- United States

- /

- Real Estate

- /

- NYSE:LB

LandBridge (LB) Valuation After $500 Million Senior Notes Refinancing and Capital Structure Reset

Reviewed by Simply Wall St

LandBridge (LB) just reshaped its balance sheet by closing a $500 million private placement of 6.25% senior notes due 2030 through its DBR Land Holdings subsidiary to refinance and retire its old credit facility.

See our latest analysis for LandBridge.

The refinancing news lands as LandBridge’s share price sits at $59.35 and a 90 day share price return of nearly 14% signals improving momentum, even though the 1 year total shareholder return remains negative.

If this capital structure reset has you rethinking your energy exposure, it could be worth scanning for other fast growing stocks with high insider ownership that might be drawing similarly strong interest from management and long term holders.

With revenue and earnings growing fast and the stock still trading at a roughly 25% discount to analyst targets, is LandBridge quietly undervalued, or is the market already baking in all of its future growth?

Most Popular Narrative Narrative: 20.3% Undervalued

With LandBridge last closing at 59.35 dollars against a 74.50 dollars fair value, the most followed narrative sees meaningful upside driven by structural growth.

LandBridge's capital light model and focus on long term, fee based contracts (e.g., triple net leases and surface use royalties now making up 94% of revenue) enhance free cash flow generation and lead to greater earnings resiliency, even in periods of commodity price weakness, positively affecting both EBITDA margins and cash flow stability.

Curious how fast growing revenue, rising margins, and a richer future earnings multiple all combine to justify that higher fair value estimate? The full narrative unpacks the precise growth runway, profitability shift, and valuation re rating assumptions hiding behind that target.

Result: Fair Value of $74.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on execution, with Permian concentration and long lead times on data center and renewable projects both posing meaningful timing and regulatory risks.

Find out about the key risks to this LandBridge narrative.

Another View: Richer On Earnings

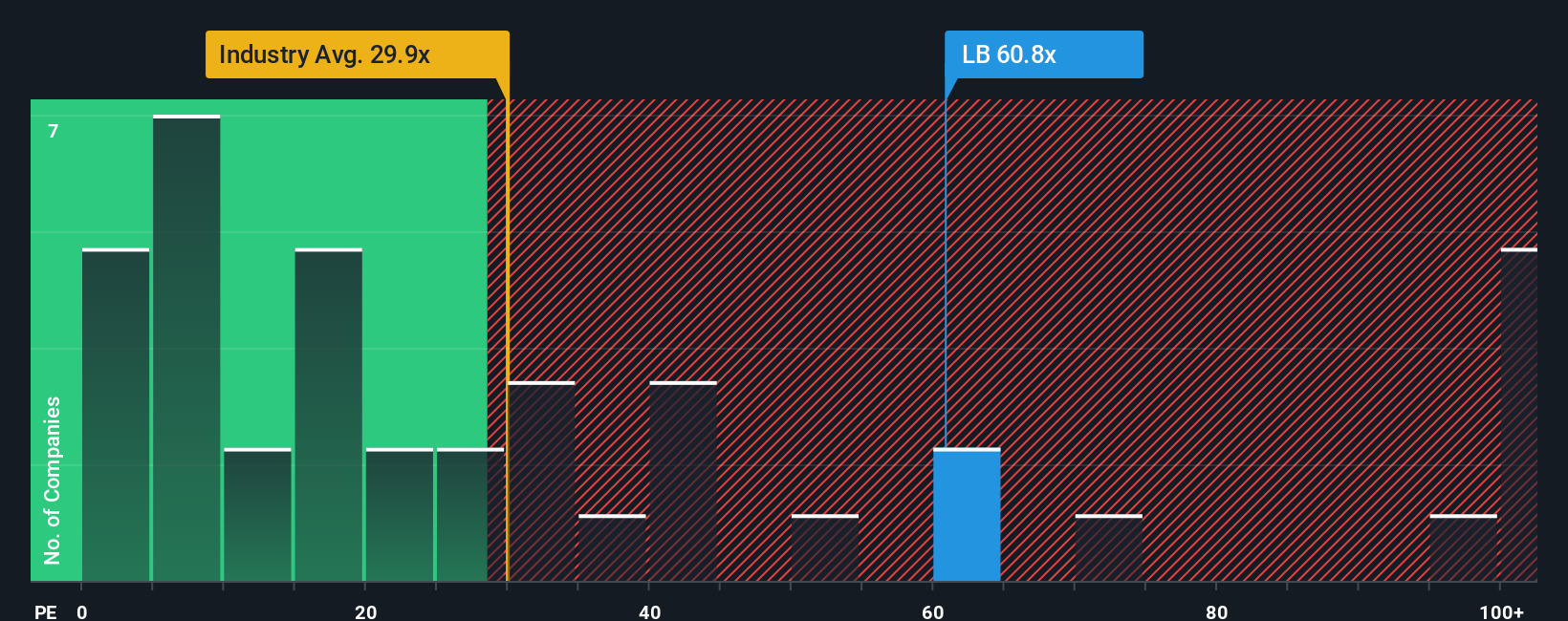

Our cash flow based fair value points to upside, but the earnings ratio tells a tighter story. At 63.4 times earnings versus 30.2 times for the US real estate sector, 40 times for peers, and a 53 times fair ratio, LandBridge carries valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LandBridge Narrative

If you see the story differently, or prefer to analyze the numbers yourself, you can create a custom view in minutes using Do it your way.

A great starting point for your LandBridge research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next potential candidates by running a quick screen for fresh opportunities that match your style, risk, and return goals.

- Capture early momentum by zeroing in on these 3577 penny stocks with strong financials that already show solid balance sheets and improving fundamentals instead of speculative hype.

- Explore growth opportunities by targeting these 26 AI penny stocks where real revenue traction backs the role of artificial intelligence, not just buzzwords.

- Look for potential mispricings by focusing on these 908 undervalued stocks based on cash flows that strong cash flow models still indicate may not fully reflect underlying business performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LB

LandBridge

Owns and manages land and resources to support and enhance oil and natural gas development in the United States.

High growth potential with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026