- United States

- /

- Life Sciences

- /

- NYSE:TMO

What Does Thermo Fisher’s Recent 17.6% Surge Mean for Investors in 2025?

Reviewed by Bailey Pemberton

If you're reading this, chances are you're wondering whether now is the moment to make a move on Thermo Fisher Scientific stock. Maybe you've watched its price swing over the last few weeks and thought to yourself, something interesting is going on. After all, in just the past seven days, Thermo Fisher shares have jumped 17.6%. Take a step back and look year-to-date, and the climb is a more modest 4%, while the past year actually shows a dip of 9%. Over a longer stretch, though, the company’s solid track record shines through, with 3-year returns coming in at 7.3% and an impressive 17.9% over five years.

These moves aren’t happening in a vacuum. Recent shifts in sentiment across the healthcare and science sector are driving new optimism, with investors recalibrating their expectations around companies positioned at the intersection of research, diagnostics, and innovation. Thermo Fisher, thanks to its broad exposure across lab technologies and its reputation as an industry leader, has been swept up in this momentum. This possibly reflects a re-assessment of risk and future growth potential.

So how does Thermo Fisher stack up on a valuation basis? According to our analysis, it lands a value score of 3 out of 6, meaning it appears undervalued on half the key checks investors typically watch. But just looking at the numbers tells part of the story. In the next section, we’ll dig into exactly how this score is calculated across several popular valuation methods, and if you want the best decision-making edge, stay tuned for a more nuanced approach to valuation that we’ll reveal at the end of this article.

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present day. This approach helps investors gauge whether a stock is undervalued or overvalued based on realistic growth expectations and the time value of money.

Thermo Fisher Scientific's current Free Cash Flow stands at around $6.0 Billion. Analyst forecasts suggest a strong trend, with annual Free Cash Flow projected to steadily climb over the coming years. The 2029 estimate reaches $11.3 Billion. Beyond what analysts provide, further growth estimates are extrapolated based on reasonable assumptions, indicating continued expansion through 2035.

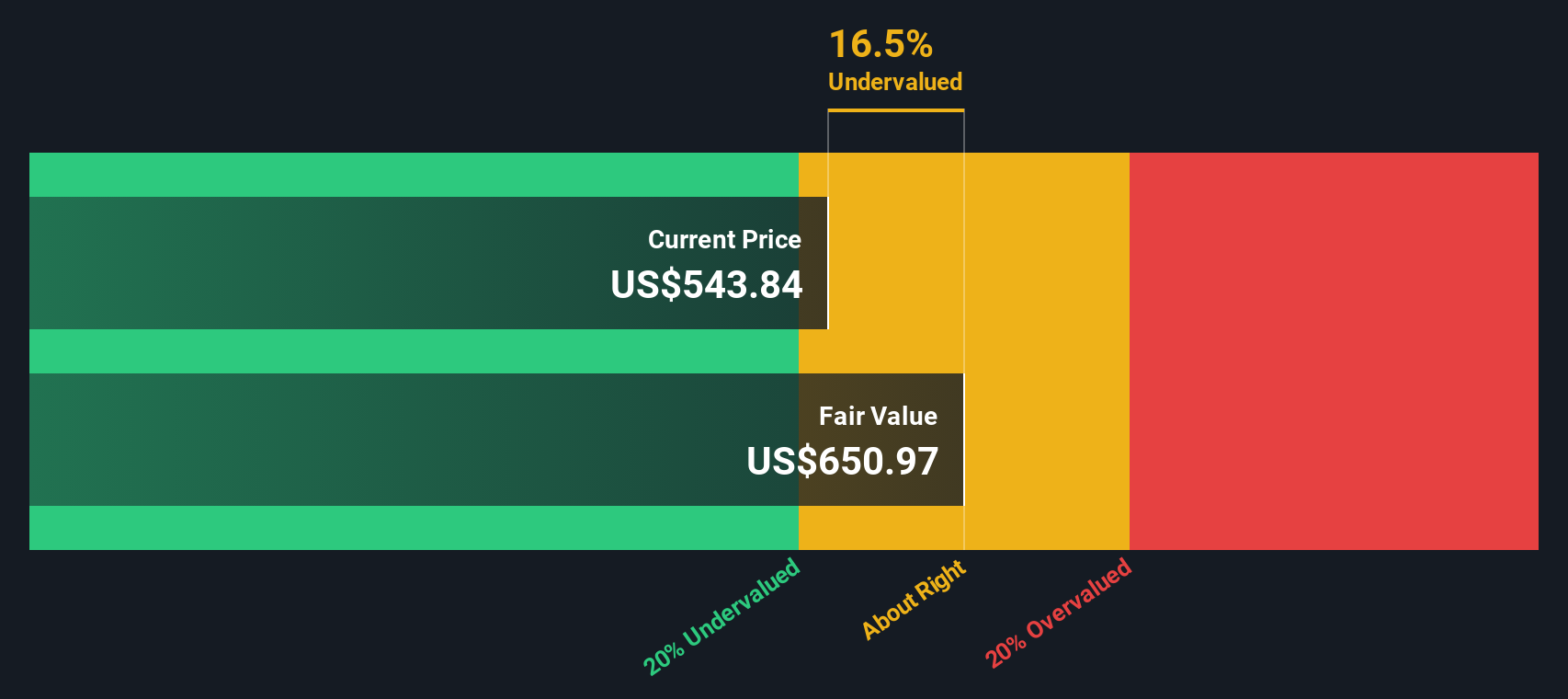

By aggregating these projected cash flows, discounting them at an appropriate rate, and summing the result, the DCF model arrives at an intrinsic fair value of $653.76 per share. At present, this means Thermo Fisher Scientific’s stock price is trading at a 16.9% discount to what the DCF suggests is fair value, characterizing it as significantly undervalued by this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Thermo Fisher Scientific is undervalued by 16.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Thermo Fisher Scientific Price vs Earnings

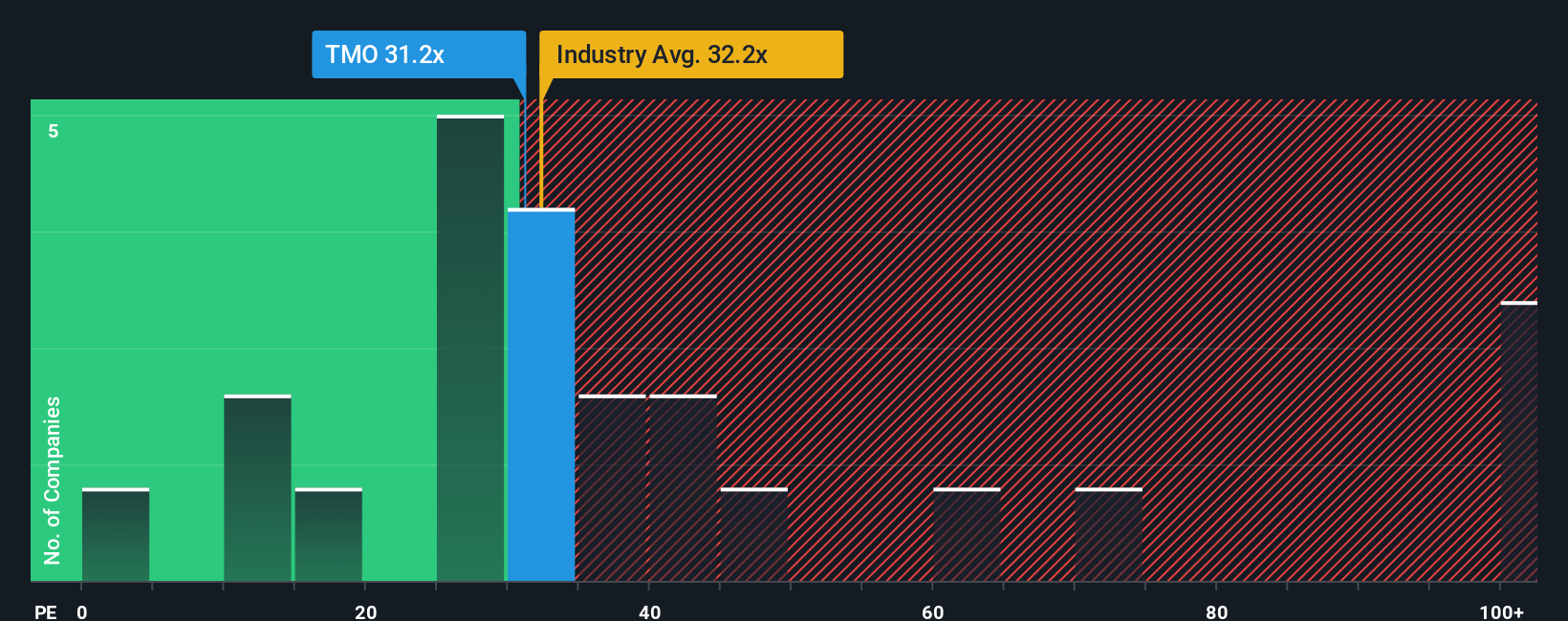

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for established, profitable companies like Thermo Fisher Scientific. It gives investors a quick snapshot of how much they are paying for each dollar of the company’s current earnings, providing a practical way to gauge market expectations for future growth.

Growth outlook and risk profile play a big part in determining what a "normal" or "fair" PE ratio should look like. Higher growth prospects typically warrant a higher multiple, while increased risks may drive it down, reflecting investor caution.

Thermo Fisher Scientific currently trades at a PE ratio of 31.2x. This closely matches the broader Life Sciences industry average of 31.2x, but it is lower than the average among direct peers, which sits at 34.8x. On the surface, this suggests the stock is relatively in line with its wider market context.

Simply Wall St's “Fair Ratio” takes things a step further. This proprietary metric considers not only earnings growth, but also profitability, market cap, risk, and Thermo Fisher’s unique position within its industry. By rooting the comparison firmly in company-specific fundamentals, the Fair Ratio goes beyond basic multiples and offers a more nuanced and forward-looking assessment.

For Thermo Fisher, the Fair Ratio is calculated as 27.3x, which is just below the company’s actual PE multiple of 31.2x. This small difference implies the stock is trading a bit above its fair value according to this approach, but not significantly so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned a more powerful way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, the perspective you bring to the numbers, where you lay out your vision for Thermo Fisher Scientific’s future by setting your own forecasts for revenue, earnings, and margins, then see what fair value those expectations imply.

Narratives connect the company's story and long-term prospects to real financial forecasts, allowing you to move beyond one-size-fits-all valuation models. With Simply Wall St’s easy-to-use Community page, building and sharing your Narrative is now accessible to anyone, and millions of investors already use them to sharpen their buy-sell decisions by comparing their fair value to the actual share price.

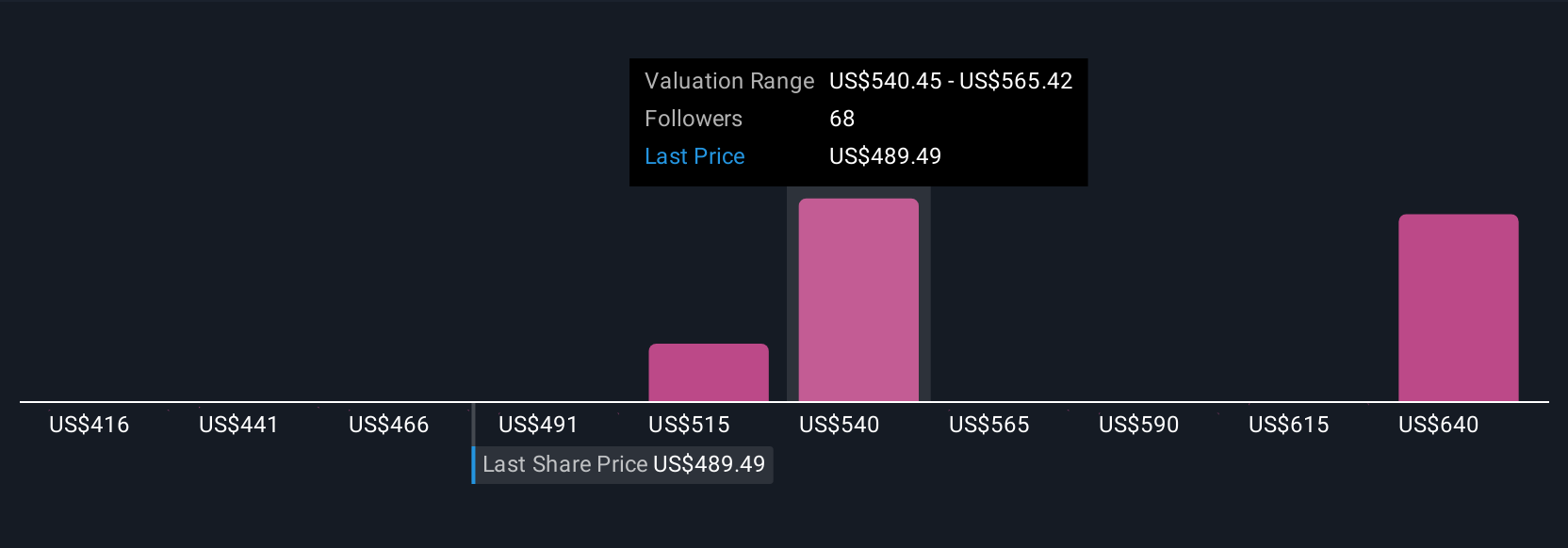

Narratives automatically update when new news or earnings reports are released, so your investment thesis always reflects the latest facts. For example, some investors see Thermo Fisher Scientific as a long-term winner, forecasting 7 to 10% annual revenue growth and a future PE ratio of 28x, resulting in a fair value above $767 per share. Others may take a more cautious view, assuming just 5% revenue growth and margin pressure, leading to a fair value as low as $490 per share. Narratives let you visualize these differences and make investing truly your own.

For Thermo Fisher Scientific, we have made it easier for you by offering previews of two leading Thermo Fisher Scientific Narratives:

- 🐂 Thermo Fisher Scientific Bull Case

Fair value: $546.76

Current price is 0.6% below this narrative’s fair value

Revenue growth rate: 4.9%

- Expansion in pharmaceutical manufacturing, innovation in analytical tools, and customer integration are expected to drive robust, recurring revenue and strengthen market leadership.

- AI-driven efficiency, disciplined cost management, and strategic acquisitions are projected to support higher margins and sustainable returns, even amid demand fluctuations.

- Risks include prolonged academic or government funding uncertainty, China market headwinds, margin pressure in analytical instruments, and the need for seamless leadership transition.

- 🐻 Thermo Fisher Scientific Bear Case

Fair value: $540.27

Current price is 0.6% above this narrative’s fair value

Revenue growth rate: 7%

- Continued growth in diagnostics, pharma or biotech R&D spending, AI-driven automation, and strong presence in emerging markets are expected to propel long-term demand and margin expansion.

- Recurring revenue from consumables and services adds stability, while recent acquisitions and diversified segments help drive steady performance through economic cycles.

- Main risks stem from post-pandemic sales declines, regulatory and compliance changes, possible M&A integration missteps, and potential slow-downs in biotech or pharma funding.

Do you think there's more to the story for Thermo Fisher Scientific? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives