- United States

- /

- Real Estate

- /

- NYSE:MMI

Marcus & Millichap (MMI): Exploring Valuation Disconnects After Recent Share Price Uptick

Reviewed by Simply Wall St

Marcus & Millichap (MMI) shares have gradually edged higher over the past month, which stands in contrast to a longer downward trend investors have seen over the past year. This recent activity comes as market participants weigh the company’s latest financial performance and evolving sector sentiment.

See our latest analysis for Marcus & Millichap.

Marcus & Millichap’s 1-month share price return has ticked slightly higher, suggesting a shift in momentum after a tough stretch. However, the longer-term picture remains challenging with a 1-year total shareholder return of -28.5%, which reflects persistent headwinds for the business.

If you’re curious about what else is out there, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

So with shares sitting below their intrinsic value, even as earnings show some recovery, is this the kind of disconnect savvy investors should act on? Or is the market already looking ahead to future growth?

Most Popular Narrative: 2.3% Undervalued

While Marcus & Millichap closed at $29.30, the most widely followed narrative pegs its fair value slightly higher, hinting at a slim disconnect that could spark debate among investors eyeing the company’s future potential.

The company is benefiting from renewed institutional investor activity and an improving lending environment. This is fueling larger transaction volumes and a stronger capital markets pipeline, both factors that are likely to boost future revenue and earnings growth.

Want to know why this narrow margin could matter? There is a blueprint of ambitious growth projections and margin recovery buried in the full narrative. Wondering which financial leap justifies a premium valuation for a company still posting losses? Uncover the main assumptions that drive this close call.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on transaction commissions and heightened competition from new technologies could challenge Marcus & Millichap’s ability to sustain its current growth trajectory.

Find out about the key risks to this Marcus & Millichap narrative.

Another View: Are Multiples Suggesting Caution?

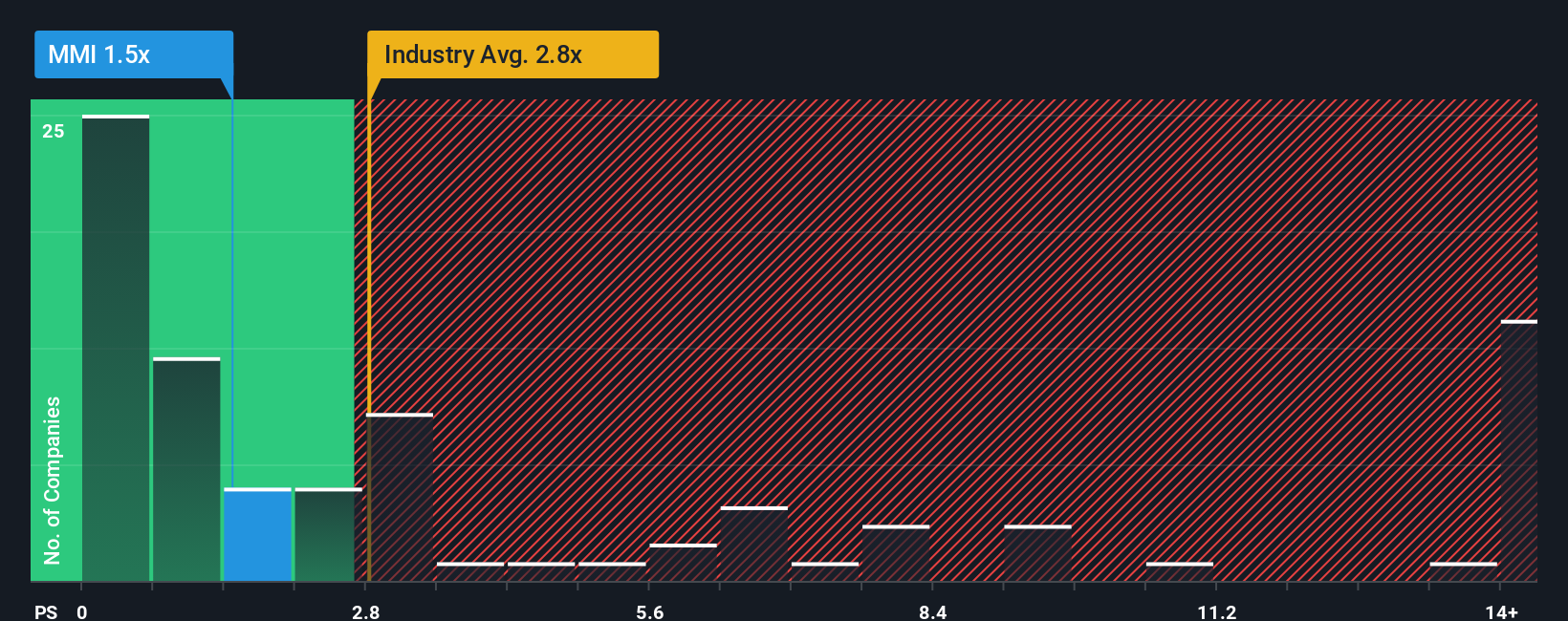

Looking at valuation through a price-to-sales lens, Marcus & Millichap trades at 1.5 times sales. This is much higher than the peer average of 0.5 times and also above the fair ratio of 0.9. This indicates investors may be paying a premium. If the market shifts closer to that fair ratio, the stock could face downside pressure. Does this premium signal confidence in a turnaround, or is it raising the risk for new buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marcus & Millichap Narrative

If you think there’s another angle to the story or prefer to draw your own conclusions from the numbers, it only takes a few minutes to build your perspective. Do it your way.

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

There’s no reason to leave your next winning stock to chance. Use these powerful tools to spot fresh opportunities and get ahead of the curve. These trends are moving fast and you don’t want to be left behind.

- Tap into market momentum by checking out these 920 undervalued stocks based on cash flows filled with stocks trading below their intrinsic worth and showing strong financial signals.

- Uncover steady income potential by reviewing these 15 dividend stocks with yields > 3% that highlight yields exceeding 3%, which may help build a resilient portfolio.

- Seize opportunities in the future of tech with these 25 AI penny stocks featuring companies making significant advancements in AI innovation and shaping tomorrow’s industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.