- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST): Evaluating Valuation After Recent Share Price Dip and Sector Shifts

Reviewed by Simply Wall St

West Pharmaceutical Services (WST) shares have edged lower over the past week, dipping about 3%. Investors are watching closely to see if recent trends in pharma packaging and component demand could signal a shift in sentiment for the company.

See our latest analysis for West Pharmaceutical Services.

While West Pharmaceutical Services has seen its share price drop 16.6% year-to-date, a recent bounce over the last month hints at shifting momentum. The stock’s 1-year total shareholder return stands at -20.1%, but its three-year total return remains positive, which suggests some resilience despite recent setbacks.

If you’re reevaluating opportunities in healthcare and biotech, now could be the perfect time to discover See the full list for free.

With shares currently trading at a significant discount to analyst targets and ongoing growth in both revenue and net income, the question remains: Is West Pharmaceutical Services undervalued today, or has the market already accounted for its future growth?

Most Popular Narrative: 21.9% Undervalued

With a last close price of $273.85 and the most widely followed narrative setting fair value at $350.77, sentiment currently reflects significant room for upside if the projections bear out.

The anticipated high single-digit growth rate for Biologics HVP components in the second half of 2025, despite initial destocking challenges, shows potential for revenue acceleration and earnings improvement. The strategic focus on expanding the contract manufacturing business into drug handling, which is expected to be higher margin and require lower capital intensity, could improve net margins and earnings after the initial ramp-up phase.

What’s really fueling these bold price targets? Behind this optimistic outlook is a series of ambitious profit and revenue projections that challenge typical sector expectations. Wondering which assumptions make the math work? See which financial levers drive this trajectory and why the narrative has doubled down on future earnings strength.

Result: Fair Value of $350.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts in customer demand and rising tariff pressures could still challenge West Pharmaceutical Services' revenue growth and profit margins in the near term.

Find out about the key risks to this West Pharmaceutical Services narrative.

Another View: Multiples Tell a Cautionary Story

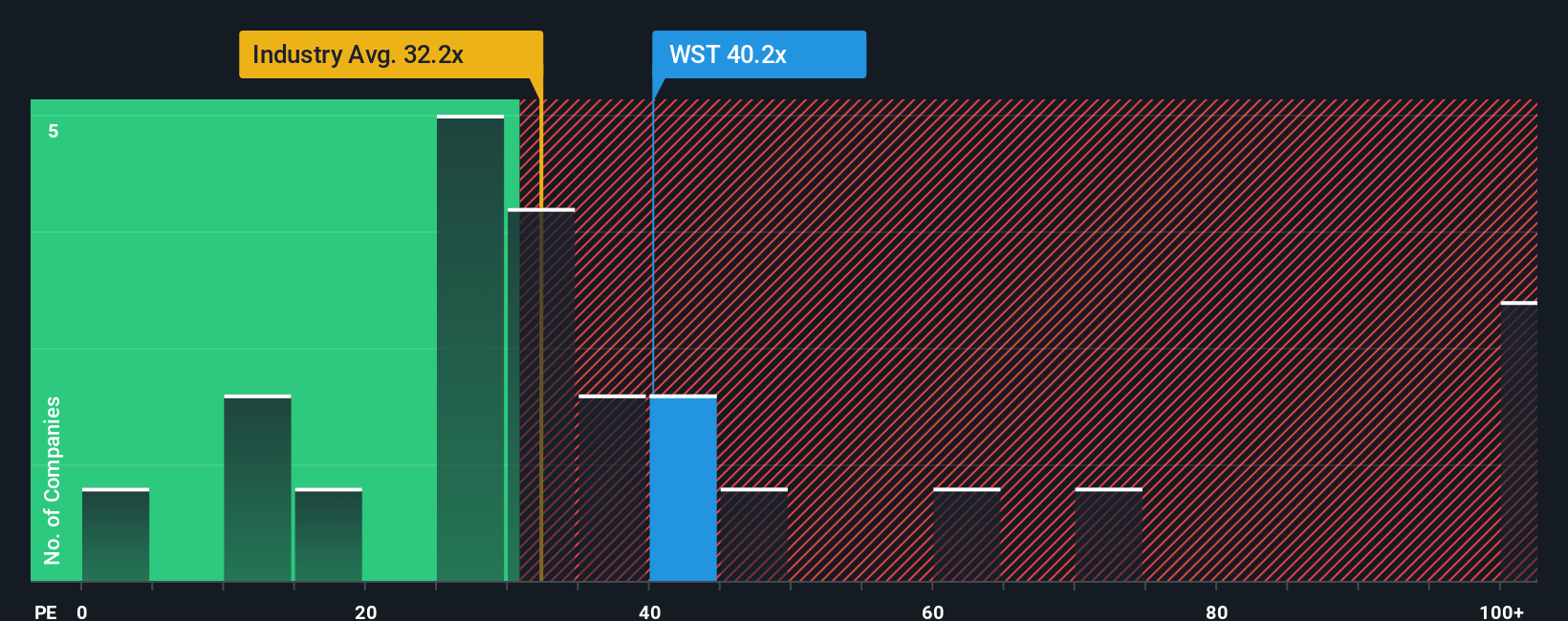

Switching gears to a multiples approach, West Pharmaceutical Services trades at a price-to-earnings ratio of 40.1x, noticeably higher than both the North American Life Sciences industry average of 37.3x and its peer average of 29.6x. The fair ratio, based on our analysis, sits even lower at 26.8x. This significant gap may signal valuation risk if the market decides to re-rate expectations. Are investors overlooking potential downside in favor of growth hopes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If you see the story differently, or want to dive into the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Don't let opportunity pass you by. Make your next smart move by tapping into investment angles most investors overlook. The right screener can reveal tomorrow's winners.

- Capture rising dividends and secure steady income streams as you grow your portfolio with these 14 dividend stocks with yields > 3%.

- Spot tomorrow’s disruptive breakthroughs by reviewing these 27 AI penny stocks that are shaping the future of artificial intelligence.

- Capitalize on undervalued gems with real upside potential using these 881 undervalued stocks based on cash flows, before they catch the broader market’s attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives