- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Evaluating Valuation After Key EMA Nod for Breakthrough Cat Osteoarthritis Therapy

Reviewed by Kshitija Bhandaru

If you have been keeping an eye on Zoetis (ZTS), the latest buzz centers on a game-changing update from Europe. The company just received a positive opinion from the European Medicines Agency's Committee for Veterinary Medicinal Products for Portela, its new long-acting antibody therapy that targets osteoarthritis pain in cats. This milestone could set Zoetis up to launch the first therapy of its kind if approval follows. This represents a potential expansion into an unmet market and another win in the company’s drive to stay at the forefront of animal health innovation.

Of course, this fresh development comes at a time when Zoetis' stock has been moving in the opposite direction compared with its product pipeline. Over the past year, shares have dropped around 24%, with momentum slipping further this month and since the start of the year. While the Portela news may spark new excitement about long-term growth, the stock’s short- and medium-term trends have signaled that markets are cautious about its valuation and future prospects right now.

The big question for investors is whether Zoetis' current weakness is simply the market catching its breath before a rebound or if it reflects realistic concerns about growth being fully priced in. Is this a buying window, or is Wall Street already anticipating what comes next?

Most Popular Narrative: 24% Undervalued

The consensus among leading analysts suggests Zoetis shares are currently trading at a significant discount to their calculated fair value, implying considerable potential upside if core business trends play out.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share. This could positively impact organic revenue growth and net margins.

Ready to uncover what is fueling this bullish outlook? This narrative hinges on ambitious growth assumptions, including a ramp-up in profits and a valuation multiple rarely seen outside top-tier growth stocks. Think you know the key projection that underpins the 24% undervaluation? You might be surprised by what drives these forecasts.

Result: Fair Value of $190.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting competition and slower-than-expected adoption of new therapies could limit margin gains and challenge the bullish narrative on Zoetis.

Find out about the key risks to this Zoetis narrative.Another View: Market Comparison Signals a Higher Price Tag

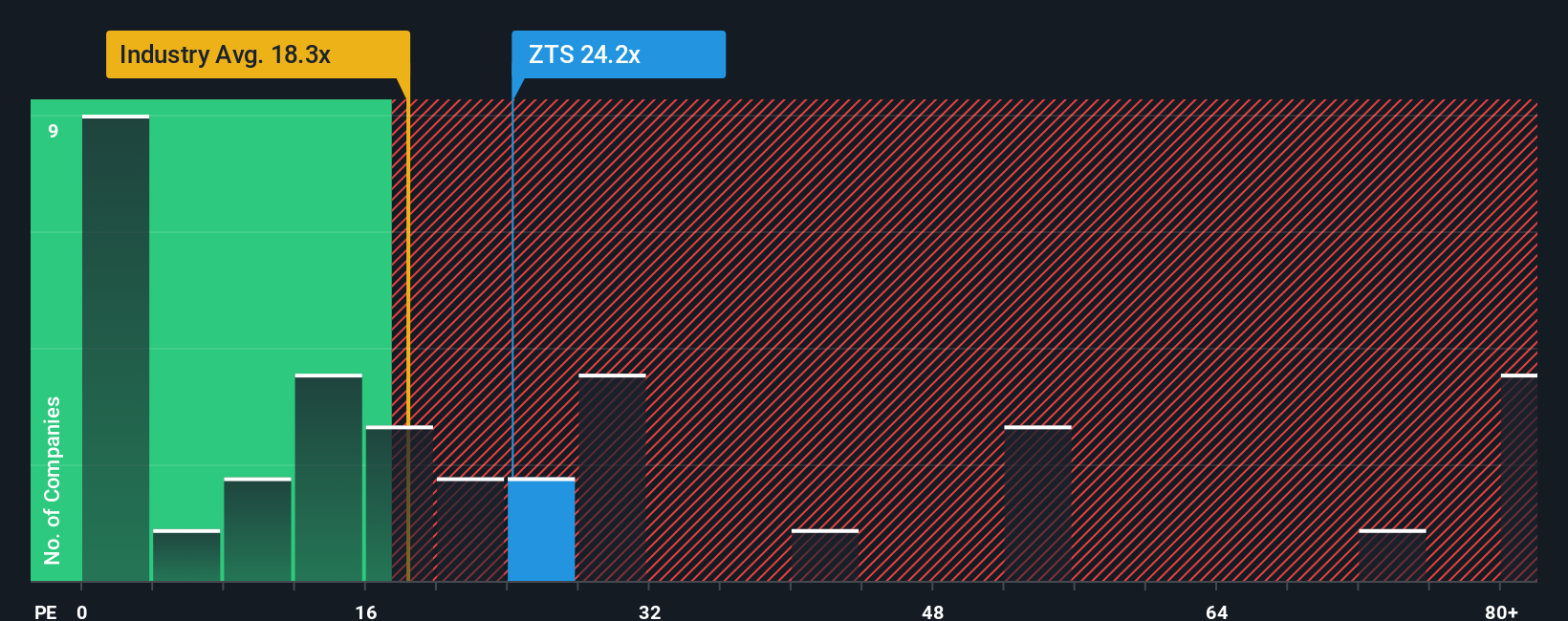

On the other hand, when we use a market comparison method, Zoetis looks a little pricey compared to other U.S. pharmaceutical companies right now. Does the market see something analysts are missing, or is this careful caution?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Zoetis to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Zoetis Narrative

If you see things differently or prefer digging into the numbers yourself, you can piece together your own viewpoint in just a few minutes. Do it your way.

A great starting point for your Zoetis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move: do not let the best opportunities pass you by when standout stocks are just a step away with the right tools.

- Uncover companies riding the AI wave and transforming entire industries by starting your search among AI penny stocks.

- Access shares priced below their true worth through our handpicked collection of undervalued stocks based on cash flows.

- Start earning with reliability and growth potential by checking out businesses offering dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026