- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings (NYSE:BEKE): Assessing Valuation After Efficiency Gains, Buyback, and Mixed Quarterly Results

Reviewed by Simply Wall St

KE Holdings (NYSE:BEKE) just wrapped up a quarter that highlighted its transition toward efficiency, with city-level profitability in its home rental and renovation services. The period saw a sizeable completed share buyback, even as overall profit softened.

See our latest analysis for KE Holdings.

After briefly rallying on optimism around its completed buyback and solid progress in home rental services, KE Holdings’ share price momentum has cooled. The stock is down 12% on a total shareholder return basis over the past year, though it remains up nearly 20% over three years. Recent market action reflects more cautious sentiment as investors weigh short-term profit declines against efficiency gains and improving long-term prospects.

If you’re open to broadening your opportunities, now’s a great time to explore fast growing stocks with high insider ownership.

With the stock trading about 21% below consensus analyst targets and profitability shifting toward high-growth services, investors may wonder if this is the disconnect that smart investors seek or if future growth is already reflected in the current price.

Most Popular Narrative: 25% Undervalued

According to the most widely tracked narrative, KE Holdings’ last close of $16.85 is considerably below the fair value estimate of $22.55. This notable price gap brings attention to whether the company’s digital transformation and service expansion could unlock significant upside.

KE Holdings is diversifying revenue through rapid expansion of its high-margin, recurring service businesses, such as home renovation, furniture, and rental services. These non-transactional revenues now make up 41% of total sales, which reduces cyclicality and supports more stable revenue and higher blended margins as the platform matures.

Curious what bold financial bets power this bullish outlook? The narrative hints at transformation, recurring revenues, and a new profit mix. The key assumptions might surprise you. Explore how much future growth and margin expansion analysts are factoring in before concluding this stock is undervalued.

Result: Fair Value of $22.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China's property market and slow government policy support could quickly undermine even the most optimistic forecasts for KE Holdings.

Find out about the key risks to this KE Holdings narrative.

Another View: Multiples Suggest a Different Story

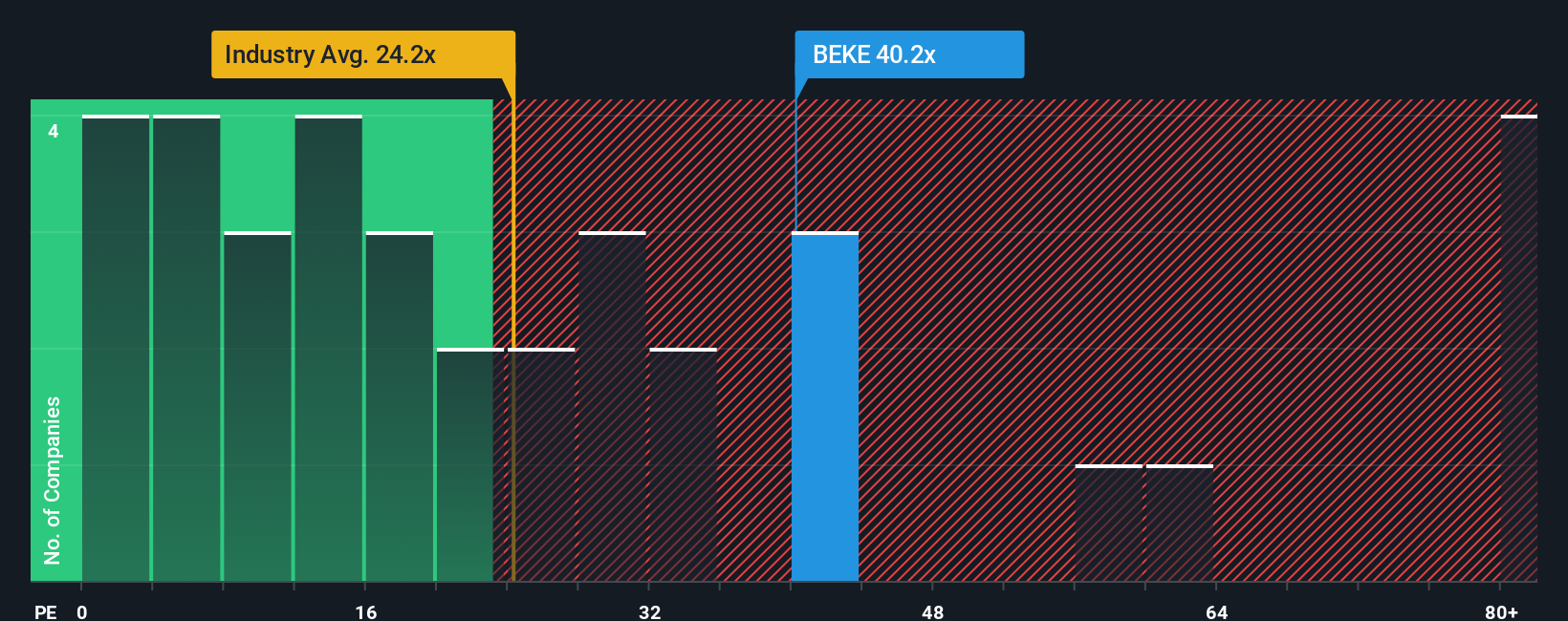

While some see KE Holdings as undervalued based on fair value estimates, the market’s price-to-earnings ratio tells a more cautious tale. At 40.2x, it is substantially higher than the industry average (26.9x) and even further from the fair ratio of 25.9x. This could signal potential valuation risk if market sentiment shifts. Should investors worry this premium could fade?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KE Holdings Narrative

If you want to dig deeper and shape your own perspective, you can create a personalized narrative using the available data in just a few minutes. Do it your way.

A great starting point for your KE Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock your next opportunity by targeting strategies that countless investors wish they had found sooner. Use the screeners below on Simply Wall Street and don’t let market wins pass you by.

- Tap into growth potential with these 24 AI penny stocks, redefining entire industries using artificial intelligence, automation, and machine learning breakthroughs.

- Secure stable income streams by checking out these 16 dividend stocks with yields > 3%, offering yields above 3%, a choice for investors prioritizing steady returns.

- Ride the wave of innovation and financial disruption through these 82 cryptocurrency and blockchain stocks, featuring companies advancing blockchain infrastructure, payments, and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives