- United States

- /

- Real Estate

- /

- NasdaqGS:CSGP

Reassessing CoStar Group (CSGP) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

CoStar Group (CSGP) has slipped over the past few months, even as its revenue and earnings continue to grow at a healthy clip. That disconnect between share performance and fundamentals is what makes the stock interesting today.

See our latest analysis for CoStar Group.

Despite a recent pullback, including a roughly 22.8% 3 month share price return that has weighed on sentiment, CoStar's longer term total shareholder returns remain negative. This signals that investor enthusiasm has cooled even as the business keeps compounding.

If CoStar's mix of growth and volatility has your attention, this might be a good moment to see what else is out there in fast growing stocks with high insider ownership.

With revenue still growing double digits and analysts seeing roughly 35% upside from here, yet intrinsic value models flashing little apparent discount, investors face a key question: is CoStar undervalued today or is future growth already priced in?

Most Popular Narrative Narrative: 26% Undervalued

With CoStar Group last closing at $68.01 against a narrative fair value of $91.94, the valuation case leans heavily on future profit expansion and scale.

Analysts are assuming CoStar Group's revenue will grow by 16.9% annually over the next 3 years. Analysts assume that profit margins will increase from 3.6% today to 18.6% in 3 years time.

Curious what justifies that kind of margin leap and rapid earnings build up? The narrative leans on a bold mix of growth, pricing power, and richer profitability. Want to see the exact financial path that underpins that valuation gap?

Result: Fair Value of $91.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on Homes.com scaling profitably and on legal or competitive pressures not eroding CoStar's pricing power and margin ambitions.

Find out about the key risks to this CoStar Group narrative.

Another Lens On Valuation

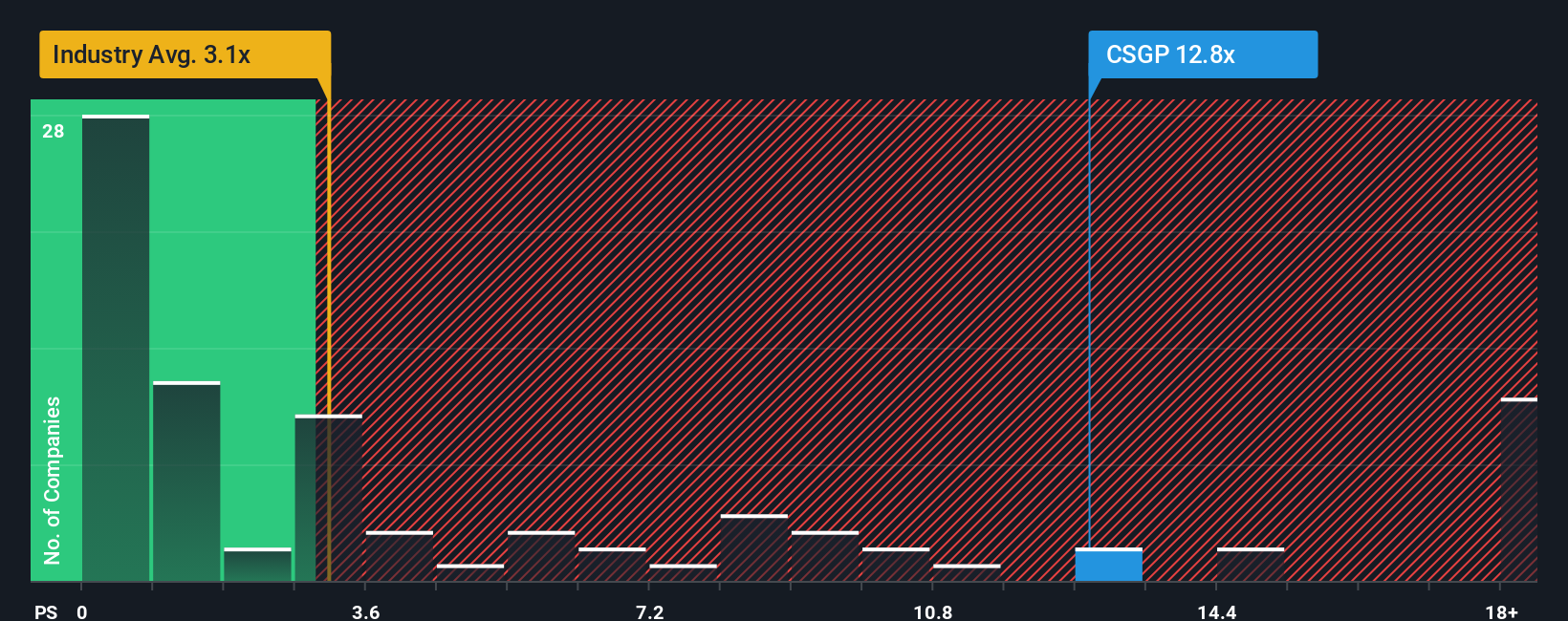

Step back from the narrative, and CoStar looks pricey on a simple price to sales yardstick. The stock trades around 9.4 times sales versus 2.1 times for the US real estate sector and a fair ratio of 6.1 times, leaving little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If this story does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a fresh take in minutes: Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall St Screener to uncover focused sets of stocks matched to specific strategies before the market catches on.

- Capture potential mispricings early by checking out these 907 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride powerful AI-driven tailwinds by reviewing these 26 AI penny stocks shaping the next wave of intelligent software and automation.

- Lock in reliable portfolio income by scanning these 15 dividend stocks with yields > 3% that can help support returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGP

CoStar Group

Provides information, analytics, and online marketplace services in the United States, Canada, Europe, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026