- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Newmark Group (NMRK) Is Up After Raising 2025 Guidance and Expanding Facilities Management Into India—What’s Next?

Reviewed by Sasha Jovanovic

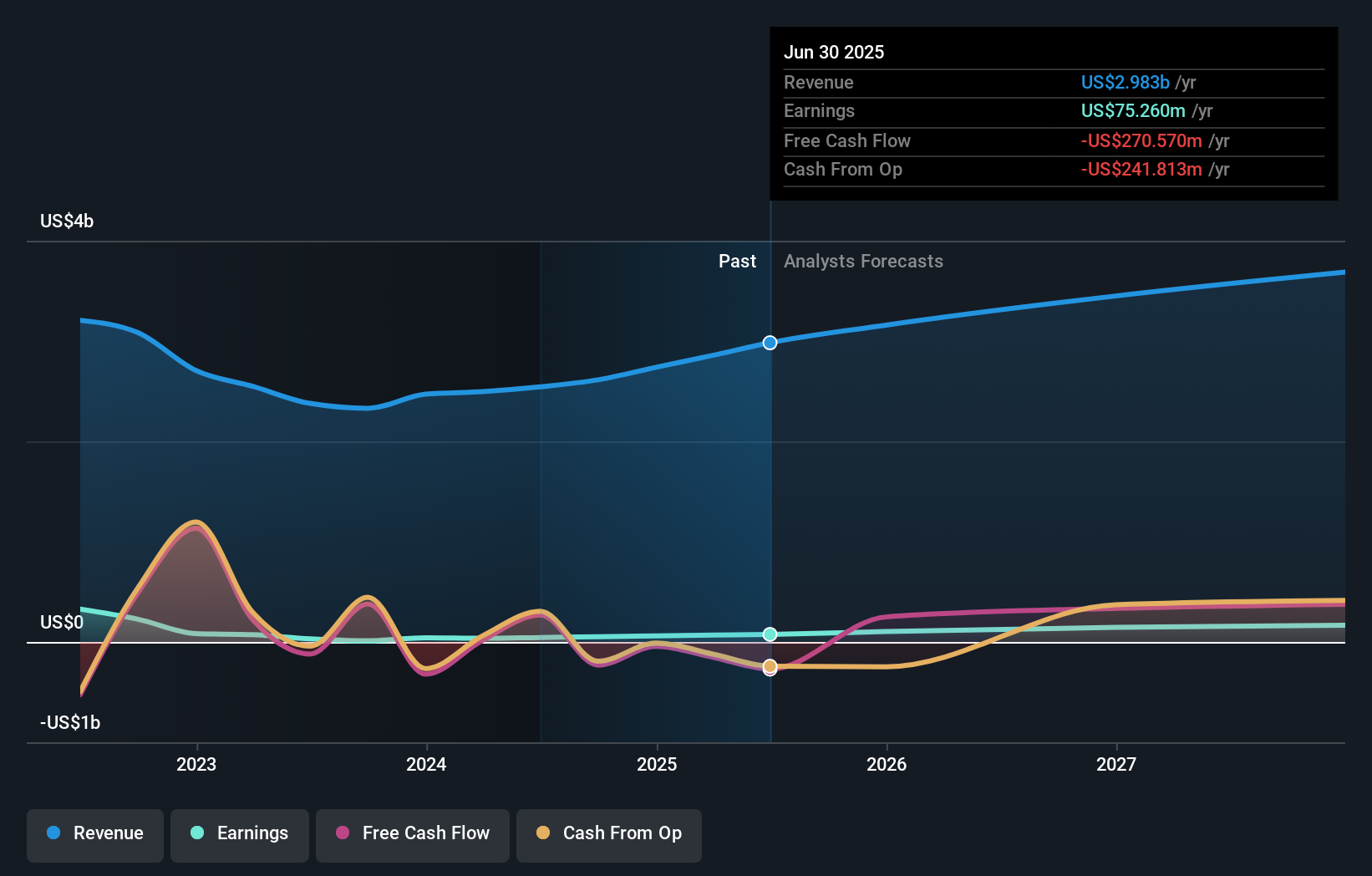

- Newmark Group, Inc. recently reported third quarter 2025 results with revenue of US$863.46 million and net income of US$46.15 million, both higher than the prior year, and raised its full-year 2025 guidance to a revenue range of US$3.18 billion to US$3.33 billion, which represents an 18.5% increase at the midpoint.

- An interesting development is Newmark's expansion of its Property and Facilities Management business into India, appointing experienced executive Sathish Rajendren to lead its operations across India and the Asia-Pacific region, highlighting the company's push into new international markets.

- We'll explore how Newmark's stronger third quarter earnings and upgraded 2025 guidance influence the company's long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Newmark Group Investment Narrative Recap

To be a shareholder in Newmark Group, you need to believe in the company's ability to scale internationally and capture new, fast-growing market segments while managing risks from rapid expansion and evolving industry cycles. The recent third quarter revenue beat and raised 2025 guidance boost the near-term outlook but do not fundamentally alter the biggest short-term catalyst, demand in alternative property sectors, or the largest risk: successful execution and integration of new overseas operations, particularly in Asia.

The recent announcement expanding Property and Facilities Management into India is directly tied to Newmark’s international ambitions and near-term revenue drivers. Appointing a seasoned executive to lead this business suggests a commitment to establishing credibility and operational depth, yet also amplifies exposure to potential integration and operational risks as they build out these platforms in new markets.

But investors should be aware, in contrast to the company’s upbeat guidance, that integration and execution risk in new international markets remains...

Read the full narrative on Newmark Group (it's free!)

Newmark Group's narrative projects $3.8 billion revenue and $201.7 million earnings by 2028. This requires 8.2% yearly revenue growth and a $126.4 million increase in earnings from $75.3 million today.

Uncover how Newmark Group's forecasts yield a $19.05 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range widely, from US$11.81 up to US$24.24 per share. While community opinions differ, the company’s aggressive expansion into Asia presents both growth opportunities and the real challenge of managing operational risk in unfamiliar territory.

Explore 3 other fair value estimates on Newmark Group - why the stock might be worth as much as 42% more than the current price!

Build Your Own Newmark Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmark Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmark Group's overall financial health at a glance.

No Opportunity In Newmark Group?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives