- United States

- /

- Real Estate

- /

- NYSE:JLL

Gareth Jones’ Appointment Could Be A Game Changer For JLL (JLL)

Reviewed by Simply Wall St

- JLL recently appointed Gareth Jones as the new EMEA head of data centres for capital markets, marking his return to the company after previously establishing its Central and Eastern European capital markets business and bringing over 25 years of industry experience.

- This move signals JLL's intent to reinforce its position in the growing data centre sector and deepen its relationships with key market players across the EMEA region.

- We’ll explore how Gareth Jones’ addition to the leadership team could influence JLL’s future growth plans within the data centre sector.

Jones Lang LaSalle Investment Narrative Recap

For shareholders, the core belief centers on JLL’s capacity to drive sustainable revenue growth by deepening its presence in resilient sectors like data centres and leveraging its expertise in real estate services. Gareth Jones’ appointment as EMEA head of data centres underscores this focus, yet the most significant short-term catalyst, recovery of transactional activity in capital markets, may not see immediate material impact from this news. The biggest risk remains macroeconomic policy volatility affecting client decision-making and transaction volumes.

The recent appointment of Phoebe Geake as UK head of industrial and logistics is relevant here, reflecting JLL’s ongoing investment in sector-specific leadership across EMEA. Both appointments highlight efforts to strengthen key growth areas, aiming to offset potential pressures from challenging market conditions and to support resilient revenue streams.

Yet while these leadership moves shine a light on expansion, investors should also be aware that macroeconomic fluctuations could drive…

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's narrative projects $29.2 billion revenue and $974.5 million earnings by 2028. This requires 6.6% yearly revenue growth and a $438.5 million earnings increase from $536.0 million today.

Exploring Other Perspectives

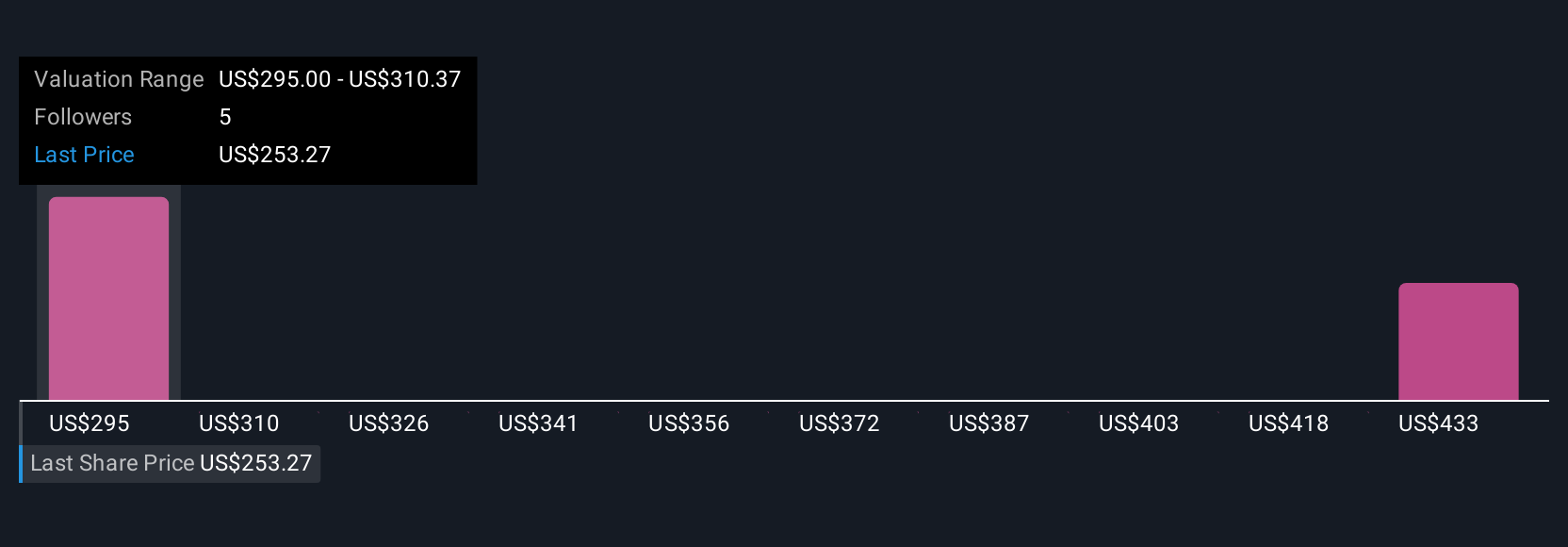

Simply Wall St Community members estimate JLL’s fair value between US$295 and US$446, with two distinct perspectives represented. While some see an opportunity in resilient business lines, others caution that macroeconomic instability may weigh on revenue growth, explore these diverse outlooks before making your own assessment.

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

Operates as a commercial real estate and investment management company.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives