- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (CBRE): Examining Current Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

CBRE Group (CBRE) has been drawing attention lately as investors reassess the company’s performance and outlook following recent trading activity. With its shares relatively steady over the past month, there is renewed curiosity about the factors behind CBRE’s current valuation.

See our latest analysis for CBRE Group.

Momentum has been quietly building for CBRE Group, with its share price notching a solid 6.2% gain over the past month and a robust year-to-date price return of nearly 25%. This recent performance adds to a longer track record of shareholder returns. CBRE’s total return stands at about 16% over the past year and has more than doubled over the last three years, suggesting that investors remain optimistic about its growth potential amid evolving market dynamics.

If you’re tracking shifts in the real estate sector, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With shares hovering near recent highs, the question now becomes whether CBRE Group offers attractive value at today’s prices or if the market has already accounted for its expected growth. Could there still be a buying opportunity here?

Most Popular Narrative: 7.5% Undervalued

CBRE Group closed at $162.21, while the most popular valuation narrative sets fair value at $175.45. This notable gap has investors watching closely for what might justify this premium. These expectations stem from forecasts that connect growth, margin expansion, and capital management to stronger shareholder value in the coming years.

CBRE's strategic realignment of its Project Management and Building Operations & Experience segments has resulted in strong financial performance and is expected to drive future growth by enhancing operational synergies, including shared client access and opportunities for mergers and acquisitions. This is likely to positively impact both revenue and net margins.

Want to know what future targets drive this bullish stance? Discover the key calculations behind the narrative—shifting profits, rising margins, and a bold path to growth. One crucial prediction shapes everything. Ready to see which financial lever makes all the difference?

Result: Fair Value of $175.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain. Tariff-related uncertainty and slowdowns in leasing activity could challenge the optimistic forecast and test CBRE’s growth momentum.

Find out about the key risks to this CBRE Group narrative.

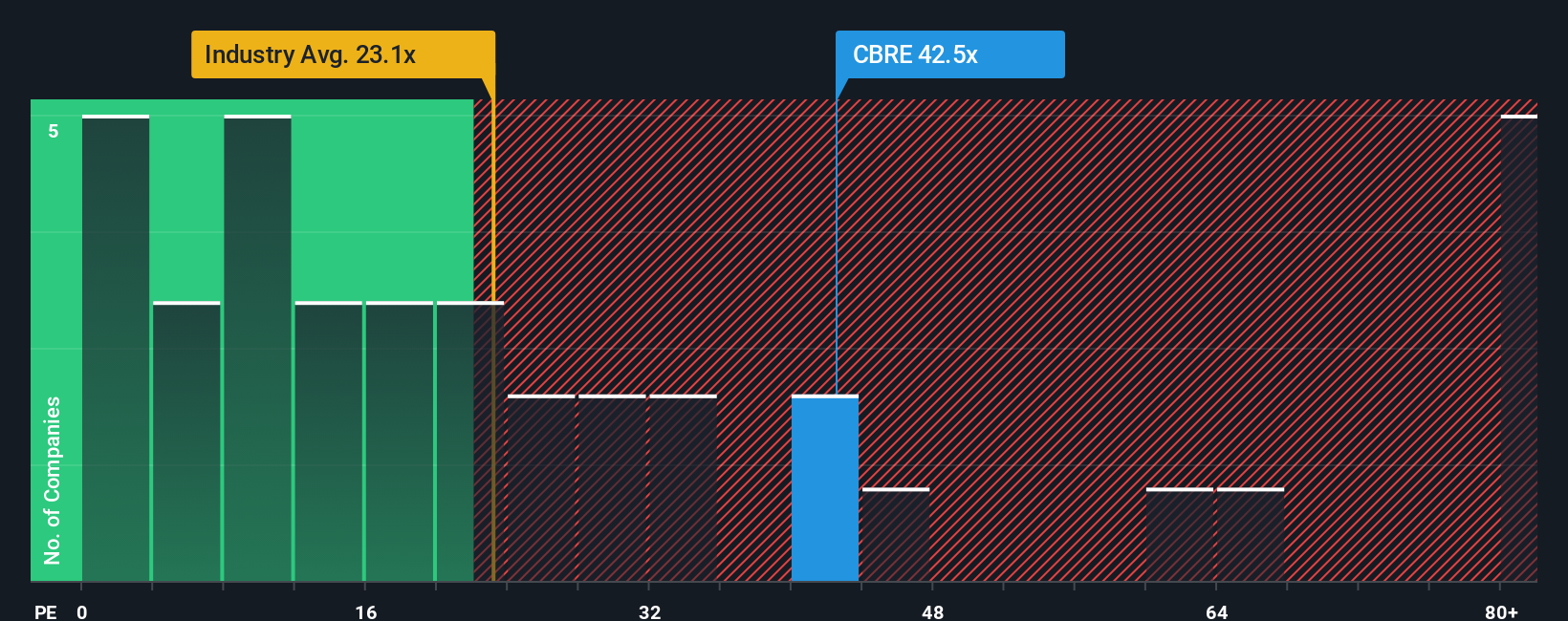

Another View: Market Ratios Tell a Different Story

While the most popular valuation method suggests CBRE Group is undervalued, a look at the actual price-to-earnings ratio paints a much less attractive picture. CBRE is trading at 38.7x earnings, well above the US real estate industry average of 30.3x and even higher than the peer average of 28.3x. The market could eventually move toward the fair ratio of 27x, indicating real valuation risk at current prices. Is the enthusiasm already priced in, or is there something the multiples are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If you want a different perspective or would rather delve into the numbers firsthand, crafting your own CBRE Group story takes under three minutes. Do it your way

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the next hot tip. Get ahead by targeting opportunities most investors overlook. The Simply Wall Street Screener empowers you to find tomorrow’s winning stocks today.

- Seize the chance to spot rising technology leaders by checking out these 25 AI penny stocks pioneering advancements in artificial intelligence.

- Unlock stable income streams as you sort through these 15 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Capitalize on emerging trends in distributed finance by zeroing in on these 82 cryptocurrency and blockchain stocks riding the wave of cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.