Narratives are easy to build, update, and share. This means you can quickly decide if you think a stock is a buy or sell by comparing your Narrative’s Fair Value with the current Price, and revisit your stance as soon as new news, earnings, or data emerges.

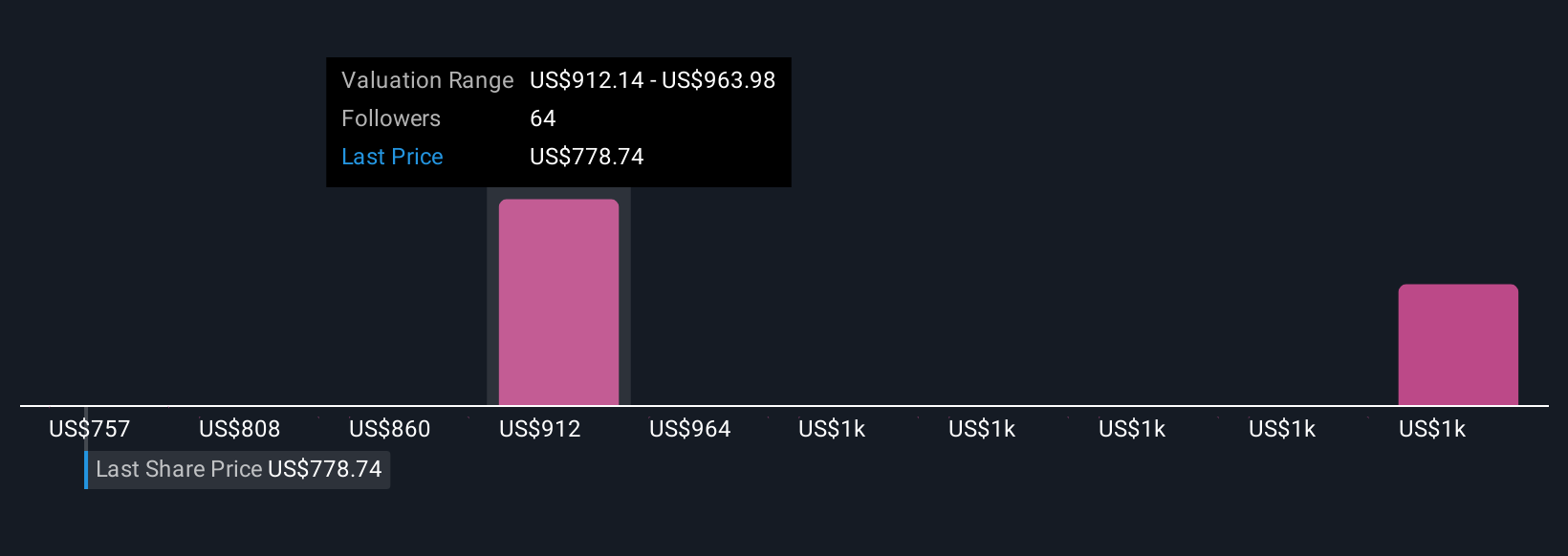

For example, recent Equinix Narratives show a range of views. The most optimistic investors see a fair value above $1,200 per share based on robust expansion and AI-driven growth, while more cautious users estimate fair value closer to $804, reflecting concerns about competition or rising costs. This lets you see the full spectrum of community perspectives at a glance.

Do you think there's more to the story for Equinix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026