- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Newmark Group (NMRK) Valuation in Focus Following Analyst Upgrade and Earnings Momentum

Reviewed by Simply Wall St

Newmark Group (NMRK) recently caught investors’ attention after an upgrade in analyst rating was driven by a steady rise in earnings estimates over the past 3 months. This upbeat sentiment hints at a shifting outlook.

See our latest analysis for Newmark Group.

Newmark Group’s upbeat analyst upgrade arrives as its share price has rallied 37.6% year-to-date, reflecting renewed investor confidence amid rising earnings expectations. Over the past year, shareholders have seen a 13.7% total return. With a 110% three-year total return, momentum appears firmly positive.

If you’re curious what else is generating buzz this season, consider expanding your search and discover fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets, the real question facing investors is whether Newmark Group remains undervalued or if the market is already pricing in its future growth outlook.

Most Popular Narrative: 12.9% Undervalued

Compared to the recent closing price of $17.25, the most widely followed narrative puts Newmark Group's fair value at $19.80, suggesting significant upside potential from current levels. The story behind this narrative centers on rapid growth strategies and new international ventures, fueling the case for a higher valuation.

Accelerated expansion in alternative asset classes such as data centers, supported by robust demand stemming from AI and digital infrastructure, is driving above-industry revenue growth and higher-margin capital markets activities. This positions Newmark for long-term top-line and earnings expansion. Global platform buildout, especially in Europe and Asia, is opening significant new addressable markets and providing runway for further market share gains, which supports multi-year revenue and EBITDA growth potential.

Want to know what really powers this bullish price? The narrative is built on aggressive growth bets, new market entries, and a financial forecast usually reserved for industry leaders. Wonder which bold projections might justify this premium? Click through to see what’s driving these targets before the rest of the market catches up.

Result: Fair Value of $19.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the pace of Newmark's global expansion and heavy investment in tech could strain margins if expected synergies or demand do not materialize.

Find out about the key risks to this Newmark Group narrative.

Another View: Market Ratios Suggest Less Room for Upside

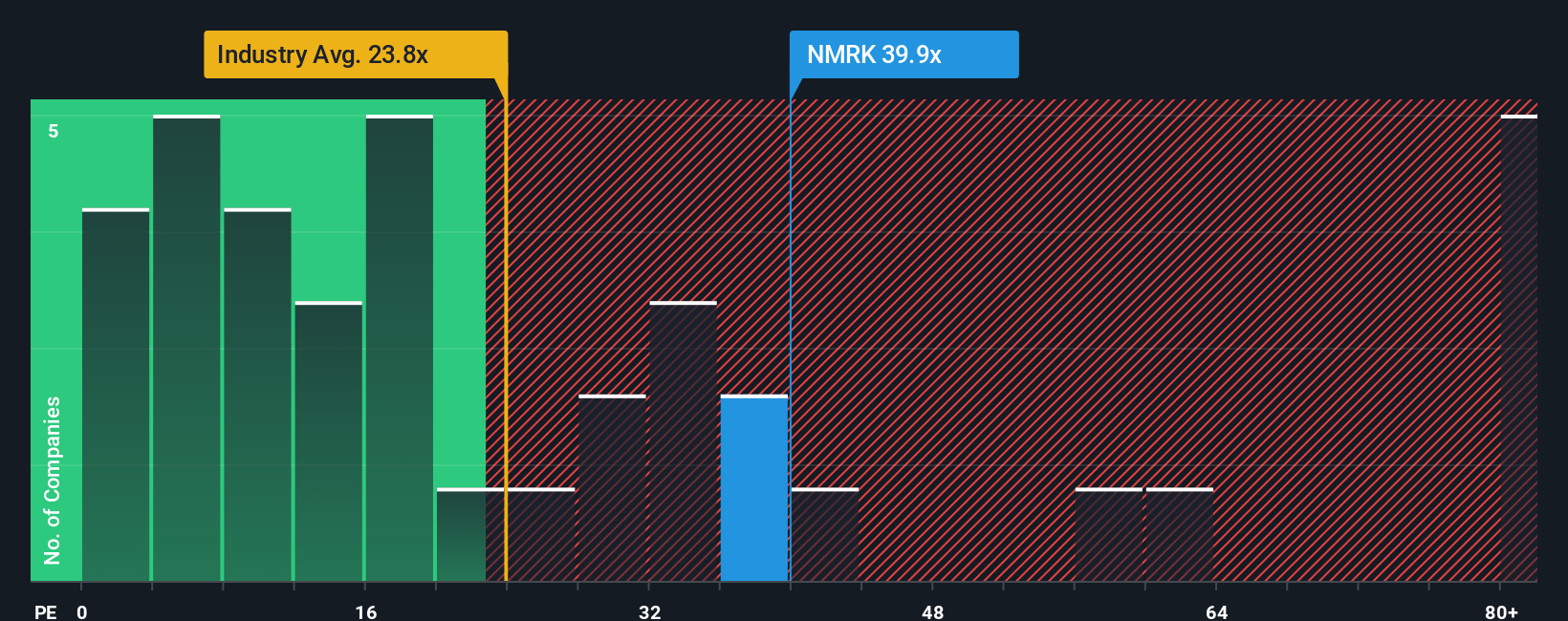

Looking at current price-to-earnings measures, Newmark Group trades at 30 times earnings. This is just above both its peer average of 29.7x and the wider US Real Estate industry at 29.7x. It is also higher than the fair ratio of 24.1x, meaning today’s market price leaves limited margin for error. If investor optimism fades or growth slows, the valuation could compress toward that lower level. Is the premium justified, or is caution warranted with the current optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newmark Group Narrative

If you have a different perspective or want to chart your own view, it’s easy to dive into the data and build your own storyline in just a few minutes. Do it your way

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Investment Opportunities?

Make your portfolio stand out by seeking out tomorrow’s winners now. Don’t miss your chance to catch the next breakout before it’s headline news.

- Fuel your search for hidden gems by scanning these 928 undervalued stocks based on cash flows, which are poised for a comeback and may deliver genuine value others might overlook.

- Tap into the momentum of artificial intelligence with these 25 AI penny stocks and get ahead of one of the world’s fastest-changing sectors.

- Find reliable payouts and stability by targeting these 14 dividend stocks with yields > 3%, which consistently offer strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026